In our recent market report, we analyzed the Enterprise Resource Planning (ERP) systems landscape. The ERP market is experiencing a major growth spurt. HG’s data shows that the total ERP market size will reach $147.7 billion in spending in 2025. This surge is a testament to the important role ERP systems play in enhancing the efficiency and integration of business processes across organizations, from small businesses to large enterprises.

ERP solutions have consistently evolved, transitioning from simple inventory management systems to the backbone of enterprise-wide digital transformation. Now, ERP cloud computing services are revolutionizing how businesses manage everything from inventory levels to financial reports, making it easier to track inventory, manage purchase orders, and ensure business operations run smoothly. The increasing adoption of ERP systems signifies the shift towards more flexible and scalable software solutions.

Here, we give an overview of the ERP market size and spending in each market segment, as well as ERP market share by vendor across subcategories.

ERP Market Size: Breaking Down the ERP Software Market

The ERP market is experiencing a significant growth spurt. According to HG’s data, the ERP market size will reach $147.7 billion in the next year, with 3.8 million companies investing in ERP solutions. ERP applications are the largest software subcategory, making up about 13% of

software market spend and 4% of spending in the global IT market.

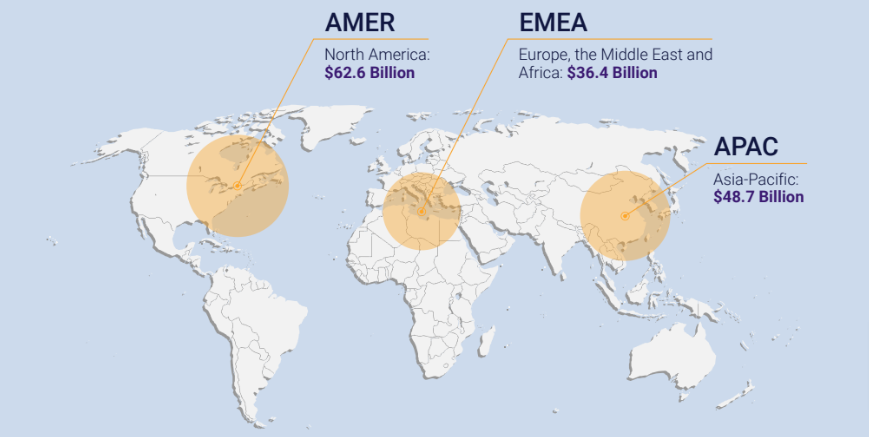

The AMER region (which includes the United States, Canada and South America) leads in ERP spending with $62.6 billion − which is nearly 43% of the total ERP market size. The APAC (Asia-Pacific) region follows with $48.7 billion in ERP spending. This region is witnessing rapid market growth due to its expanding startup ecosystem, manufacturing sector, and the need for robust order management systems. The global distribution of ERP buyers highlights its significance across different economic landscapes and business models.

ERP Market Buyers: Spending by Subcategory and Industry

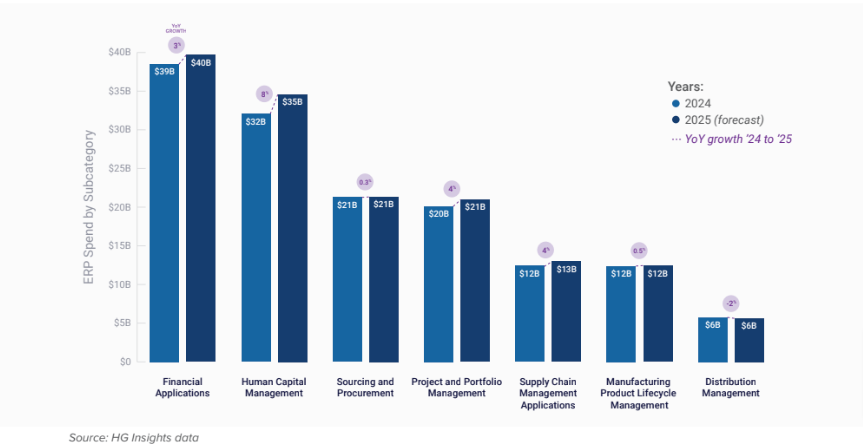

We divide the ERP market into the seven subcategories shown in this chart. Financial Applications and Human Capital Management (HCM) make up the largest subcategories, accounting for 27% and 23% of projected spend by ERP market buyers, respectively.

HCM is having a banner year, with HG’s data showing an 8% increase in spend versus the 12 months prior. That’s double the growth rate of the next fastest-growing categories, Project and Portfolio Management and Supply Chain Management Applications.

It’s worth noting that there is crossover between categories, with some vendors offering one tool that covers more than one area or multiple tools across the ERP category.

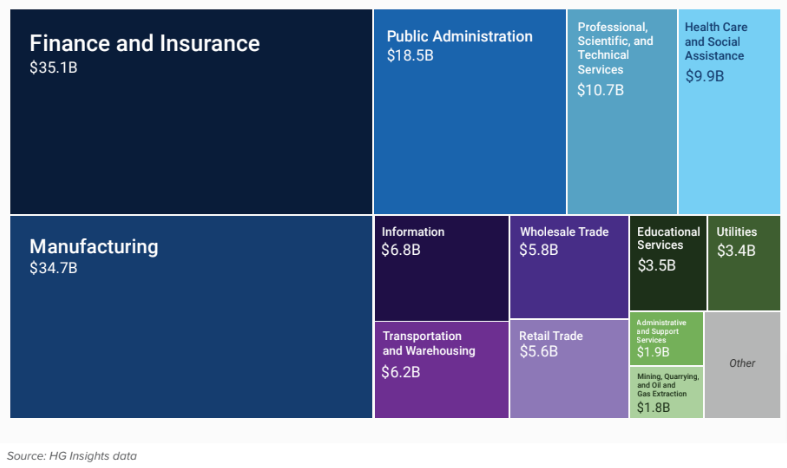

According to HG’s data, the Finance & Insurance, Manufacturing, and Public Administration industries spend the most in the ERP market, accounting for approximately 60% of the overall spend.

However, while sectors like Transportation & Warehousing and Utilities have lower ERP spend overall — $6.2 billion and $3.4 billion, respectively — this spend is spread across a lower number of buyers compared to other industries, indicating a higher average spend per ERP buyer.

ERP Market Share: Key Players in the Market

In this section, we dive into ERP market share by vendor across market segments using HG Insights’ data. Keep reading to see the top ERP companies by their number of customers and share of the market.

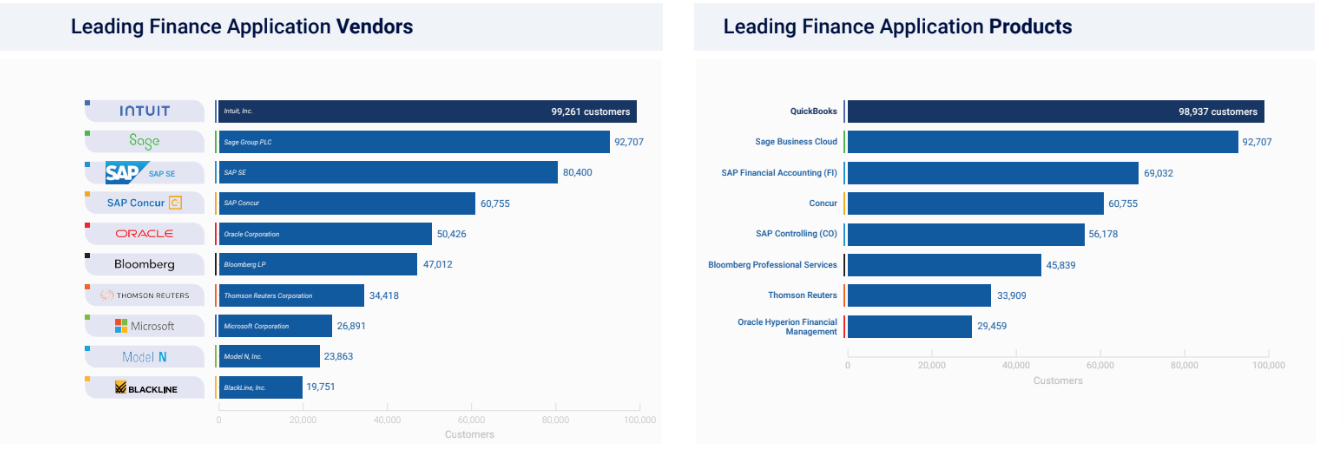

Top Financial Application Vendors

HG projects that spending on Finance Applications will grow 3% to a total of $39.7 billion over the next 12 months, making up 27% of the total ERP market.

These charts show the leading Finance Application vendors and products in terms of customer count. Vendors Intuit (QuickBooks); Sage (Sage Business Cloud); and SAP (SAP Financial Accounting, Concur, and Controlling) are leading the market, capturing five of the top eight product spots in this subcategory.

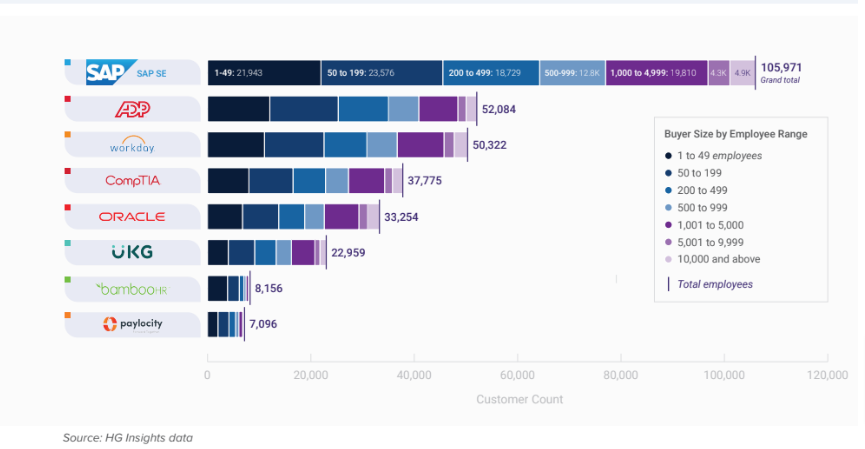

HCM Vendors by ERP Market Share

Human Capital Management (HCM) software packages cover a wide range of tasks, from recruitment and talent management to reporting and compliance. HG forecasts that HCM spend will grow 8% over the next 12 months to $34.6 billion. SAP has the largest customer base of any HCM vendor with nearly 106,000 buyers – double the customer base of the next largest vendors, ADP and Workday.

(Note that customer count data is not indicative of revenue, and many of these vendors – like Workday – are some of the fastest-growing and most successful businesses in 2024.)

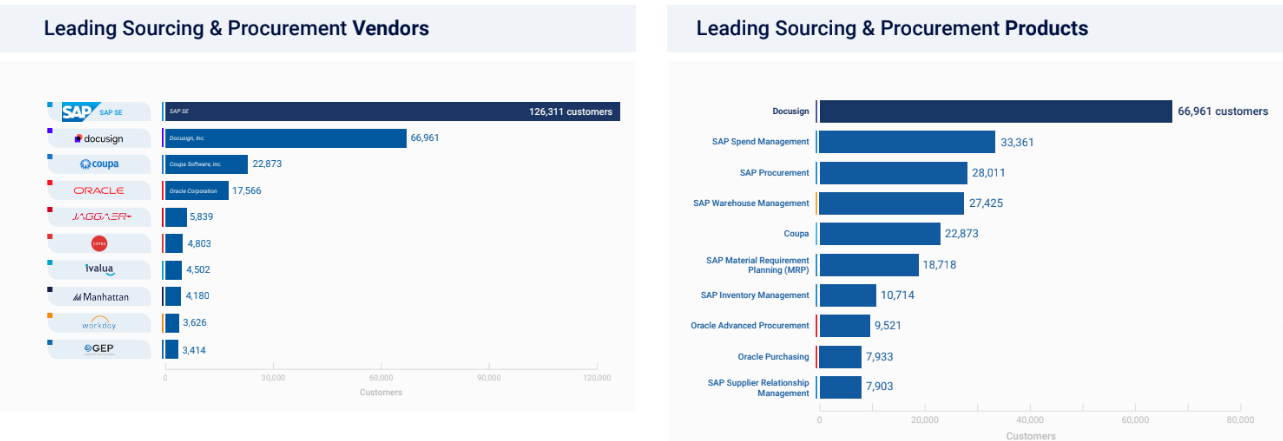

Sourcing & Procurement Companies by ERP Market Share

According to HG’s data, spending on Sourcing and Procurement software is projected to grow only slightly (0.3%) over the next 12 months, reaching $21.3 billion in total spend.

According to HG’s data, spending on Sourcing and Procurement software is projected to grow only slightly (0.3%) over the next 12 months, reaching $21.3 billion in total spend.

The leading Sourcing and Procurement vendor by customer count is Germany-based SAP, with a customer base of more than 126K. SAP is the developer of six out of the top 10 products in this subcategory. However, Docusign has the largest customer base of any product in this subcategory with nearly 67K buyers.

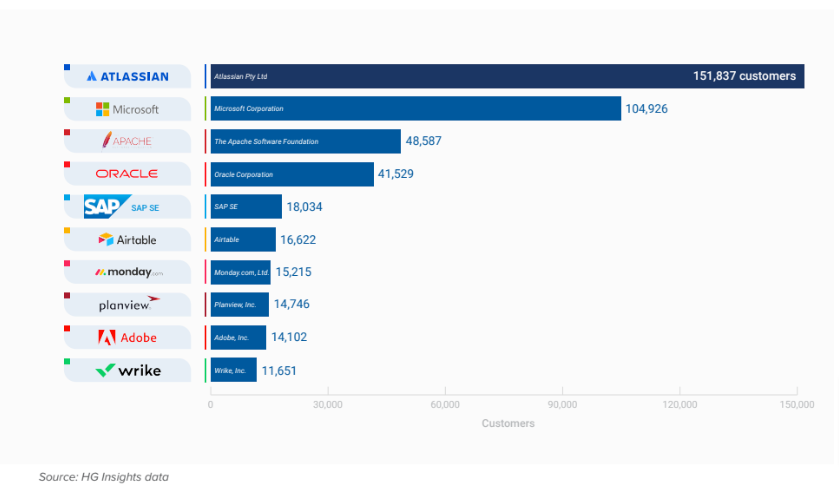

Top Project & Portfolio Management Vendors

HG’s data forecasts total spending on Project & Portfolio Management solutions will grow 4% to reach $21 billion in the next 12 months. This subcategory accounts for approximately 14% of all spending in the ERP market.

In terms of customer count, Atlassian and Microsoft outpace the other vendors in this category, with about 152K and 105K customers, respectively.

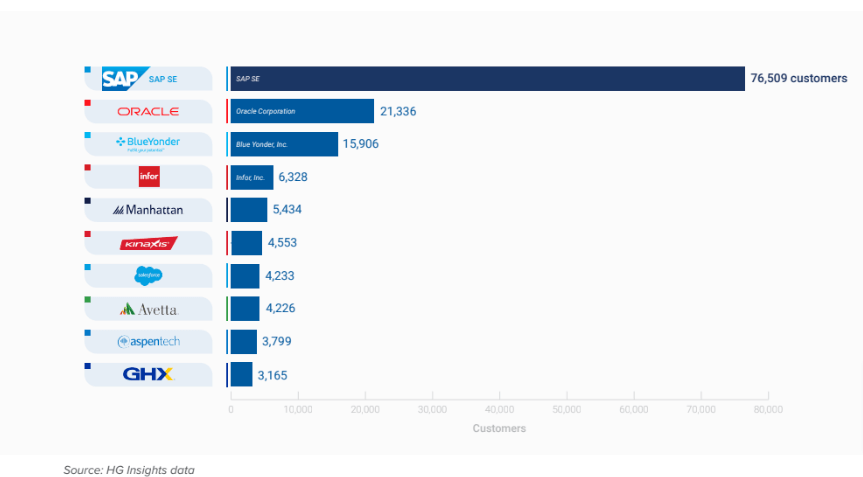

Leading Supply Chain Management Application Vendors

ERP market buyers are projected to spend $13 billion on Supply Chain Management Applications over the next year, a YoY increase

of 4%. When looking purely at customer base size, SAP is the leader, with more than 3x the number of customers than the next leading provider.

Oracle and BlueYonder make up the second size tier, with approximately 21K and 16K customers, respectively.

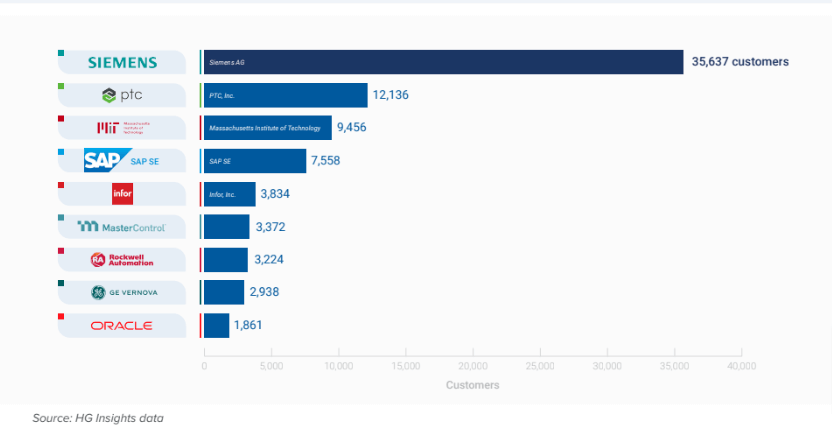

Top Manufacturing Product Lifecycle Management Vendors

HG’s data indicates that the Manufacturing Product Lifecycle Management (PLM) subcategory is just slightly smaller than the Supply Chain Management subcategory, with a projected spend of $12.4 billion over the next year – a slight YoY increase of 0.5%.

The leading manufacturing PLM providers can be seen in this chart. Looking only at customer count, there are three main groupings: Siemens, the clear leader, with about 36K customers; the next three vendors – PTC, MIT, and SAP – in the 7K to 13K range; and the rest of the providers with 4K customers or less.

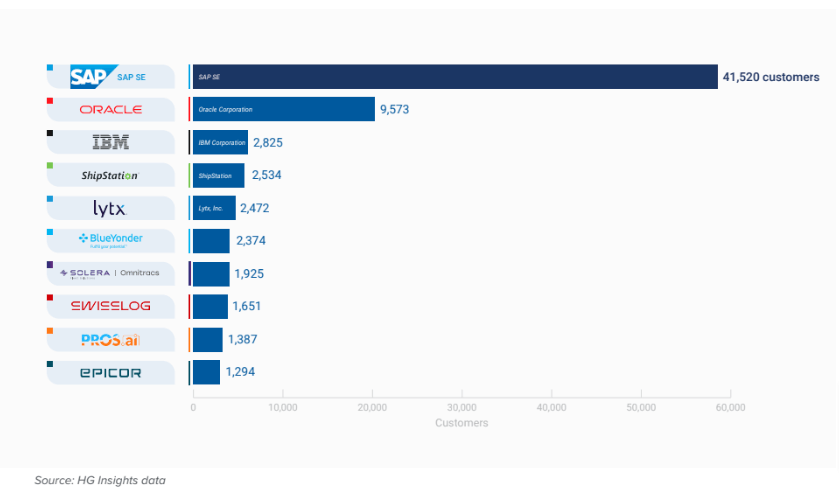

Distribution Management Companies by ERP Market Share

Distribution Management is the smallest ERP subcategory, but still shows substantial projected spend: $5.6 billion over the next 12 months. However, this is a decrease of -2% YoY. SAP is the largest vendor by customer base with approximately 42K buyers – more than 4x the number of customers than the next leading vendor, Oracle.

It’s also worth noting SAP and Oracle’s broad market penetration: They are the only vendors to be present on the leading vendors list by customer count for all subcategories in this report.

Analysis of ERP Market Trends

The competitive landscape of ERP system vendors is as dynamic as the technology itself. With Microsoft Corporation playing a significant role alongside other major market players, the ERP platform and ERP application market is set to expand further. The forecast period looks promising for the ERP software vendors, with a focus on supply chain management, industry verticals, and advanced software solutions.

Market research indicates a continuous increase in ERP system adoption across various industry verticals, driven by the need for comprehensive software solutions that can handle complex business processes. As companies seek to optimize their operations, the demand for integrated ERP platforms that offer robust supply chain management capabilities and sector-specific functionalities is growing.

Want more insights into the geography, scale, and breakdown of ERP market share? Get the complete ERP market report here

Discover Revenue Opportunities in the ERP Market with HG

HG Insights provides sales and marketing teams with account-level data on over 7 million businesses worldwide, across 21,000+ cloud products.

We use advanced insights into Technology Intelligence — on IT spend, technographics, cloud usage, intent signals, Functional Area Intelligence, contract details, and AI maturity — to provide global B2B companies with a better way to analyze markets and target prospects. Our customers achieve unprecedented results in their marketing and sales programs thanks to the indexing of billions of unstructured documents each day with insights into product adoption, usage, spend data, and more to build high-resolution maps of activity across an organization’s entire digital infrastructure to power business decisions with precision and confidence.

Our market reports are designed to give you an unparalleled view of your markets

If you have questions or want to talk more, reach out! Our team is here to talk.