HG Insights is combining deep B2B market, account, spend, and buyer intent data, and customer’s first-party data with AI-powered GTM workflows and solutions.

For years, HG Insights has been known for B2B data, collecting billions of market data points about companies, technographics and firmographics, IT spend, competitive intel, sales intel, and more. With it, go-to-market (GTM) leaders can zoom-in to get detailed information about companies, products, and buyer info, and also zoom-out to analyze market trends, market and segment sizing, white space, competitive presence, and more.

Now, we’re excited to share a major milestone: We’ve layered AI agents across our massive Revenue Growth Intelligence Fabric (RGIF), as well as across first-party customer data. In many ways, this has been a holy grail for GTM leaders — AI and agents that are trained and up-to-date on industry, company, and trend information, as well as on your own (customer) data. (Remember: Your AI is only as good as the data it uses!).

What’s behind our AI: market data, buyer data, your data

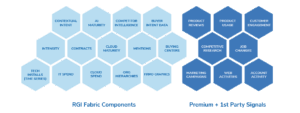

Our Revenue Growth Intelligence is an AI-curated database of billions of market data points, including market, sales, and competitive intelligence, not to mention buyer intent data. It all starts with data about customers and competitors to power sophisticated GTM campaigns that move the needle for your business.

We continue to enhance our RGIF. Most notably, we’ve recently added TrustRadius Buyer Intent and customer-validated product reviews to help identify which accounts/buyers are actively evaluating solutions in their category. We’ve also added millions more SMB companies, including their tech profiles and IT spend data. The extension to SMB companies brings HG Insights’ spend coverage to over ~3.8 million entities.

Pairing AI-powered solutions with data … how cool is this?

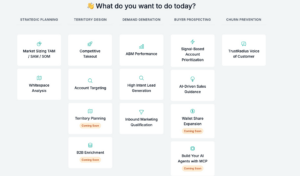

We’ve structured our new Revenue Growth Intelligence Platform with copilots and agents to provide exceptionally focused end-to-end solutions covering the most relevant high-value GTM use cases.

Our AI-powered platform takes into account the wealth of data and signals you already have from your own CRM system, website, events, and other customer data apps, and uses it in concert with HG Insights’ RGIF. You can bridge the gap between your own sources and signals, and the deeply curated data HG Insights provides. Now, given that our AI draws from a unified data structure, you’ll be confident that insights ranging from GTM strategy, to marketing, to RevOps, and to sales will all be consistent and aligned.

Example: Using HG Insights’ AI for competitive displacement

Let’s get to our new agentic Competitive Analysis and Takeout solution. Competitor displacement is one of the highest-ROI motions in today’s highly competitive environment. And since companies are constantly consolidating vendors and reevaluating their tech stacks, capitalizing on displacement is a highly effective and targeted growth strategy.

Traditionally, a salesperson might blindly call into prospects hoping to discover competitive presence. Just a few years ago, they might have bought lists of competitor customers not knowing how accurate or fresh the list was or how broad/mature the competitive deployment was. Chances are, they were blind to IT spend levels, to buyer intent, or to who the actual departments and users were. Without this data, prospecting was often a waste of time.

With HG Insights, you now have ideal starting points, data, and insights for this type of campaign:

- An understanding of your chief competitors (even some look-alikes you may not know about)

- What their coverage and usage is and what target companies are spending on them

- Which competitors are displacing you and where you’re currently displacing them

- Which potential customers (plus buying centers and locations) are “shopping” for competitive alternatives

- What current users are saying about your competitors

- What to say (and who to say it to) during your nurture and prospecting process

So, let’s walk through activating this competitive analysis and takeout use case. In this example, HG Insights provides three new agents:

- Competitive Analyst looks at the competitive landscape, market positioning, and market insights to help inform how, when, and to whom a sales campaign should be initiated.

- Prospecting Assistant helps launch and manage end-to-end takeout campaigns using AI-guided recommendations and workflows.

- Displacement Message Writer generates emails and sequences tailored to product reviews of your competition (and yours!) combined with market insights to create custom account-opening appeals.

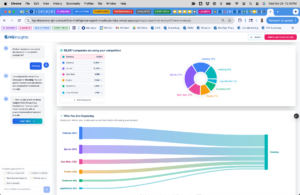

Starting with the Competitive Analyst and Prospecting Assistant, you can quickly assess and select which competitors to focus on and how they compare to other competitors in terms of footprint, IT spend, segment, and even the rate at which you’re displacing them or they’re displacing you.

Then you can drill into each competitor’s set of customers and prioritize by any number of factors, like firmographics, technographics, buying groups, and usage maturity, and ultimately target which specific opportunities to approach. This provides you with a precise set of high-propensity accounts across segments and regions to target for competitive takeout.

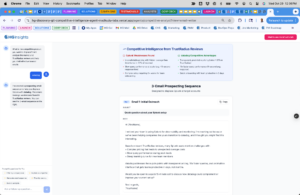

The Displacement Message Writer can craft opportunity-specific messages, drawing from actual first-hand validated customer reviews about the competitor, summarizing and highlighting strengths and weaknesses, so you know why to reach and have social proof to reinforce your claims, all within a few minutes.

An upgrade from what you’re probably doing

Assuming your GTM team uses a relatively rich tech stack, you’re likely using multiple tools to achieve the example use case above. That’s all fine, except you’re probably experiencing:

- Multiple product data leakage and learning curves

- Large tech stack expenses

- Engineering resources needed for tool integration

- Building manual workflows that don’t scale

- Workflow hand-offs between teams that lead to data leakage

- Dealing with inconsistent data, terminologies, and taxonomies

With our new platform, this cumbersome tech stack can be simplified, all while drawing from a consistent source of market, account, customer, and buyer intent data, fully integrated into the CRM and account-based marketing (ABM) systems you already use daily.

Delivering a consistent source of market intelligence truth

What’s perhaps most valuable about our approach is the breadth of our data from top-level market analysis that includes in-depth details about accounts, buying groups, buying intent, and buyers. This allows our AI and agents to accomplish what takes multiple third-party tools and workflows to accomplish. Remember, your AI workflows are only as good as the data you use.

This means your entire GTM teams, from strategy and RevOps to marketing and sales, are working with the same essential market data. For example, a total addressable market (TAM), serviceable available market (SAM), and serviceable obtainable market (SOM) sizing exercise that a CMO performs is based on the same fundamental market data and insights that a campaign manager would use for a targeted campaign. And the same account targeting and propensity insights used by RevOps for territory optimization. Your team — and the GTM data it draws from — is consistent from top to bottom.

Looking forward

The work we’re doing at HG Insights is designed to push the envelope of B2B data and AI automation to perfect Revenue Growth Intelligence. We are bridging the data divide between market-, technology-, sales-, competitive-, and account intelligence. On top of that data, we’re building special-purpose agents and signal detection to move sales and marketing to a precise, data-driven GTM decision making and action.

So, in this new big data and AI era, you should expect three trends:

- You’ll see the boundaries between individual GTM tools fall. They will become integrated to perform more sophisticated end-to-end workflows, and the integrations will consist more of AI-to-AI communications (market cost percentage [MCP] servers) and more data/signal collection by AI agents.

- You’ll see more AI that draws from specialized, sophisticated, deep, and active sources of data, combining multiple first-party and third-party data and signals, as well as market- and account-level technographic, IT Spend, and buying center insights. This fit-for-purpose data will empower fit-for-purpose AI.

- Expect to see more tools that help you day-to-day, whether it’s regularly updating your call lists, recommending sales plays, or helping with personalized opening emails, sequences, and talking-points. These will likely be new GTM AI Agents that will work hand-in-hand with agents from your other sales and marketing tools.

Stay tuned for more exciting updates and solutions from HG Insights!

If this interests you, take the next steps:

- View a short demo of our Competitive Analysis and Takeout solution

- Meet your next AI Competitive Intel Agent

- Take a free test-drive of our data and AI agents using HG Discovery

- Contact us for an in-depth demo of our platform