Key Takeaways:

- $57 billion in projected IT spend by the Telecommunications industry in the next 12 months.

- 38% of the Telecom market size for IT comes from the APAC region.

- 46% of IT spending by Telecom companies will go toward IT Services, 29% will be spent on Software, 17% on Hardware, and 8% on Communications.

- Telecommunications industry trends like AI, potential overlap with cloud providers, and expanded connectivity are impacting IT adoption and spend.

The Telecommunications industry leads many of the most exciting technological advancements today, from virtual reality to autonomous vehicles to robotic surgery. Without these companies’ investments in wireless infrastructure, we wouldn’t be able to access many of the technologies we use daily.

Telecommunications definition:

Telecommunications companies – also called Telecoms, Telcos, or communications service providers (CSPs) – are companies that provide internet and network access. Examples include companies like AT&T or other major providers that are responsible for laying down the fiber and physical network connections in the real world that enable wireless and cellular networking. Their business models revolve around building wireless infrastructure all over the world.

Our data enables us to see how Telcos are investing in IT across the various categories, regions, and buyer profiles. According to the HG platform, 52,000 companies in the Telecommunications industry will spend $56.8 billion on IT over the forecast period of the next 12 months.

This report analyzes Telecommunications industry trends in IT adoption, usage, and spend. It also highlights the leading vendors and products across five key categories. All data and insights were uncovered with the HG Market Intelligence Platform to help you identify your distinct opportunities in the market.

Telecommunications Industry Trends in IT

Digital transformation in areas such as artificial intelligence (AI,) 5G, and Internet of Things (IoT) will continue to push the Telecom industry forward. Here are three key Telecommunications industry trends we are watching:

1) Artificial intelligence (AI) in telecommunications

Artificial Intelligence (AI) is unlocking a number of new opportunities in the Telecommunications industry, from automating routine tasks to providing personalized content to customers to using predictive maintenance for networks. This is just the latest of a number of technological advancements that have forced the Telecom industry to transform in recent years, from 5G to IoT to machine learning and more.

As a whole, these AI solutions help Telecom operators to improve operational efficiency and build an enhanced customer experience. For example, with generative AI, Telcos can proactively serve customers with personalized content in real time or use it to analyze trends in customer data and behavior to see which direction their product development should go next.

2) Expanded connectivity and the Internet of Things (IoT)

As consumer demands change and technological advancements continue, the connectivity of our world is growing. We’ve already seen how Fifth-generation (5G) telecom infrastructure has expanded and upgraded connectivity, and the coming wave of sixth-generation (6G) infrastructure will continue on this path.

As connectivity limits decline, the number of connected devices is expected to grow, up to a projected 51.9 billion by 2025 – a 21% increase from 2020.

One example of connected devices, the Internet of Things (IoT), has become far more common in recent years. The popularity of IoT devices is expected to continue growing: Projections put the number of installed devices at over 25 billion by 2027, about three devices per capita globally.

3) Potential overlap with cloud providers

Since the COVID-19 pandemic, Telecom companies have been coming into direct competition with cloud providers more and more often. Why? Enterprise connectivity is evolving, and businesses are seeking more integration across their providers. This has led some providers of cloud computing services to expand into connectivity solutions

As some buyers start to view cloud companies as a one-stop shop for multiple services including connectivity, this may create friction with Telcos and erode their revenues.

Telecommunications Market Size

The global Telecommunications market size for IT will reach $56.8 billion over the next 12 months. Our analysis identified 52,000 businesses in the Telecom industry that are buying IT solutions. (The HG database includes only businesses with registered addresses.)

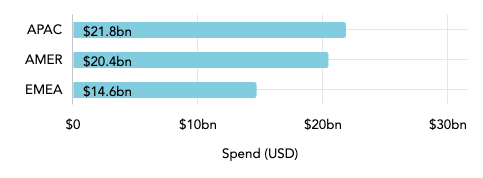

Telecom Industry IT Spending (by Region)

Telecom companies in APAC (Asia Pacific) are projected to spend the most on IT – $21.8 billion – in the next 12 months. But the AMER region (North, Central, and South America) is nipping at APAC’s heels with $20.4 billion in projected spend.

Telecommunications Market Size for IT (by Country)

| Country | Total Spend | Total Companies |

| United States | $16,137,953,671 | 19,423 |

| China | $9,419,874,650 | 997 |

| Japan | $4,132,841,248 | 500 |

| United Kingdom | $2,556,725,308 | 4,219 |

| Canada | $2,250,462,628 | 2,191 |

| France | $1,936,564,283 | 1,643 |

| Germany | $1,631,543,070 | 1,837 |

| India | $1,321,744,956 | 2,229 |

| South Korea | $1,302,503,624 | 138 |

| Australia | $1,046,111,592 | 1,626 |

The United States is by far the largest market for IT in the Telecom industry, both in terms of spend ($16.1 billion) and number of buyers (19,423). This accounts for about 79% of IT spend from the AMER region.

Three of the top markets on this list – China, Japan, and South Korea – boast a much higher average spend per company. So, although the total market size is smaller than the US, the Telcos in these APAC countries are spending 9 to 10 times more on IT individually.

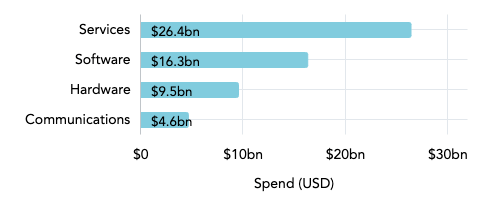

Telecommunications Market Size by IT Category

IT buyers in the Telecom industry are projected to spend $26.4 billion on IT Services in the next 12 months. This is the highest of any category and accounts for 46% of total spending. Telcos will spend a further 29% of IT investment on Software, 17% on Hardware, and 8% on Communications.

HG’s best-in-class data helps you understand your market landscape to size opportunities, track competitors, target accounts, and win deals. Try our Market Intelligence platform →

Telecommunications Market Share for IT

In this section, we use HG data to highlight the leading vendors and products across five key IT categories for buyers in the Telecom industry: Cloud Services, Security Software, Core ERP, Database Management, and Business Intelligence.

Leading Cloud Services Vendors and Products

According to HG’s data, companies in the Telecom market will spend $6.1 billion on Cloud Services in the next 12 months.

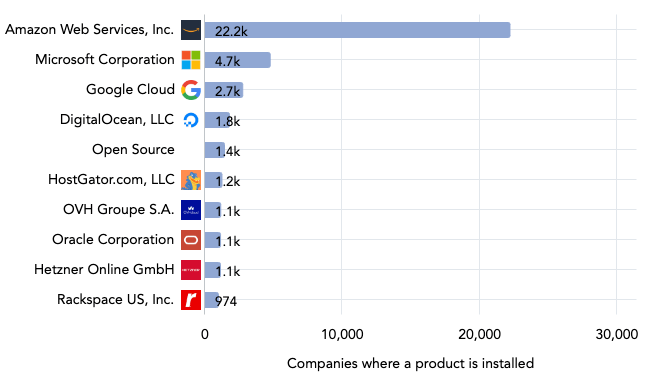

Top Cloud Services Vendors

The largest three cloud companies – Amazon Web Services (AWS), Microsoft, and Google Cloud – are locked in the so-called “Cloud Wars” across the market, and the Telecom industry is no different. These three vendors lead in the number of installs at Telcos, but AWS is a clear winner with 22,207, more than 4x the Telecom customer count of the next highest vendor.

Learn more about the “Cloud Wars” among the big three cloud companies. We’ve covered them extensively in our cloud market reports:

- The AWS Ecosystem in 2024

- The Microsoft Azure Ecosystem in 2024

- The Google Cloud Platform Ecosystem in 2024

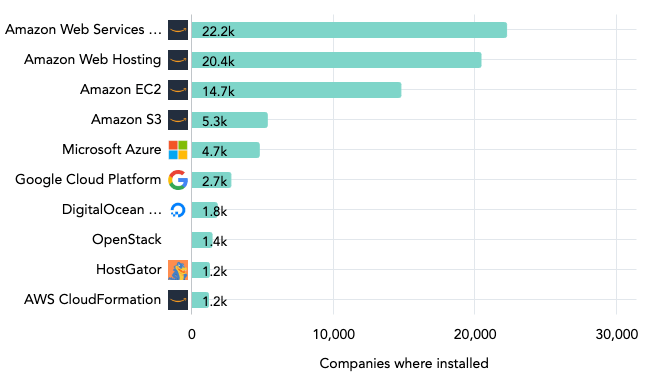

Top Cloud Services Products

The top Cloud Services products for Telecom buyers skew heavily toward AWS, with the vendor capturing five out of the top ten spots by number of installs. Many of the top AWS products are bundled or purchased together, explaining the relatively high count of installations, especially for the top three (Amazon Web Services, Amazon Web Hosting, and Amazon EC2).

Leading Security Software Vendors and Products

HG’s data projects that Telcos will spend $1.5 billion on Security Software in the next 12 months.

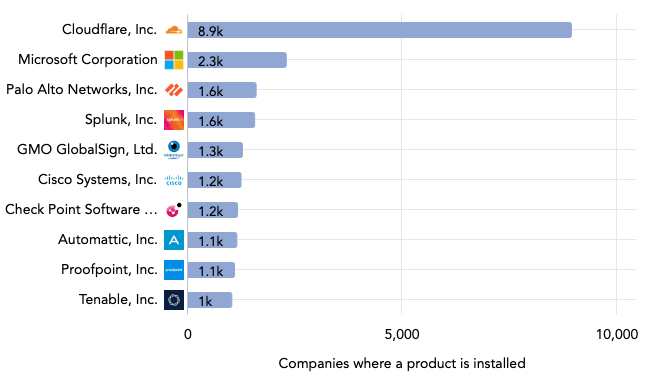

Top Security Software Vendors

Security software plays a crucial role in protecting servers, devices, and networks from attacks, viruses, unauthorized access, and a number of other threats. In the Telecom industry, Cloudflare, Microsoft, Palo Alto Networks, and Splunk are the top vendors for Security Software. This analysis includes all three Security Software subcategories: Identity and Access Management, Information and Threat Management, and Vulnerability Management.

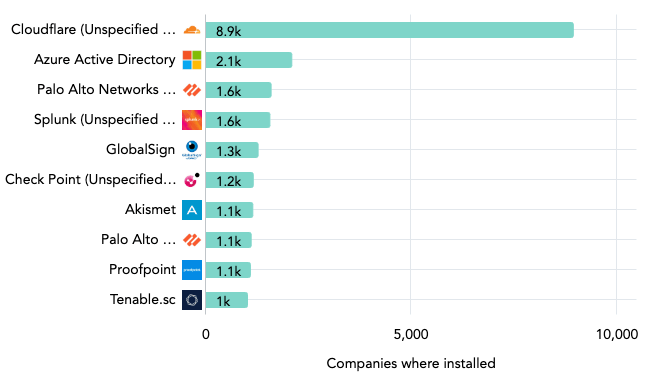

Top Security Software Products

The top three Security Software products for IT buyers in Insurance are Cloudflare (8,937 buyers), Azure Active Directory (2,087), and Palo Alto Networks (1,584). This product data tells a similar story to the previous chart, with the five leading products precisely aligned with the vendors who sell them.

Learn more about this category in our Cloud Security Market Report →

Leading Core ERP Vendors and Products

HG defines Core ERP as all subcategories of Enterprise Resource Planning (ERP) including Manufacturing Product Life Cycle Management, Supply Chain Management Applications, Distribution Management, Sourcing and Procurement, Project and Portfolio Management, Human Capital Management, and Financial Applications.

Our data indicates that Telecom companies will spend $1.4 billion on Core ERP Systems in the next 12 months.

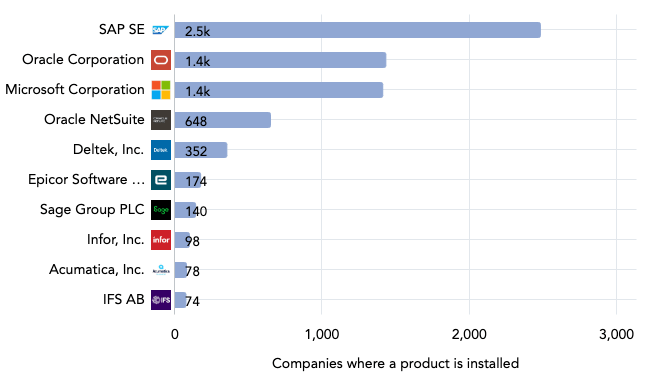

Top Core ERP Vendors

ERP systems tend to work their way into the fabric of a company’s daily operations, making them one of the stickiest product categories in IT. For buyers in the Telecom industry, the top Core ERP providers are SAP (2,480 installs), Oracle (2,079 buyers when combined with NetSuite), and Microsoft (1,410 installs).

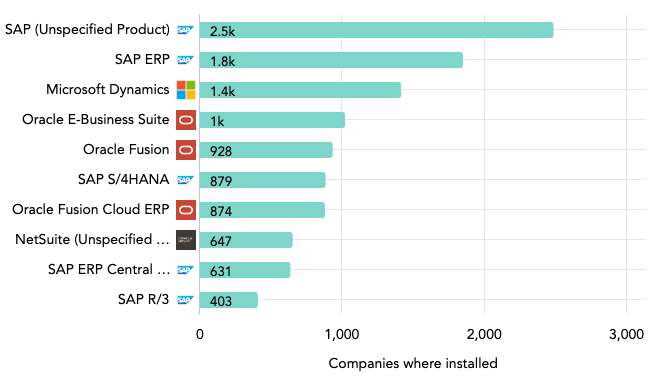

Top Core ERP Products

The list of top Core ERP products for buyers in Telecom is dominated by those top three vendors:

- SAP – ERP, S/4HANA, ERP Central Component (ECC), R/3, etc.

- Oracle – E-Business Suite, Fusion, Fusion Cloud ERP, NetSuite

- Microsoft – Dynamics

Learn more about this category in our ERP Market Report →

Leading Database Management System Vendors and Products

According to our data, companies in the Telecommunications industry will spend $1.1 billion on Database Management Systems over the next 12 months.

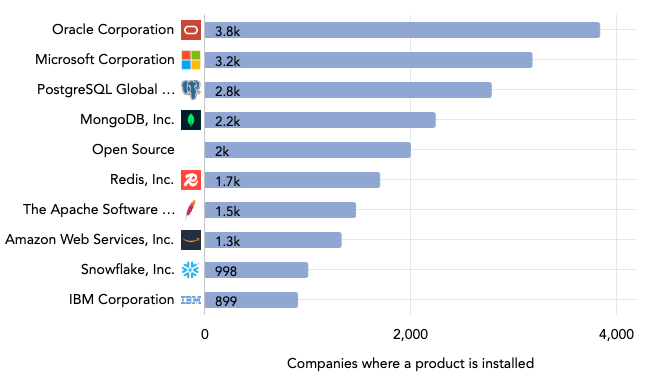

Top Data Management Vendors

The most used Database Management vendors in the Telecom industry are Oracle (3,832 installs), Microsoft (3,175), PostgreSQL Global Development (2,779), and MongoDB (2,235). The fifth place “vendor” on this list is actually not a vendor at all, but illustrates the count of Telcos with detected installations of open source Database Management solutions (1,993).

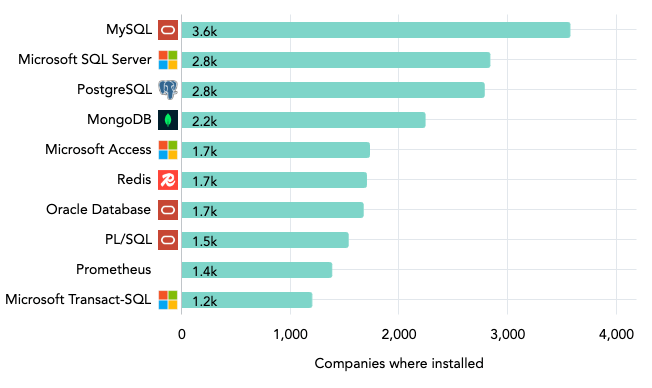

Top Data Management Products

The top four Database Management products align exactly with the four leading vendors. Both Microsoft and Oracle have three products on the top ten list:

- Oracle: MySQL (3,567 installs), Database (1,666), and PL/SQL (1,528)

- Microsoft: SQL Server (2,831 installs), Access (1,724), and Transact-SQL (1,194)

Leading Business Intelligence Vendors and Products

HG’s data projects that Telecom companies will spend $817.2 million on Business Intelligence (BI) and Analytics Tools in the next 12 months.

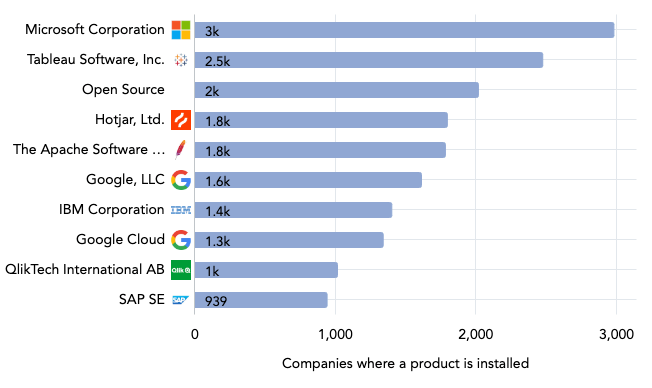

Top Business Intelligence Vendors

Microsoft – the developer of top product Power BI – leads the Business Intelligence vendor set with 2,978 installations at Telcos. Tableau (2,472) and Hotjar (1,794) are also popular, as are open source BI solutions with 2,015 installations.

When we combine the installations of Google and Google Cloud, the provider is detected at 2,948 Telecom businesses – just shy of overtaking Microsoft.

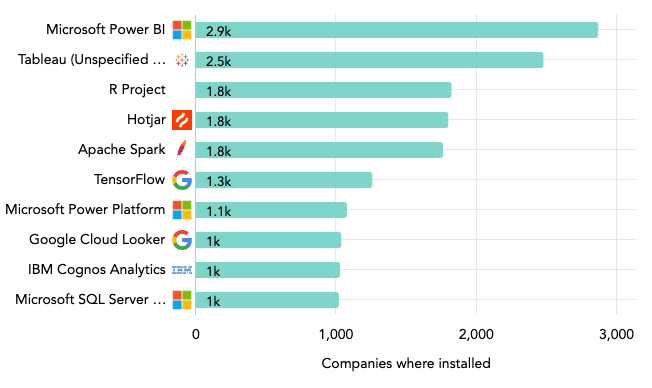

Top Business Intelligence Products

Top vendor Microsoft is the developer of three of the top ten BI products for the Telecom industry: Power BI (2,863), Power Platform (1,072), and SQL Server Reporting Services (1,014).

Learn more about the leading providers and products for other markets beyond Telecommunications. Read our Business Intelligence market report →

Uncover Telecom Industry Trends and IT Opportunities

This report features data uncovered with the award-winning HG Market Intelligence platform. Our customers, including 90% of tech companies in the Fortune 100, use HG to perfect their Go-To-Market through self-served, fact-based, and unique market analysis and technology insights – all of which are essential for accelerating growth.

Start discovering your distinct opportunities within the Telecommunications industry by scheduling a demo with one of our solutions experts.