NEW COMPETITIVE ANALYSIS AND TAKEOUT WORKFLOW | CHECK IT OUT >

Search HGInsights

Revenue Growth Intelligence for Strategy

Enable strategy teams to use unified data and AI-driven market, account, and competitive insights for opportunity analysis, strategic objectives, and coordinated GTM execution to drive scalable growth.

Remove Barriers to Strategic Analysis, Planning, and GTM Execution

Challenge

Contending with fragmented data and data silos.

Solution

Conduct analysis from a unified market, account, and buyer repository that integrates first-, second-, and third-party data.

Challenge

Incomplete and poor market and account data quality.

Solution

Utilize bottoms-up market insights with deep, AI-enriched firmographic, technographic, and spend details.

Challenge

Varied GTM analysis and plans that lack sufficient, data-driven operational detail.

Solution

Standardize on AI-augmented data and analytics that provide granular, actionable insights for GTM execution.

Challenge

Slow to uniformly adopt AI agent capabilities.

Solution

Employ a platform that offers an essential GTM agent suite that can be integrated within teams existing workflows and systems.

Challenge

Disjointed cross-functional execution and objective tracking.

Solution

Leverage predictive modeling to activate data-driven GTM objectives that can be applied across teams for account, campaign, conversion, and pipeline growth.

Essential AI-Driven GTM Insights and Automation for Strategy Teams

Empower strategy and data-analysis teams with comprehensive, in-depth datasets that enable high-precision analytics across GTM use cases from market sizing, ICP design and segmentation analysis, whitespace, competitive, and high-propensity account targeting to focus resources and optimize outcomes.

Streamline Precise Market Analysis

Create Well-defined ICPs and Segments

Target Expansion Opportunities

Capture Competitor’s Market Share

Enrich Datasets for Analytics and Agents

How Stratyve Transforms Go-To-Market Strategy

“HG Insights AI capabilities brings in all the data – like having a partner at your side. You don’t need to figure out which filters to apply or how to interpret graphs. Everything is done quickly, efficiently, and accurately. You can move from planning to campaign.”

Vinay Damojipurapu | GTM Partner, Stratyve

How Hyland Software Unlocks Precision in B2B Marketing with HG Insights

“The technographic, competitive, and IT spend insights all feed into our ICP scoring model. This allows us to prioritize accounts effectively for each play and ensure sales and marketing are aligned. With AI, we can react instantly when a potential customer shows intent -acting at the right moment with context.”

Joe Hannun | Sn. Manager, Customer Intelligence, Analytics, Hyland Software

How DXC Technology Uses HG to Build Pipeline

“We use it in our sales processes, including proposal development and to support our pipeline generation. We need to be able to tell that whole story from top to bottom, and HG allows us to drive down into those layers. The dimensions and ability to slice and dice is extremely important for us as we get down into the sales cycle.”

Kevin Downey | Sn. Managing Partner, DXC Technology

Top Strategy Use Cases to Advance Analytics, Identify Opportunity, and Operationalize GTM

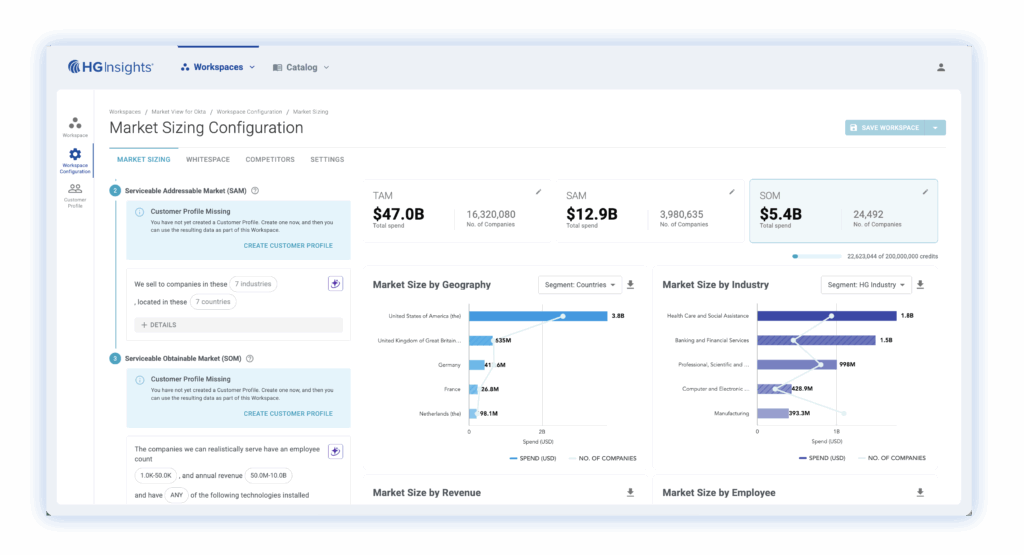

Market Sizing, ICP Design and Segmentation Insights

Turn GTM strategy into pipeline growth leveraging AI-driven TAM/SAM/SOM market analysis and ICP design with account-level details to focus marketing and sales resources where opportunity is the greatest.

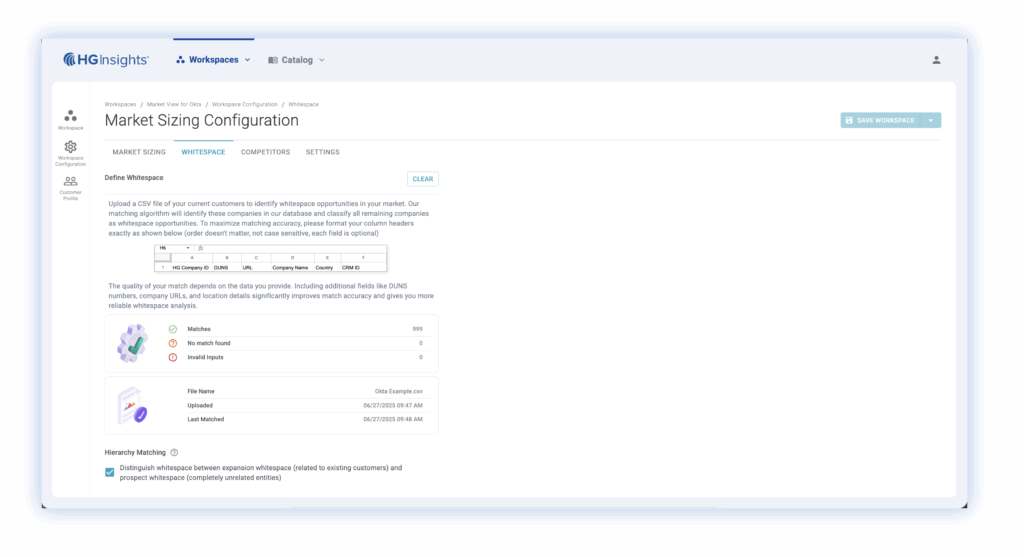

Whitespace Analysis and Activation

Surface accounts with revenue potential to drive new business within your existing customer base or by expanding your target market.

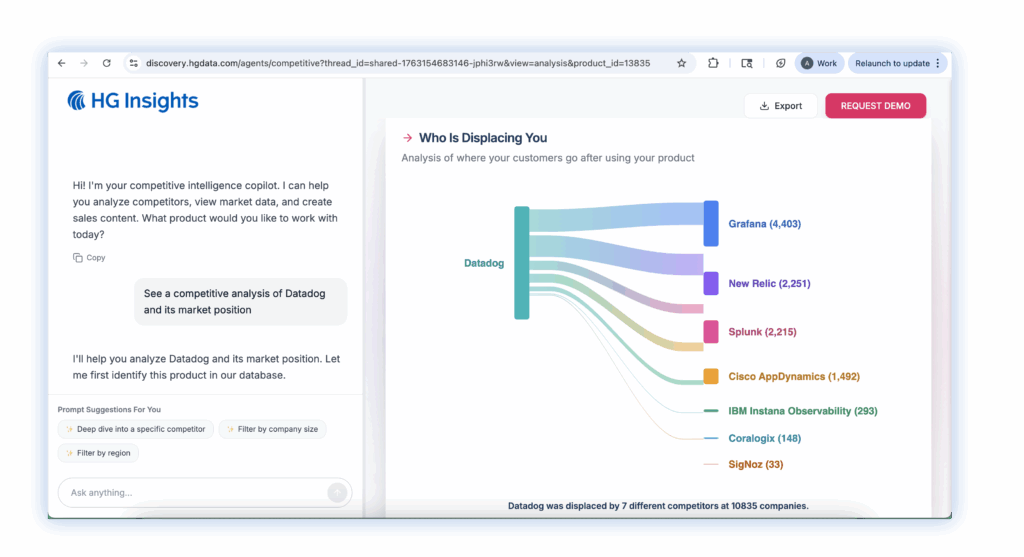

Competitive Analysis and Takeout

Identify your competitors’ weak spots, reach out to their customers at the best moment in the renewal cycle, and automate your takeout campaigns, all within the tools you already have.

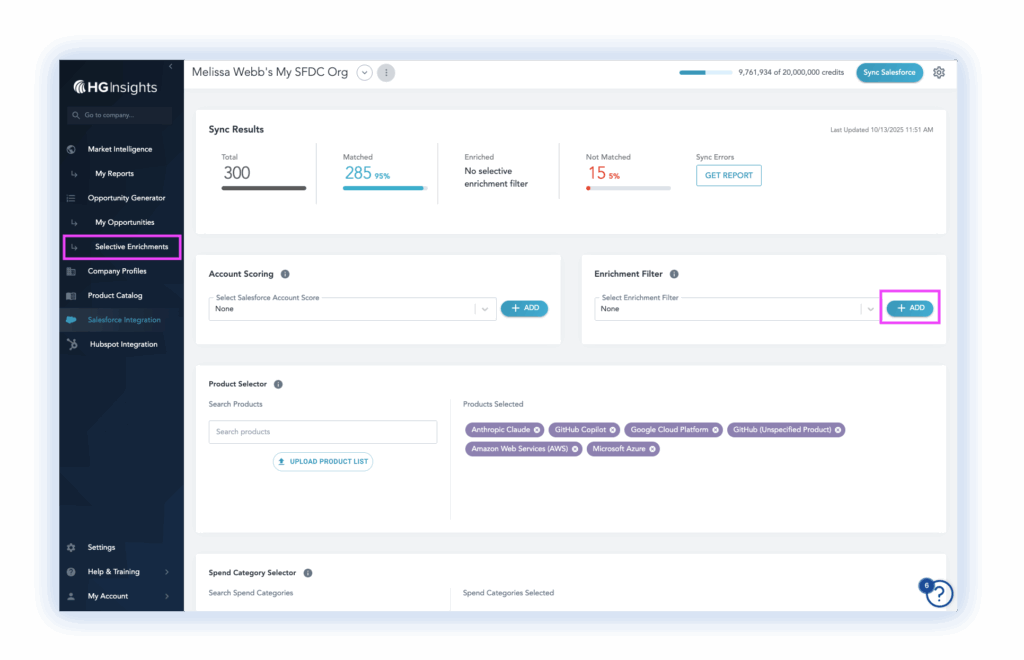

B2B Data Enrichment for GTM Precision

Enrich your MDM/CRM with the most comprehensive, current, and granular market, account, spend, tech installs (which technologies they use, how much they spend, contracts, cloud consumption trends, and when those contracts renew), and buyer datasets in the market that is powered with AI-powered insights, sourced from over 20 billion 2nd and 3rd-party datapoints.

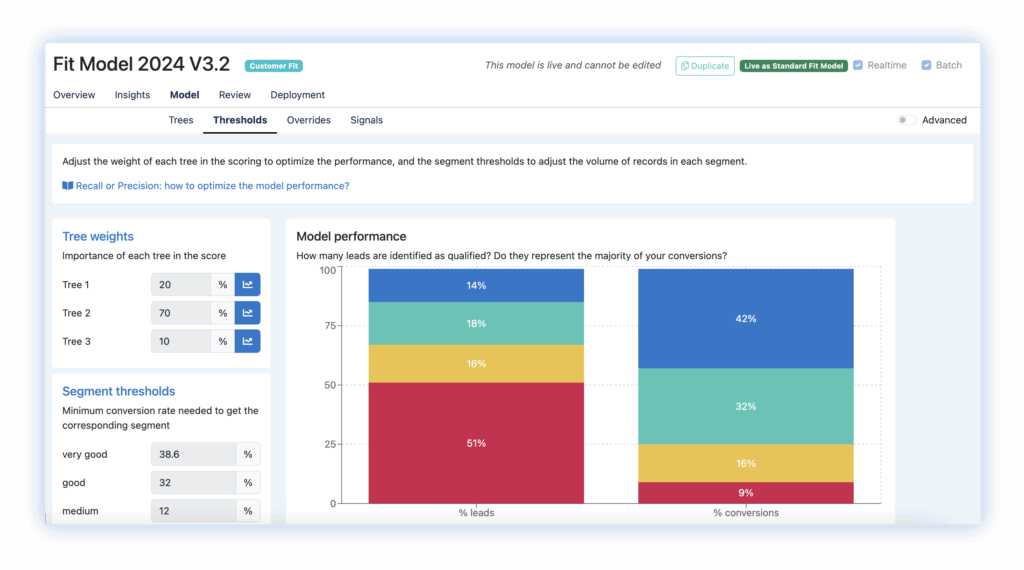

Predictive Account Targeting, Prioritization, and Scoring

Use AI-driven propensity modeling and dynamic scoring across fit, intent, and engagement signals to accelerate targeting, focus seller time on high-likelihood pipeline, increase conversion, and tighten forecasting.

Our Customers Are Achieving Revenue Growth Results

45%

Increase in Sales Quota Achievement

18%

Increase in Sales Participation

30%

Increase in Marketing Pipeline

49%

Increase in Revenue from Target Accounts

25%

Increase in Overall Revenue Growth

10x

Rise in Lead-to-Opportunity Conversions

FAQ: Strategy

How does HG Insights support bottom-up market sizing and TAM, SAM, and SOM analysis?

HG Insights enables strategy teams to conduct precise, bottom-up market sizing using real account-level data rather than top-down estimates or static reports. TAM, SAM, and SOM analyses are built from detailed firmographic, technographic, spend, and buying-center insights across millions of companies.

This approach allows strategy teams to size markets based on actual technology environments, adoption patterns, and spend signals, producing more accurate and defensible market models. As markets evolve, these analyses can be continuously refreshed, ensuring strategy decisions remain aligned with real-world conditions.

How does HG Insights connect market opportunity to account-level detail?

HG Insights links high-level market opportunity directly to individual accounts. Strategy teams can move seamlessly from market sizing and segment analysis down to specific companies, locations, buying centers, and technology footprints.

This market-to-account connection enables teams to validate assumptions, understand where opportunity truly exists, and translate strategic plans into executable GTM priorities. Instead of disconnected strategy decks and execution plans, teams operate from a shared, data-driven foundation.

How does HG Insights help identify whitespace and competitive share opportunities?

HG Insights provides deep visibility into whitespace and competitive dynamics by analyzing technology adoption, installed competitors, spend patterns, and growth signals across accounts and segments.

Strategy teams can identify underserved segments, emerging markets, and accounts where competitors are entrenched or vulnerable. This enables informed decisions around expansion, product investment, market entry, and competitive takeout strategies, grounded in data rather than intuition.

Can strategy teams use HG Insights across multiple regions, products, and business units?

Yes. HG Insights is designed for enterprise-scale strategy teams operating across geographies, product lines, and business units. The platform supports global data coverage, flexible segmentation, and multi-dimensional analysis, enabling consistent insights across the organization.

Strategy teams can compare opportunities across regions, align planning across portfolios, and support coordinated GTM execution using a single source of truth. This ensures strategic alignment while allowing for regional and business-unit-specific nuance.

Ready To See How HG Can Help You Unlock Growth