Key Takeaways:

- $34.3 billion in projected revenue in the Human Capital Management (HCM) market over the next 12 months

- Nearly 45% of spending on HCM solutions comes from the AMER region

- Indeed, ADP, Workday, and SAP are the four top HCM vendors by number of installations

- 55% of spending on HCM software solutions comes from companies with revenue of $5 billion or more

- The Finance & Insurance, Public Administration, and Manufacturing sectors spend the most on HCM

Due to increasing demand for optimized HR processes and better workforce management, the global Human Capital Management (HCM) market is rapidly expanding.

According to HG’s data, 362,000 companies will spend $34.3 billion globally on HCM solutions in the next 12 months. More than half of that spend is associated with companies that have HG-validated HCM detections. With an eye on the growth rate and ballooning technological advancements in this sector, HG Insights has deep-dived into our data to provide a high-level view of the HCM market.

HCM encompasses a number of processes, including talent management, workforce planning, performance management, learning and development, and more. It goes beyond the scope of traditional “Human Resources” processes by recognizing employees as assets and aligning their capabilities with the goals of the business. The HCM market is characterized by integrated platforms that offer end-to-end workforce management capabilities.

This report shares our research — with proprietary insights uncovered with the HG Market Intelligence Platform — on the HCM software market and covers global spending, leading vendors, solutions, and buyer profiles.

Human Capital Management Market Size

According to HG’s data, the global Human Capital Management market size (the total spend on HCM solutions) is projected to reach $34.3 billion in the next 12 months. Out of the 4.3 million companies in the HG database, our data analysis identified 362,000 companies deploying HCM software.

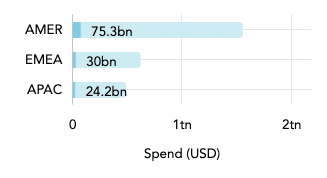

Total Spend on HCM Software by Region

- Source: This data was uncovered with HG Market Intelligence and includes only businesses with registered addresses.

This chart shows the portion of HCM software market spend (dark blue) to total Enterprise Resource Planning spend (light blue) in each region. HCM is one of several categories of Enterprise Resource Planning (ERP) apps, including Financial Applications, Project and Portfolio Management, and Sourcing and Procurement applications.

Out of the three regions, AMER (North, Central, and South America) spends the most on HCM solutions, accounting for 44.6% of revenue. APAC (Asia Pacific) accounts for 31.8% of global revenue, and 23.7% comes from EMEA (Europe, Middle East, and Africa).

Top 10 Countries in HCM Software Market

Source: This data was uncovered with HG Market Intelligence and includes only businesses with registered addresses

According to HG’s data, nearly 2 million companies in the United States spend $13.3 billion on HCM software, accounting for 38.9% of the total HCM market size. Other key markets include China, Japan, and the United Kingdom, making up 12.4%, 7.2%, and 5.1% of global spend, respectively.

HCM Market Share

We analyzed our Market Intelligence data to answer a simple question: Who’s buying HCM solutions from whom and why? This section reveals the leading vendors and products by HCM market share.

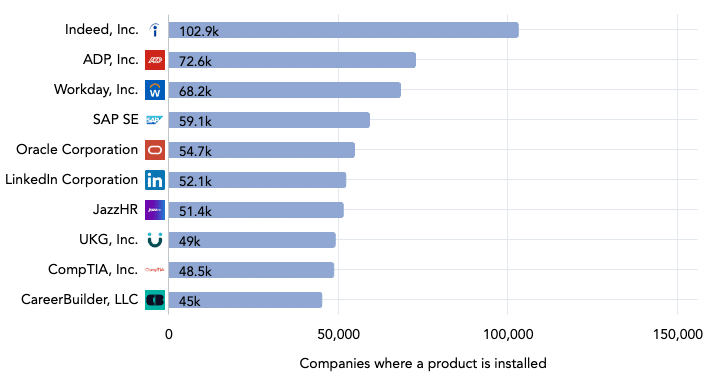

Leading Vendors in the Human Capital Management Market

This chart shows the 10 leading vendors by customer count. Please note that the HG Insights Market Intelligence Platform includes only businesses with registered addresses in its data analysis.

Indeed, the largest job site in the world, is the top vendor in terms of the number of installs with 102,938 companies. Out of the 10 vendors listed, other vendors leading the HCM market include ADP (72,631 companies), Workday (68,227 companies), and SAP (59,111 companies).

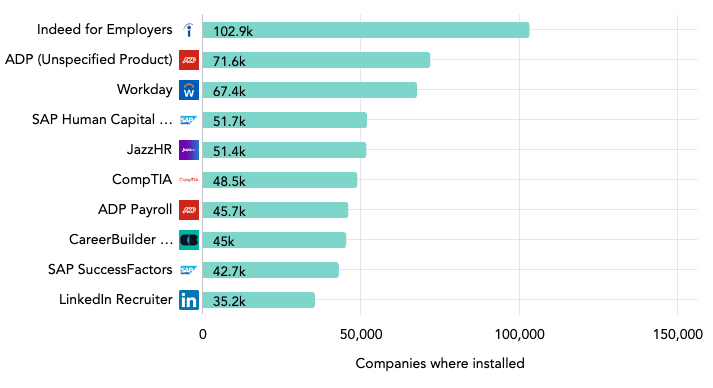

The Top 10 HCM Solutions

Here are the 10 leading products in the HCM software market. Indeed for Employers is in the lead with installs detected at approximately 102,900 companies. Unsurprisingly, the top four HCM solutions — Indeed for Employers, ADP, Workday, and SAP Human Capital Management — largely align with the top vendors. Other top HCM solutions include JazzHR, CompTIA, CareerBuilder, and LinkedIn Recruiter, as well as other products from ADP (Payroll) and SAP (SuccessFactors).

Want to learn more about leading providers and products in other verticals? Check out our market reports here →

Buyer Landscape of the HCM Market

As we continue to see exponential year-over-year growth in the HCM market, the number of buyers is also expanding — along with the size of the opportunity for sellers of HCM solutions (or complementary categories). This section digs deeper into buying trends within the HCM market. More specifically, into the number of buyers classified by industry and company size, and how much they’re spending on HCM software.

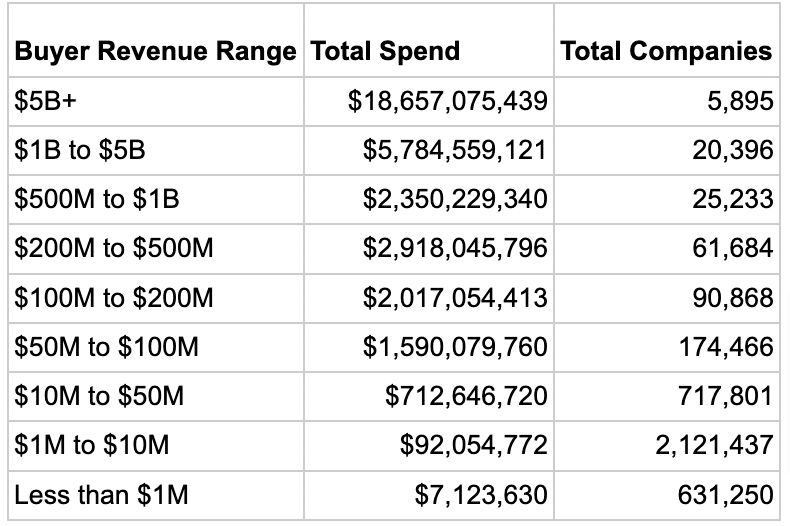

HCM Market Spend by Buyer Size (Revenue)

Companies in the highest revenue tier ($5 billion and above) make up more than half (54.5%) of the total HCM market size. However, only about 5,900 buyers fall in this revenue tier. An additional 16.9% of spending comes from about 20,400 companies earning between $1–$5 billion.

While the $1–$10 million revenue tier makes up only 0.3% of spending on HCM solutions, this tier includes the majority of HCM buyers (55.1%).

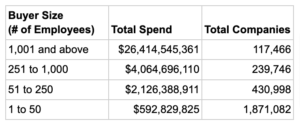

HCM Market Spend by Buyer Size (Number of Employees)

When considering the size of companies buying HCM solutions by the number of employees, the spending trends mostly align with size by revenue: A lower number of companies exist in the larger tiers (revenue or employees), but they’re spending more on HCM solutions.

HG’s data indicates that 77.1% of total spending on HCM software comes from 117,466 companies with more than 1,000 employees.

Using HG’s data, we can dig into buyer profiles further and look at the size of companies buying from specific vendors.

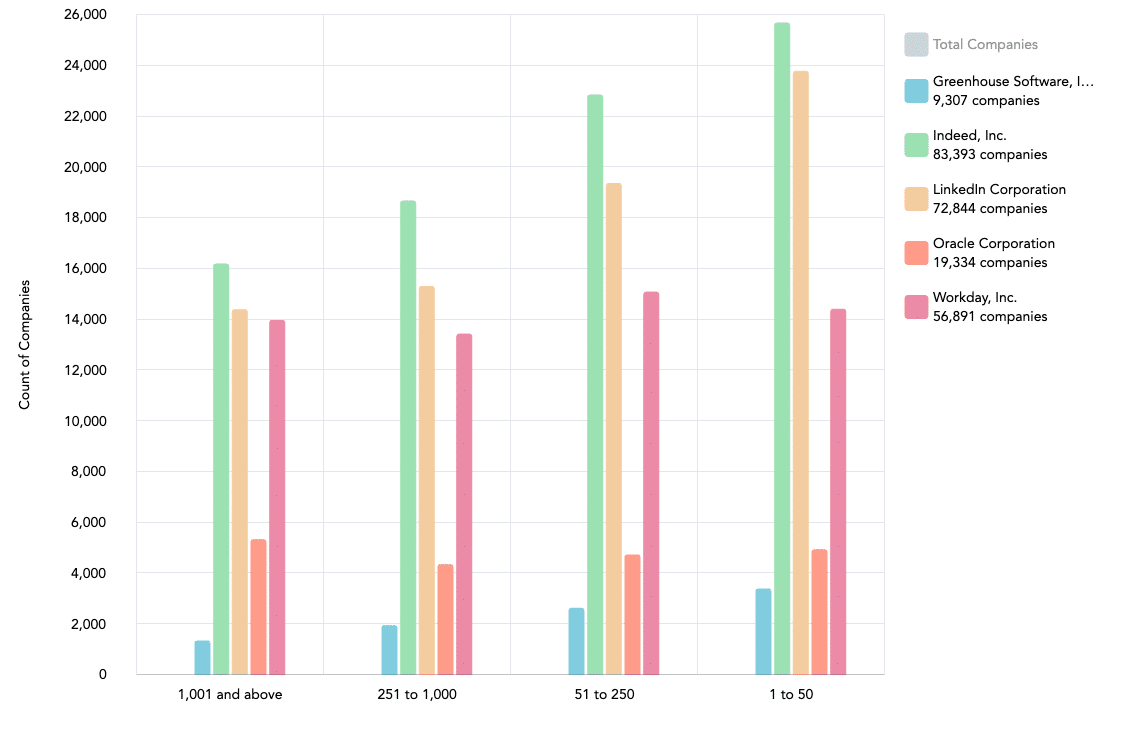

This chart illustrates the number of buyers for the five leading HCM providers — Indeed, LinkedIn, Workday, Oracle, and Greenhouse — sorted by the number of employees.

Some vendors like Indeed, LinkedIn, and Greenhouse count more customers within the smaller-employee buckets, while Workday and Oracle have a more evenly distributed customer base.

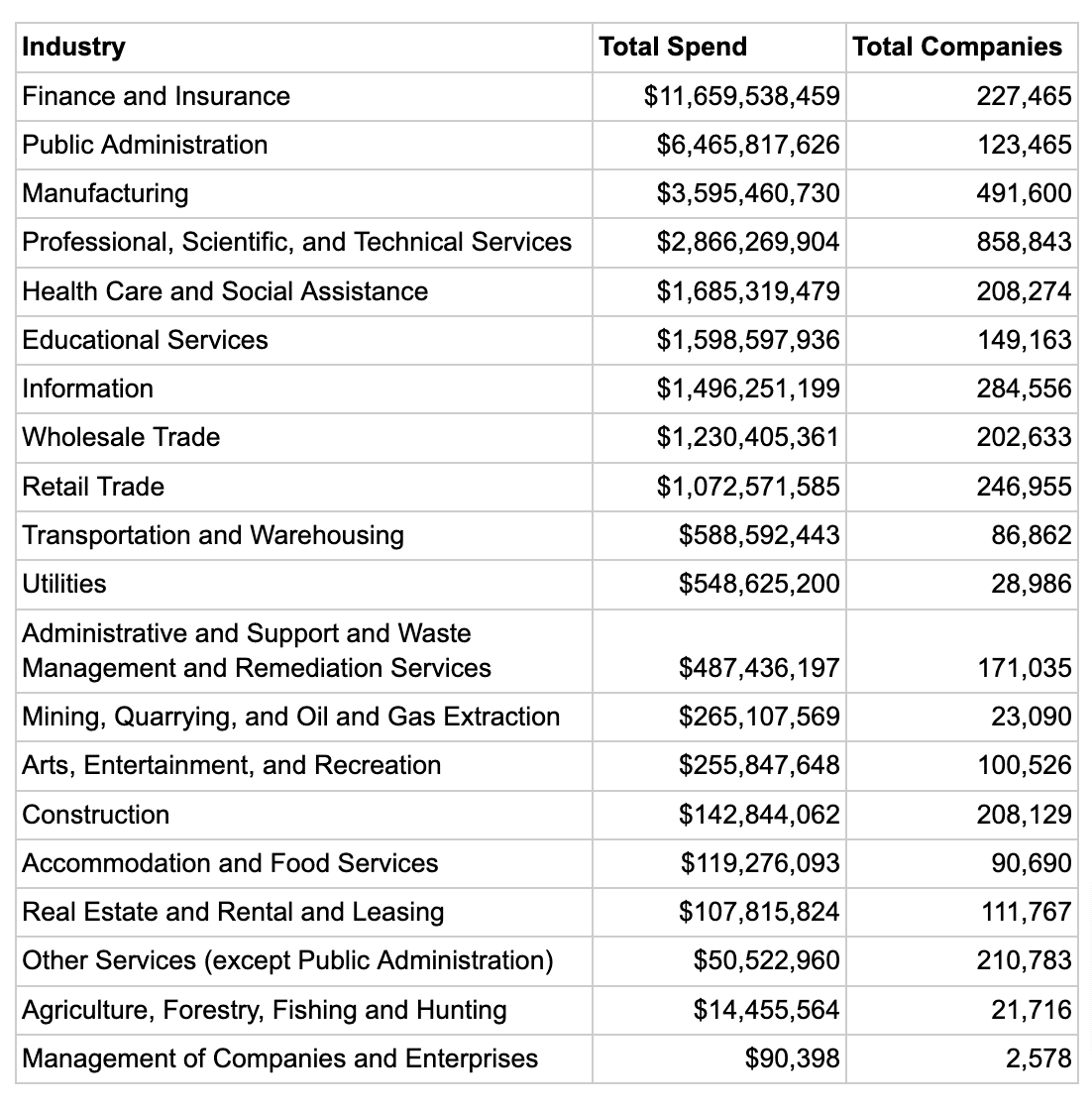

HCM Software Spend by Industry

According to HG’s data, the Finance & Insurance, Public Administration, and Manufacturing sectors spend the most on HCM solutions, accounting for 62% of the overall spend.

However, while some sectors like Manufacturing and Professional, Scientific, and Technical Services have high spend on HCM — $3.6 billion and $2.9 billion, respectively — this is spread across a large number of buyers, indicating a low average spend per customer. Professional, Scientific, and Technical Services has the highest number of buyers out of any listed industry, with nearly 860,000 customers.

Meanwhile, the two largest industries by spend, Finance and Insurance ($11.7 billion) and Public Administration ($6.5 billion), have a relatively low number of buyers (227,465 and 123,465), indicating a higher average spend per customer.

Uncover HCM Market Opportunities with HG Insights

HG Insights is a recognized leader in Sales and Marketing Account Intelligence. Our platform gives go-to-market teams a comprehensive view of the entire technology ecosystem – both at a market level and the account level – enabling them to analyze markets, spot opportunities, and target accounts with precision.

In this step-by-step video, Senior Enterprise Account Executive Leo Zunz showcases how one of his customers leveraged the power of HG Insights’ Technology Intelligence to uncover a $1.7B opportunity in the HCM market:

The HG Market Intelligence platform empowers users to identify prospects that fit their ICP, better prioritize accounts and markets, efficiently allocate sales resources and plan territories, and know which messages to send to which segments.

You can request a free data sample of HG Insights’ Technology Intelligence to view the opportunities and accounts with the highest propensity to buy HCM solutions.