What is Account Based Intelligence?

Account based intelligence (ABI) is data that measures a prospect’s behavior and activity in the market and provides context about propensity to buy in real-time.

Overview: Account Based Marketing Intelligence

Many B2B sales and marketing teams inside large technology companies have too many leads. To find leads that match their ideal customer profile (ICP) they enrich accounts with firmographic and technographic data. This data helps them segment accounts but rarely helps them target accounts with the highest propensity to buy, or the highest likelihood to purchase your product.

Account based intelligence solves this problem. When accounts are populated with data that shows how leads are engaged with a company’s product and market in real-time, better opportunities are surfaced. It becomes easier for marketing to target the right accounts for campaigns and for sales to skip “qualification calls” and start talking solutions.

The shift from data to account based intelligence

Before sales and marketing intelligence tools existed, tools that provided relatively static data helped companies prioritize accounts. This data identified the industry, employee count, annual revenue, and even technology used by accounts — but it didn’t show how prospects were interacting with the market or using technology.

For greater insight, companies “enriched” accounts with more firmographic and technographic data. This new data did little to improve sales and marketing efforts. Instead, it created data excess and decreased the data-to-insight ratio significantly. The quantity of data went up but targeting accounts with the right message at the right time remained difficult.

Account based intelligence tools recently emerged to solve this problem. These tools collect data like their predecessors but that data is dynamic and updated regularly, helping companies target accounts at the right time. These tools also collect behavioral and contextual data. For instance, behavioral data tools like Bombora show companies how contacts inside accounts are behaving around the web.

When data becomes intelligence

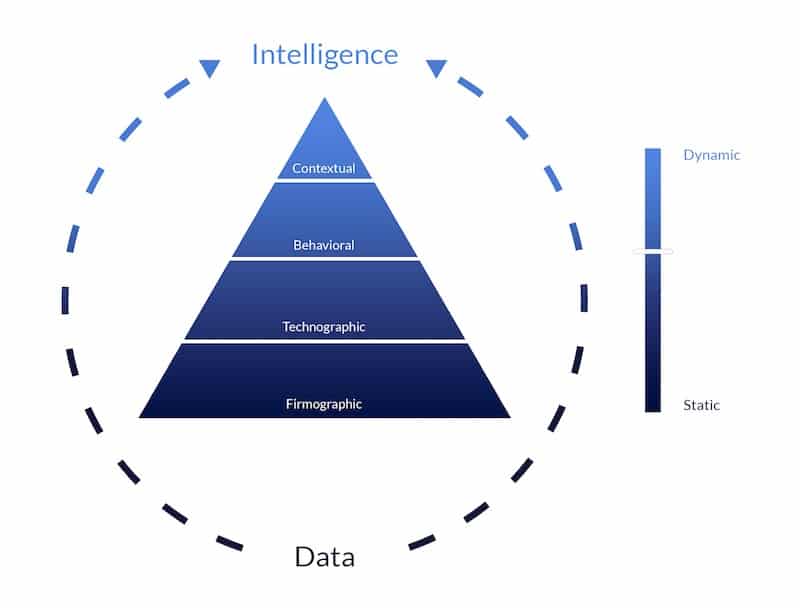

The illustration below is useful for comparing data and intelligence. As you collect data closer to the top of the pyramid, your awareness of important information increases. You increase the likelihood of targeting the right accounts, at the right time, with the right message.

Firmographic data

Firmographic data is relatively static compared to other data types. It’s also easier to obtain which is why so many firmographic data tools exist. This data is still important though. Data like annual revenue and industry helps with account segmentation.

Firmographic data is not solid dark blue in the illustration because some firmographic data can be dynamic. One example of this data comes from the tool Leadgnome. This “email mining” tool informs companies when a lead or customer leaves an account and becomes part of a new account (i.e. job change), presenting a unique opportunity to acquire new business by leveraging an already-established relationship.

Technographic data

Technographics was touted as the new firmographics in 2016. By knowing what technology an account used, marketers could create more effective messaging for campaigns and salespeople could understand how the technology they were selling fit into an account’s existing tech stack.

Some tools in this space also provide dynamic data. They show companies when an account adds new technology that complements their own and when an account drops competing technology. They don’t, however, give companies context about how technology is used by an account. Is the account using it for a single app and spending very little or using it across all digital properties and spending a great deal? Only contextual data can answer these questions.

Behavioral Data

A good way to save time and money on marketing and outreach is to know whether an account is actively showing interest in you. Are contacts inside accounts researching solutions related to your product? Are they researching your product directly? Behavioral data can answer these questions. And because it tracks daily behavior like website visits, it’s one of the most dynamic data types.

If you use marketing automation software like Marketo or Hubspot you already have access to some types of behavioral data. You can link them up with your CRM and see which accounts are actively visiting your website. You can also use tools like Bombora and Kickfire. Bombora shows you if accounts are researching your product or related products around the web. Kickfire helps you see which accounts are visiting your website by mapping public IP addresses to specific accounts.

Contextual Data

Contextual data can show companies how accounts are using technology, how much they’re spending on it, when their contracts with other vendors expire, and much more. This type of data is the rarest and most valuable because it’s product-specific.

At HG Insights, we specifically collect contextual data about how accounts are using cloud products like web security, hosting, and content delivery. We show companies when companies start and stop using these products, at what rate they’re using them, how much they’re spending on them, and more.

This information is relevant for companies that sell digital products, but less valuable for, say, steel manufacturers. Contextual data for a steel company would show how much accounts spend on steel each year, where that steel is sourced from, and what that steel is used for.

Does a contextual data solution exist for your product? Whether you’re a salesperson or marketer in cloud services or commodities, it’s worth looking into.

Example of account based intelligence

Assume the ICP of two different cloud hosting companies spending $500K on hosting per month. Each company plans to run an ABM campaign that targets one big account in the entertainment streaming industry. Company A is using firmographic and technographic tools for account selection and Company B is using account based intelligence.

Two of the accounts each company is targeting are Hulu and Netflix. Using technographic tools, Company A can see all the different hosting services Hulu and Netflix are using. One of these hosting services is a direct competitor with a weakness that was recently exposed in the news. Because Netflix owns more content than Hulu, Company A decides to target Netflix.

On the other hand, Company B is using behavioral and contextual data tools. Using these tools, Company B can see that contacts at Hulu are actively researching other hosting solutions on the web. It can also be seen that Hulu is decreasing its monthly spend with the hosting provider and that Netflix is not. For these reasons, Company B decides to target Hulu.

After spending $100K on a three-month ABM campaign, Company A learns that Netflix has decided to keep the hosting provider because its relationship with the provider is strong and the provider fixed the exposed weakness by month two. Company B only spent $10K on a one-month ABM campaign and is speaking with the CTO about migration. Because the account is worth $500K, that’s a 50x ROI for pipeline revenue.

Tips for acquiring account based intelligence

Move up the pyramid of data types.

If you’re a technology provider basing sales and marketing decisions on firmographic data, introduce a technographic solution. And if you’re currently using technographics, introduce a behavioral data solution while looking for a contextual solution. You want at least one tool for each data type and more tools that provide dynamic, event-based data.

Swap static data for dynamic data.

If you’re using technographics for prospecting, account selection, or outreach, check if your technographic data solution offers event-based alerts. This feature will notify you when an account adds, changes, or removes a technology. This data is more than information. It’s intelligence that helps you spot new opportunities in real-time.

Get data that is product-specific and contextual.

A company that sells cloud infrastructure won’t benefit much from a technographic tool that lists every piece of SaaS a prospect is using. It will benefit more from a tool that shows which hosting and CDN services a prospect is using and how it’s using them. The latter solution provides information relevant to the product the company is selling; the former does not.

In summary, the more dynamic data you have that is relevant to what you’re selling, the closer you are to acquiring account based intelligence.