Everyone is searching for a fail-safe business plan—especially for their Go-To-Market (GTM). So, when a company asks us to advise on their GTM strategy, what they’re really asking for is a data-driven way to make the right decisions for their business, confidently. This means they understand—just as you need to—that when it comes to GTM decisions, your gut instinct is not enough, that you need to make these decisions on solid data… because they’re some of the most important decisions you’ll ever make.

You need deeper insights

Actionable intelligence that makes your GTM successful is not based on tribal knowledge. No, data-driven insights are always more accurate and easier for revenue teams to understand, operationalize, and stand by. To get this GTM intelligence, you need deeper insights than what you’ll find on a typical analyst report.

60% of B2B sales organizations will transition from experience- and intuition-based selling to data-driven selling by 2025.

Gartner

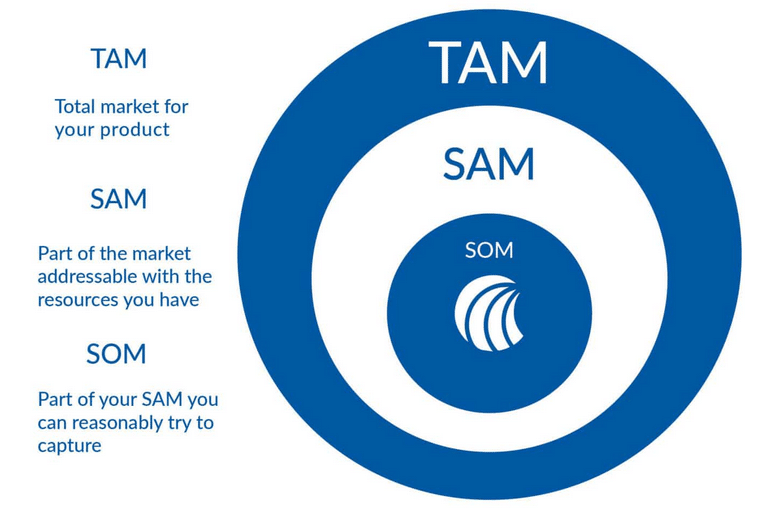

These reports typically give you estimates of a company’s total addressable market (TAM) or serviceable available market (SAM). But when it comes to fine-tuning your business plan, making realistic revenue projections, and perfecting your GTM, you need more than just TAM or a SAM estimates. You need a thorough understanding of your serviceable obtainable market (SOM), which represents the segment of the market you can reasonably capture with the resources available to you.

Why Your SOM Leads to Go-To-Market Success

Essentially, your SOM tells you how many customers would actually benefit from buying your product or service, within the confines of what your sales and marketing teams can actually do. As such, your SOM is unique to your business, product, or solution. These insights allow you to make better business decisions. That’s why understanding your unique SOM is invaluable.

But here’s the catch: your SOM is calculated based on complex signals and data. It’s not easy to identify. Most businesses don’t have the data they need to get to their SOM, or the sophistication to calculate it.

Calculate Your Som

1. Pursue the Right Go-To-Market Opportunities

Let’s use a real-world example. You’re faced with a decision between investing resources in two different countries, for example, England and Spain. Let’s say the market sizes are:

- England: $45 billion

- Spain: $15 billion

On the surface, it looks like the market in England is 3x the size of Spain. So, you’d naturally think that England would be a much more lucrative place for you to invest your resources. But what if the majority of the English market was saturated with well-seated competitors who have held market share for years, even decades, that are difficult to displace.

Without a SOM analysis containing detailed information about competitor product installations, you’d have no way of knowing how difficult it would be to penetrate the English market, and you may enter a market that’s already saturated with competition—a market where you have very little likelihood of displacing incumbent players. Meanwhile, the Spanish market has very little competition and unmet high demand.

Think about how this would impact your revenue projections, not to mention the wasted budget from allocating staff and resources to fund the wrong market opportunity.

2. Win Whitespace

Now, say you’re looking at regions or countries in order to identify the best growth opportunities for your business.

Again, knowing the estimated market size in revenue isn’t going to help you much. But what if you knew what companies had budgeted to spend on your category of product by region, entity, or industry?

SOM strikes again. Not only would a SOM analysis uncover this, it will allow you to:

- Allocate budgets and resources effectively

- See what a prospect is already spending on a product/solution

If it’s with you: You can find cross-selling and upselling opportunities

If it’s with the competition: You can uncover displacement opportunities - Find whitespace to identify, and capture, new market opportunities

3. Drill Down To The Essentials

Too many companies rely on analyst research reports and high-level market intelligence to guide their planning. But you’re at a competitive disadvantage if you don’t drill down to your unique SOM.

Uncovering your SOM begins with granular technology intelligence—this is what makes market research actionable. The more granular, the better.

Insights into what products your accounts and prospects have installed and what they spend on those products allow you to quickly find the right accounts to target, deliver more relevant and effective campaigns, and hit revenue growth goals.

One Step Closer

SOM takes you beyond your SAM, giving you greater granularity so you can size your markets based on your Ideal Customer Profile (ICP). This allows you to make better decisions. And companies that size their market based on their ICP have a 68% higher win rate.

If you push past your TAM and SAM with detailed tech intelligence to find your SOM, you can:

- Ensure resources are allocated efficiently

- Project revenue more accurately and predictably

- Take the risk out of your Go-To-Market motions

Your gut feeling is not enough. You need to have quality data in order to act with confidence. Anything you think you know is based in the past. Insights look forward, and goals based on insights are how you write your own future.

To see how a SOM analysis will help you create the perfect Go-to-Market strategy, schedule your free personalized demo now.