When selling technology to complex global organizations, how well you understand corporate hierarchies has a massive impact on revenue and operational efficiency. Without a cohesive, accurate view of parent companies and their subsidiaries, you risk leaving millions in expansion revenue (and wallet share) on the table for competitors to grab. Not to mention opening the door for territory disputes between sellers.

Dun & Bradstreet, which has long been a staple of firmographics and hierarchy data for B2B technology companies, bases their corporate hierarchies around legal structures, answering the question of “who owns what”.

This approach stems from their 150+ year history of being a world leader in helping lenders assess credit risk.

While this lens makes perfect sense for pinpointing where financial responsibility sits, it’s often not an accurate reflection of how a business operates, or how and where technology purchase decisions are made.

Here’s a few examples of how basing corporate hierarchies around legal structures can negatively impact GTM efforts:

- Missing key operational units: The parent company of a global organization might legally separate Mexico, India, and Canadian operations into different companies for tax or regulatory purposes. But in reality, they have similar technology needs as the parent, and report into the parent’s centralized leadership in the United States. But a legal hierarchy view might easily miss that link, resulting in missed expansion opportunities.

- Can’t see shared decision-makers: Let’s say the chief security officer at global headquarters is driving strategy for 10 different legal companies across three continents. A legal-only view might show these as unrelated entities, so you’d never know the deals are connected, and you’d fail to coordinate deals under shared budgets and initiatives.

- Undervaluing an account: If you only see the parent legal entity, you might base an organization’s potential opportunity amount solely based on the parent’s infrastructure needs. Where, if you added up all the operationally aligned entities, the true opportunity could be 3-4x larger. By underestimating the value of an account, you risk underinvesting in time and resources as well.

Taking a broader, operational view with Corporate Hierarchies

To address these challenges, HG developed a unique, technology-focused approach to hierarchies that focuses on operational structure, instead of legal structure.

Our approach is rooted in the fact that knowing what technology products are present, and where, is a great proxy for not only understanding how a business operates, but also what business initiatives are happening at a company.

Here are the key attributes of our unique approach:

- GHQ Consolidation: HG consolidates multiple legal entities into a single Global HQ, ensuring a complete view of complex, multinational organizations.

- Operational Hierarchy: HG focuses on operational structures, revealing the actual buying centers and decision-making entities within an organization.

- Simplified Hierarchy Tiers: HG uses a simplified hierarchy structure. This structure makes it easier to navigate and prioritize accounts:

- GHQ

- Corporate Parent

- Domestic Parent

- and Lower Level Entity

- Data Accuracy: HG meticulously curates its data and combines information from various sources to ensure accuracy and completeness.

How exactly does HG identify potential buying centers? We leverage our deep understanding of technology usage and spend. For example, we look at:

- Install Base Analysis: HG tracks the technologies deployed at different entities, revealing which locations have independent IT infrastructure and decision-making processes.

- Departmental Usage: HG identifies the departments and roles using specific technologies, further indicating autonomous buying centers.

- Spend Data: HG analyzes IT spending patterns within entities, offering insights into their budget and potential buying power.

- Company Size and Structure: HG considers the size and organizational structure of entities, using factors like revenue and employee count to assess their buying autonomy

How to use HG Insights to take a broader, operational view

Here’s an example from the HG Platform on how this unified view of complex global organizations can help you pinpoint expansion opportunities with just a few clicks.

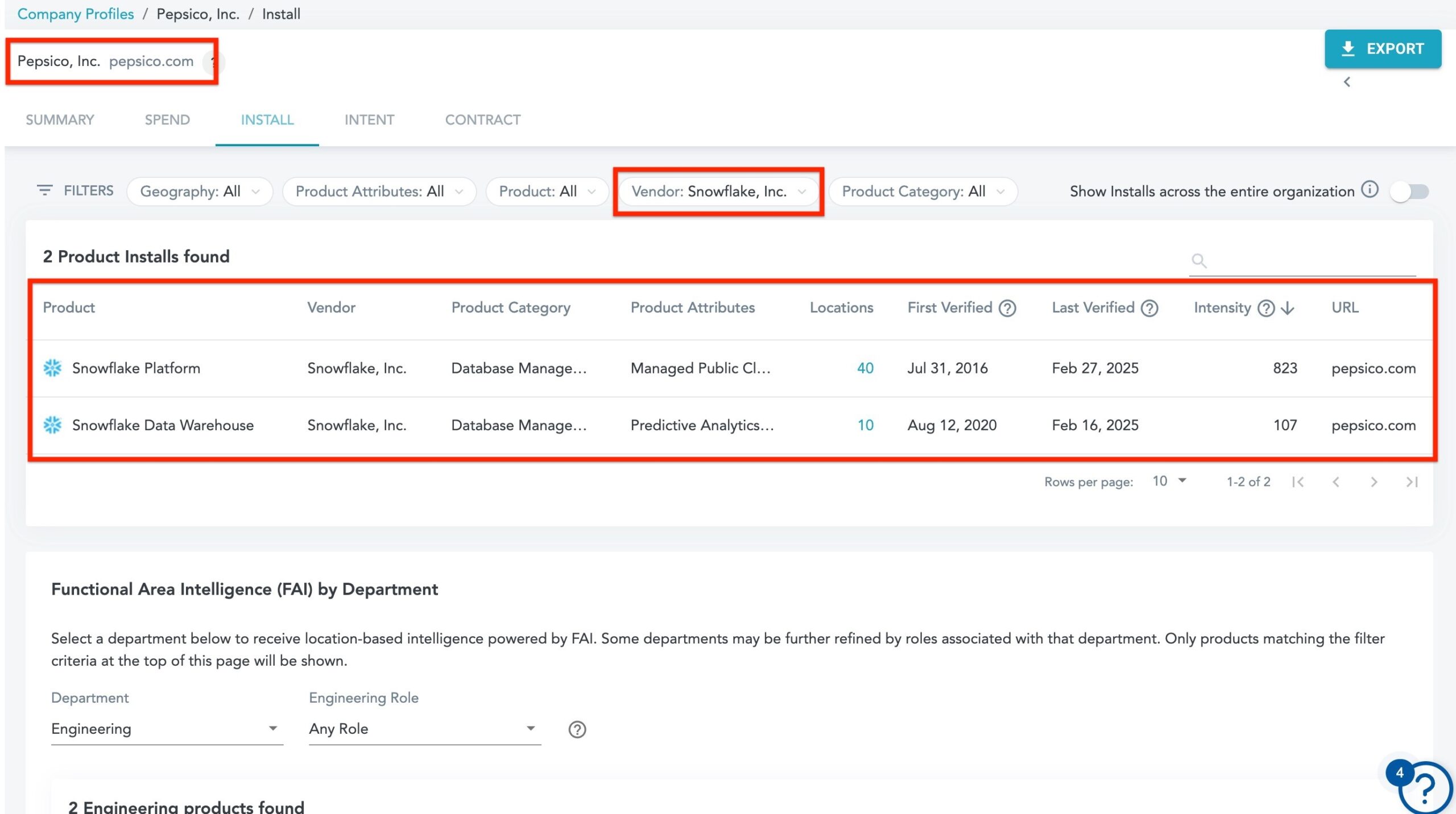

We’ll look at Snowflake’s footprint within the Pepsi organization. You can see they have a decent footprint, with high intensity usage detected across 50 geographic locations.

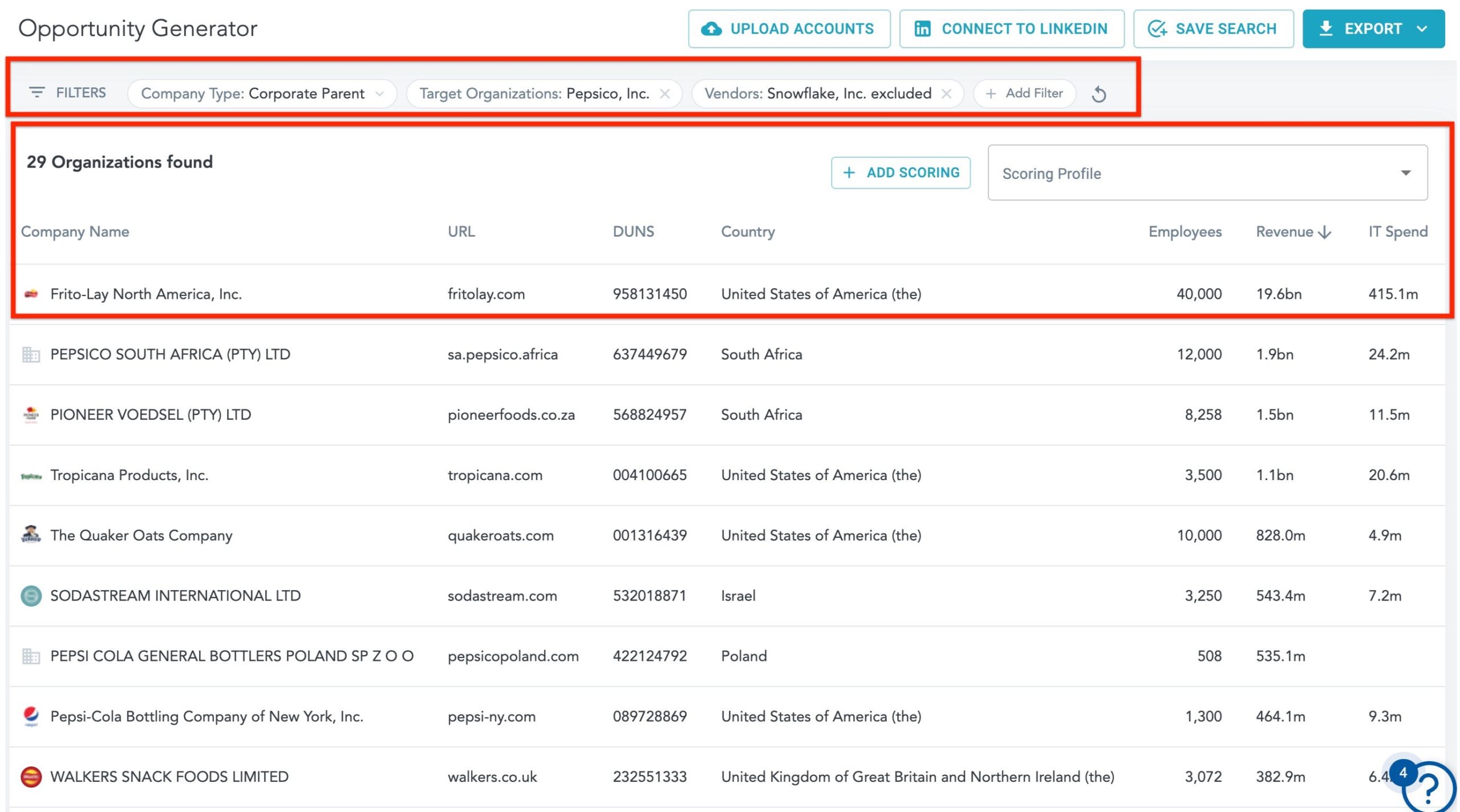

Even though Pepsi is a long-time Snowflake customer, since HG allows you to see across the entire corporate structure in one view, let’s look at things from the opposite angle — where Snowflake IS NOT penetrated across the organization. This screenshot below shows 29 subsidiaries within the Pepsico hierarchy that DO NOT have Snowflake.

Looking at the first result, you see Frito-Lay North America, with $415M in IT spend. This would be a great opportunity for Snowflake to leverage relationships at the Global HQ level to drive additional adoption and revenue across the global organization.

Up-level your GTM strategy

No other company has the depth of technology usage and spend data, nor have they dedicated the resources that HG has to establish the linkage of entities to form these operational hierarchies that give technology sellers the granular visibility they need to maximize revenue.

By leveraging HG Insights for your firmographic data and hierarchy management needs, you benefit from:

- Improved Account Targeting: Identify and prioritize the right accounts within complex organizations, focusing your sales and marketing efforts where they matter most.

- Reduced Sales Cycle Times: Avoid wasted efforts pursuing entities with no buying authority by understanding the true decision-making structure.

- Increased Win Rates: Develop tailored messaging and outreach strategies based on a deeper understanding of your target accounts.

- Enhanced Sales and Marketing ROI: Maximize your return on investment by focusing on the highest-potential accounts and optimizing resource allocation.

To learn how HG helps customers drive more efficient growth, check out our customer stories. Or contact us to speak with an HG expert.