As highlighted in our recent market report, AWS (Amazon Web Services) remains the dominant player in the “Cloud Wars” with Google Cloud Platform and Microsoft Azure in 2025. In fact, AWS market share now accounts for 30% of the global cloud infrastructure market, beating out Microsoft’s 20% and Google’s 12%.

However, the cloud infrastructure services market remains highly dynamic as Microsoft and Google compete with AWS for increased cloud spending and AI dominance. This year, AWS is continuing its quest to win 99% of the AI market. The strategy? “To bring millions of companies into that ecosystem while it works to improve its own AI models and chips, and increase its market share.

In this report, we’ll provide a detailed overview of the AWS market share, buyer landscape and trends shaping the AWS ecosystem. If your business integrates with and/or complements AWS, if you resell their products, or if you compete in similar markets, we hope you’ll find these insights valuable for informing your go-to-market decisions.

2025 AWS Market Insights

HG Insights collects data on the 2.38 million businesses buying AWS cloud services. Here are a few key takeaways from the 2024 AWS market report:

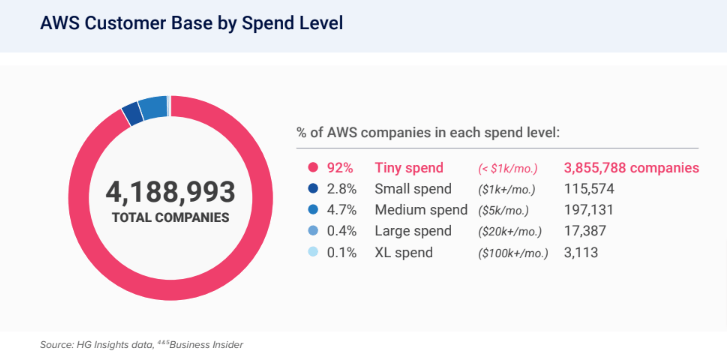

- The AWS customer base has grown to 4.19 million customers in 2025 (this only includes businesses with a physical address)

- Since 202o, AWS customer growth has skyrocketed 357%, with Startups increasing 257%

- Startups and SMBs are the fastest growing customer segment, both growing by 28% YoY from 2023 to 2024

- The vast majority (92%) of AWS customers are spending less than $1K per month on AWS services

- Key industries spending the most on AWS cloud services include: Media, Retail, Internet, Manufacturing, and Education

AWS Market Share in 2025

AWS had the highest relative market share among the top cloud providers. AWS market share now accounts for 30% of the global cloud infrastructure market, exceeding Microsoft Azure with 20% share of the cloud market and Google Cloud Platform’s 12% share, according to Synergy Group.

The AWS Buyer Landscape

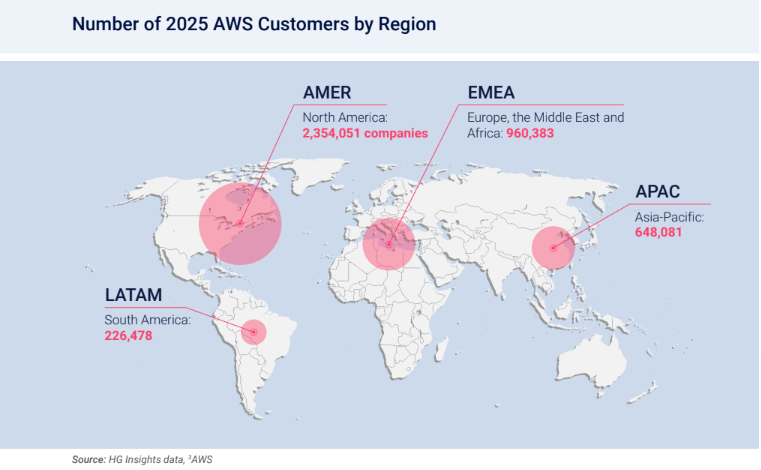

The map on the left indicates the number of AWS customers by region. More than half (56.2%) of AWS customers are located in North America (NA).

HG’s data indicates rapid global expansion for AWS in the last five years: Since 2020, total customer counts have increased by a whopping 357%.

This growth is likely to continue as AWS invests in new regions, points of presence (POPs), and availability zones. Some of the latest additions:

- Mexico (Central) region – Launched January 2025. First region in Mexico and grows AWS presence in Latin America.

- 2 new APAC regions – Thailand (January 2025) and Malaysia (August 2024).

- Middle East expansion – Top business opportunity. AWS announced plans to invest $5 billion in Saudi Arabia and has launched in Bahrain, UAE, and Israel since 2019.

AWS Market Share by Company Size and Spend

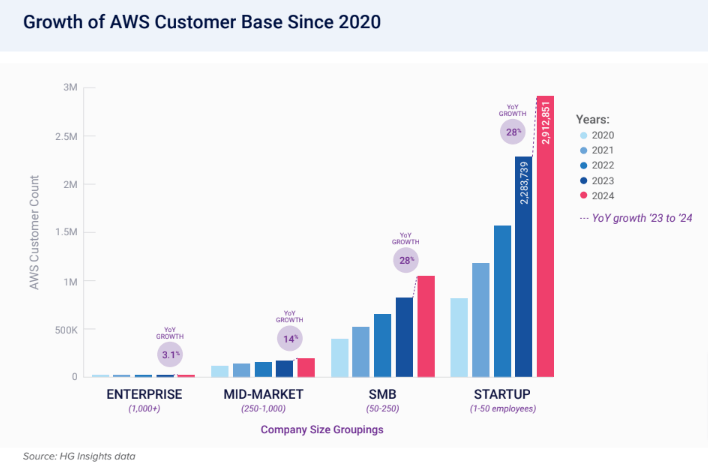

Once again, AWS has grown its customer base across all company sizes – a consistent trend since 2020. From 2023 to 2024, the fastest-growing segments were SMBs and startups, both growing by nearly 28% year-over-year.

Even more impressive is the overall growth in these two segments over the last five years: HG’s data shows that the number of SMBs buying AWS products has grown by 165% and startup customers have increased 257% since 2020.

The vast majority (92%) of AWS customers are spending less than $1K per month on AWS services. This is also the fastest-growing segment, with a YoY customer count increase of 88.7%.

According to Synergy Research Group, AWS regularly adds more cloud revenue (in absolute dollar terms) than rivals. The company accounts for 30% of the global cloud infrastructure market, beating out Microsoft’s 20% and Google’s 12%.

But while startups remain a key priority, AWS is also targeting the world’s largest enterprises – the Forbes Global 2000 list – with their Top 2000 (T2K) initiative. The complex technical architectures at these businesses will require significant financial and time investments, and AWS plans to customize solutions on a company and industry level.

Key Industries Investing in AWS

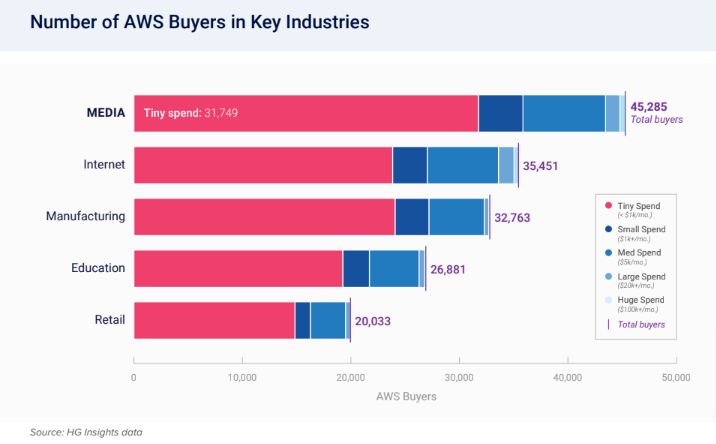

HG’s comprehensive usage and spend data can be segmented to understand current adoption and white space – what AWS calls greenfield opportunities – in key industries. Strength in certain markets is indicative of demand, and as we can see from this chart, AWS has high demand across these five key industries: Media, Internet, Manufacturing, Education, and Retail.

The Media and Internet sectors lead the pack with the highest total AWS buyer count, as well as the largest count of companies spending more than $100K per month.

Trends Shaping the AWS Ecosystem in 2025

The AWS ecosystem is undoubtedly influenced by what the company prioritizes internally. There are three key areas of focus for AWS we are watching going into 2025:

1. Artificial Intelligence

AWS’ investment in Gen AI extends beyond the list of Generative AI Competency Partners.

The company has also committed to investing $230 million in a Generative AI Accelerator program, $50 million to help public sector organizations use Gen AI, and $110 million to support AI research at universities using Trainium chips.

2. Machine Learning

As with AI, AWS is ramping up investment in other emerging technology areas like Machine Learning.

Amazon SageMaker – a service for building, training, and deploying machine learning models – launched in 2017. The next generation of the tool was announced in December 2024.

3. Data Security

Even with companies spending more than ever before on cybersecurity, data breach instances increased in 2024 and the average cost jumped by 10% YoY.

AWS has a number of services and features focused on helping customers protect their data, such as AWS Security Hub, AWS GuardDuty, and AWS Shield, which is designed to protect against distributed denial-of-service (DDoS) attacks

About HG Insights

HG Insights, the provider of data-driven insights to 90% of tech companies in the Fortune 100, is your go-to-market Technology Intelligence partner.

We deliver advanced Revenue Growth Intelligence — on IT spend, technographics, cloud usage, intent signals, buying groups, contract details, and AI maturity — to provide global B2B companies with a better way to analyze markets and target prospects. Our customers achieve unprecedented results in their marketing and sales programs thanks to the indexing of billions of unstructured documents each day with insights into product adoption, usage, spend data, and more to build high-resolution maps of activity across an organization’s entire digital infrastructure to power business decisions with precision and confidence.

Our market reports are designed to give you an unparalleled view of your markets. To get a custom view of your exact market, reach out! Our team can provide you with a complete analysis of your market and opportunity.