View HG Insights’ full market report: The AWS Ecosystem in 2024

As highlighted in our recent market report, AWS (Amazon Web Services) remains the dominant player in the “Cloud Wars” with Google Cloud Platform and Microsoft Azure in 2024. In fact, among the top ten cloud platform providers, AWS’ market share is the largest — clocking in at 50.1%.

AWS began offering IT infrastructure services in the form of web services in 2006 — two years before Google Cloud Platform and four years before Microsoft Azure. The launch of Amazon Elastic Compute Cloud (AWS EC2) made it a first mover, persistent innovator, and market leader in cloud infrastructure. Ever since AWS has surpassed its competitors with consistent year-over-year growth in cloud revenue and customer count.

However, the cloud infrastructure services market remains highly dynamic as Microsoft and Google compete with AWS for increased cloud spending. Gartner says that in 2022, the worldwide Infrastructure-as-a-Service (IaaS) market grew 30%, exceeding $100 billion for the first time.

“Cloud has been elevated from a technology disruptor to a business disruptor. IaaS is driving Software-as-a-Service (SaaS) and Platform-as-a-Service (PaaS) growth as buyers to continue to add more applications to the cloud and modernize existing ones.”

— Sid Nag, VP Analyst at Gartner

With this in mind, HG has taken a deep dive into our data to provide a detailed overview of the AWS buyer landscape and trends shaping the ecosystem. If your business integrates with and/or complements AWS, if you resell their products, or if you compete in similar markets, we hope you’ll find these insights valuable for informing your go-to-market decisions.

2024 AWS Market Insights

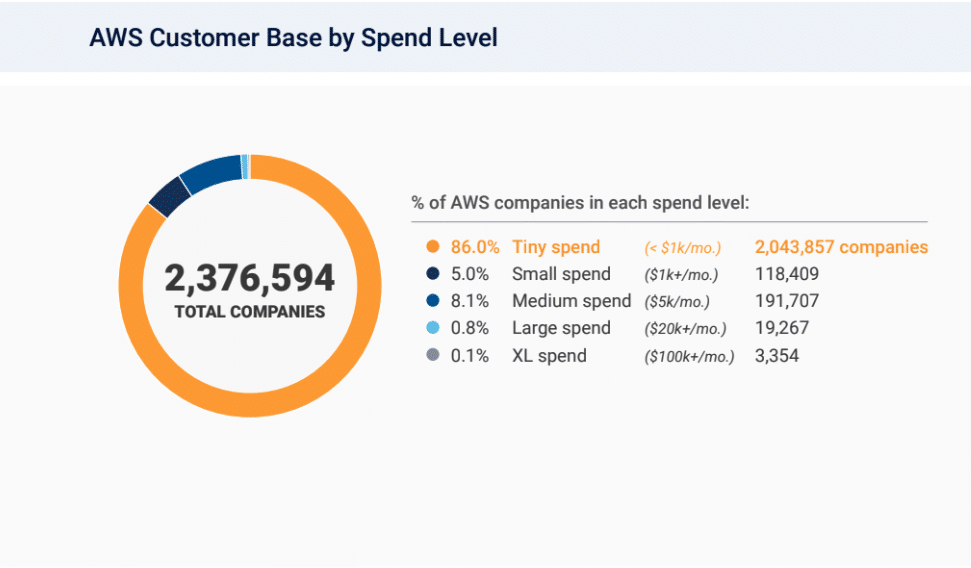

HG Insights collects data on the 2.38 million businesses buying AWS cloud services. Here are a few key takeaways from the 2024 AWS market report:

- 2.38 million businesses are buying AWS cloud computing services

- AWS market share has grown to 50.1% among the top 10 cloud providers

- The AWS customer growth rate is the highest among global cloud providers at 31%

- 53% of all AWS customers are located in North America (NA)

AWS Cloud Market Share

In HG’s 2023 Infrastructure as a Service Market Report, we explored the cloud hosting market as a whole. AWS had the highest relative market share among the top 10 providers (50.1%), as well as the highest YoY growth in customer count (31%). Google Cloud Platform trails slightly with 28% and Microsoft Azure with 20% share of the cloud market.

AWS Buyer Landscape

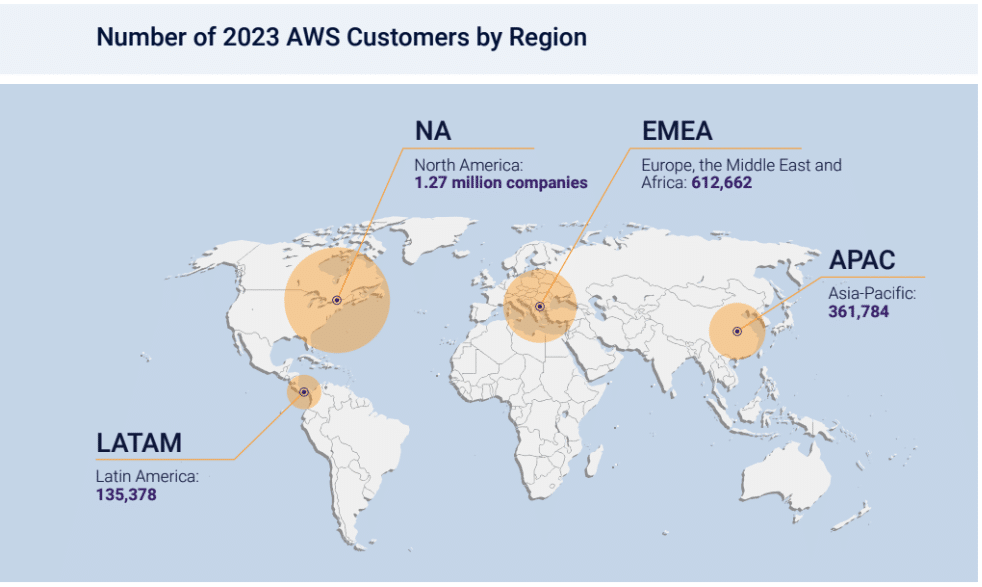

The highest volume of AWS customers are located in North America (NA) and Europe, the Middle East, and Africa (EMEA), with NA representing over half (53.3%) of all AWS buyers.

While AWS continues to expand the number of regions, points of presence (POPs), and availability zones it offers, some regions require more specialized clouds. The company announced in October 2023 that it was rolling out the AWS European Sovereign Cloud, built to meet EU data privacy and sovereignty requirements

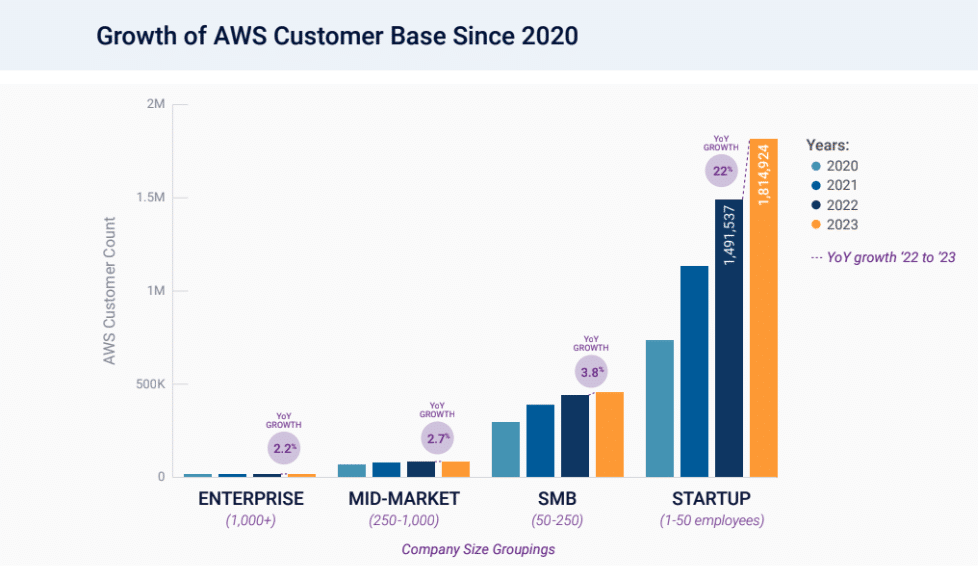

AWS has seen consistent YoY customer growth across all company sizes since 2020. From 2022 to 2023, the fastest-growing segment was startups, with a 21.7% jump in customer count.

The vast majority (86%) of AWS customers are spending less than $1K per month on AWS services. This is also the fastest-growing segment in terms of customer count, with a YoY increase of 19.7%. These numbers reflect the AWS strategy of “getting in early.” In other words, it aims to win the business of small startups for the long-term payoff of being their provider as cloud spend and usage scale up.

Trends Shaping the AWS Ecosystem in 2024

The AWS ecosystem is undoubtedly influenced by what the company prioritizes internally. There are three key areas of focus for AWS we are watching going into 2024:

1. Artificial Intelligence (AI)

AWS is investing heavily in Generative AI, a type of artificial intelligence that can create new data, such as images, text, and code. The company also hopes to help partners along their AI journey with the opening of a new Gen AI Center of Excellence and support customers with an AI Innovation Center.

2. Data Security

With the average cost of a data breach in 2023 sitting at $4.35M, data security is a top issue for cloud companies. AWS has several new services and features focused on helping customers protect their data, including AWS Secrets Manager, AWS Key Management Service, and AWS Shield.

3. Serverless

With serverless cloud computing, the cloud provider takes care of server provisioning and management. This can free up developers to focus on building their applications. AWS has several serverless solutions, including AWS Lambda and AWS Fargate.

View HG Insights’ full market report: The AWS Ecosystem in 2024

Uncover Cloud Revenue Opportunities with HG

View the complete cloud market landscape, drill into your TAM SAM SOM, and identify the accounts most likely to buy your cloud services with HG Cloud Dynamics. We provide marketing and sales teams with detailed cloud product adoption, usage, and spend data for over 7 million businesses around the world, and 21,000+ cloud products.

If you have questions or want to learn more about HG insights, reach out! Our team is happy to help.

About HG Insights

HG Insights, the provider of data-driven insights to 75% of tech companies in the Fortune 100, is your go-to-market Technology Intelligence partner.

We use advanced insights into Technology Intelligence — on IT spend, technographics, cloud usage, intent signals, Functional Area Intelligence, contract details, and AI maturity — to provide global B2B companies with a better way to analyze markets and target prospects. Our customers achieve unprecedented results in their marketing and sales programs thanks to the indexing of billions of unstructured documents each day with insights into product adoption, usage, spend data, and more to build high-resolution maps of activity across an organization’s entire digital infrastructure to power business decisions with precision and confidence.

Our market reports are designed to give you an unparalleled view of your markets.