As highlighted in our recent market report, Google Cloud Platform (GCP) remains locked in a heated competition with Amazon Web Services (AWS) and Microsoft Azure to capture market share. In the last six years, Google’s share of the cloud market has nearly doubled from 6% in Q4 2017 to 11% in Q4 2023. Overall, Google’s cloud revenue hit $33.1 billion in 2023, with Q4 2023 earnings up 26% versus Q4 2022.

Google previewed the first iteration of its cloud service in 2008 under the name App Engine, two years after Amazon EC2 popped onto the scene and two years prior to Microsoft Azure’s entry. In 2011, the platform was launched as a fully supported Google product, and has grown to include many services under the GCP umbrella across computing, networking, big data, storage, machine learning and more. To this day, GCP continues its intense battle with the other two cloud giants — AWS and Microsoft Azure — often referred to as the “Cloud Wars.”

The cloud infrastructure services market remains highly competitive as Microsoft and AWS vye with GCP for increased cloud spending. Gartner says that in 2022, the worldwide Infrastructure-as-a-Service (IaaS) market grew 30%, exceeding $100 billion for the first time.

In this report, we provide a detailed overview of the Google Cloud Platform market share and trends shaping the ecosystem.

2024 Google Cloud Market Insights

HG Insights collects data on the 960,000 businesses buying GCP cloud services. Here are a few key takeaways from the 2024 GCP Market Report:

- Google Cloud market share has grown to 28% among the top 10 cloud providers and reached 11% of the global cloud market.

- HG Insights identified 960,000 customers buying GCP cloud computing services.

- Overall, Google’s cloud revenue hit $33.1 billion in 2023, with Q4 2023 earnings up 26% versus Q4 2022.

GCP Market Share

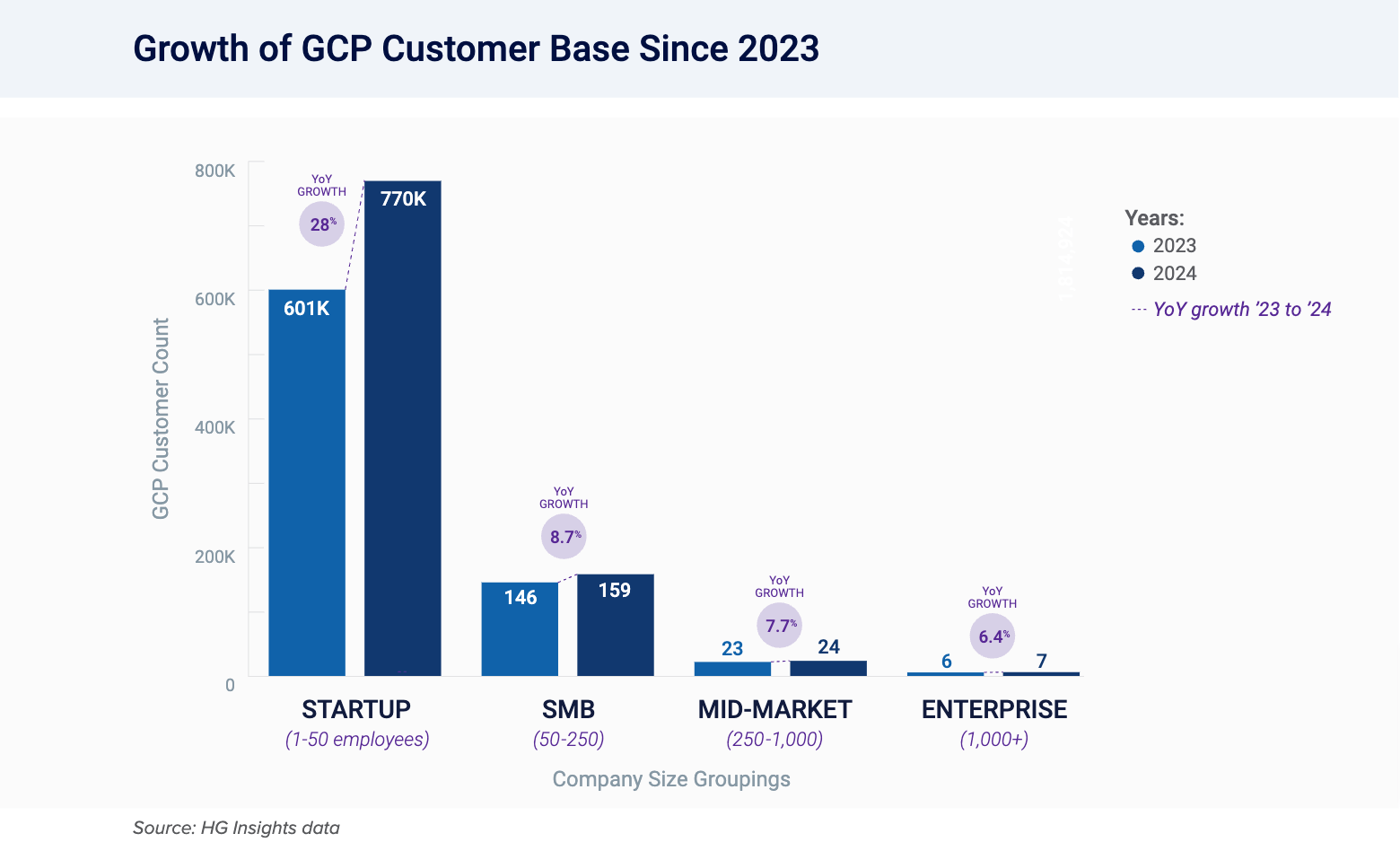

In the last six years, Google’s share of the cloud market has nearly doubled from 6% in Q4 2017 to 11% in Q4 2023. From 2023 to 2024, GCP achieved positive year-over-year customer growth — with the Startup segment growing the fastest YoY at 28.1% and SMB growth reaching 8.7% YoY.

The growth in GCP’s customer base is paying off in the “Cloud Wars,” as the company fights for market share with giants like AWS and Microsoft Azure, and other leaders like Salesforce and Alibaba cloud services.

AWS vs Azure vs Google Cloud Market Share

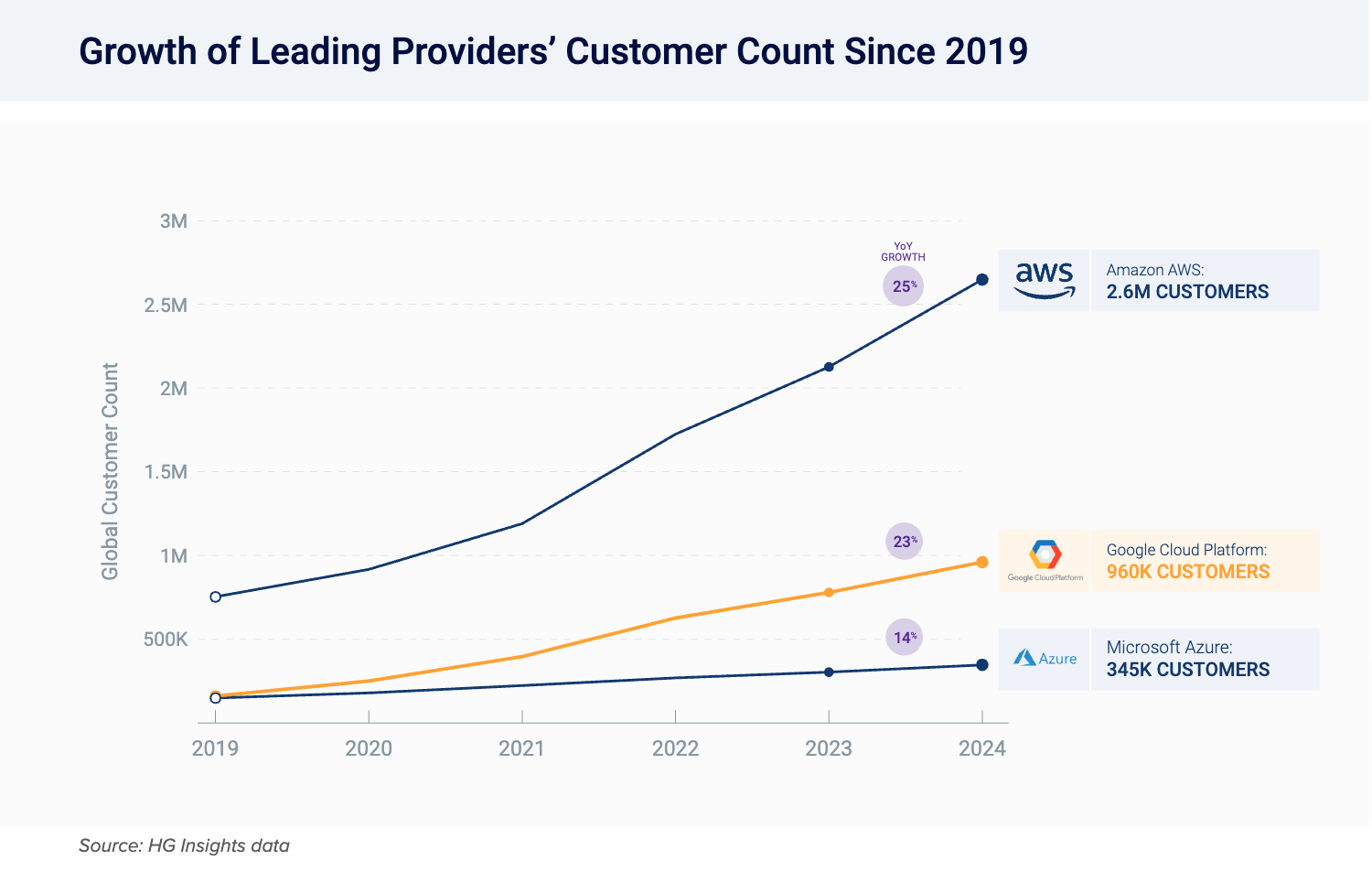

All three of the leading cloud providers have shown positive year-over-year growth in customer count every year since 2019, demonstrating the extreme competition in the “Cloud Wars.”

While GCP is in second place in terms of customer base size with nearly 960,000, the majority of its customers are in smaller spending tiers. This means the company comes in a distant third in market share, capturing 11% of the cloud market in the last calendar quarter of 2024 compared to Azure (24%) and AWS (31%).

From 2023 to 2024, GCP’s customer base grew by 23%, while AWS and Azure grew by 25% and 14%, respectively.

Google Cloud Customers in 2024

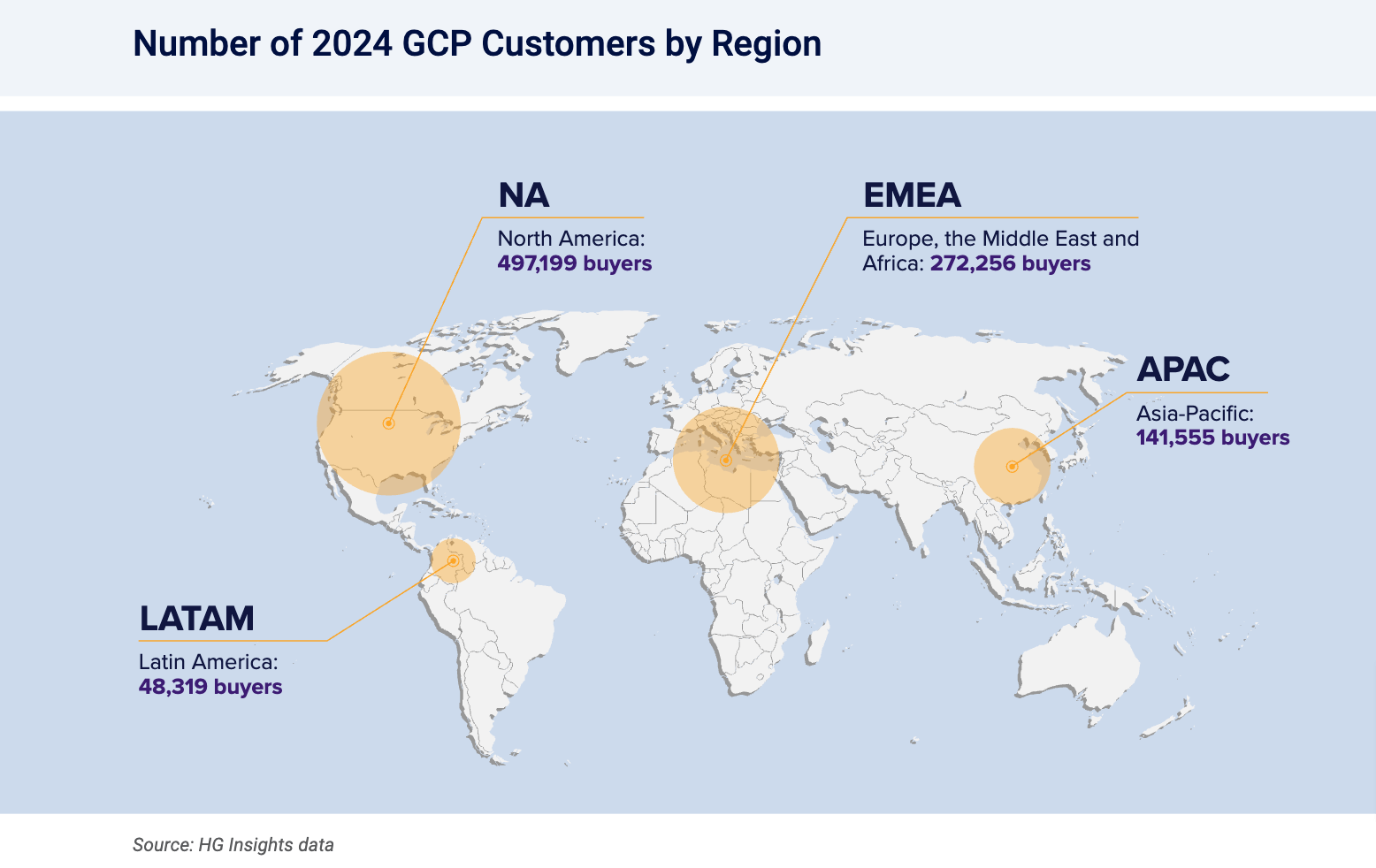

More than half (51.8%) of Google Cloud customers are located in North America (NA), with the second-largest concentration — 28.4% — in Europe, the Middle East and Africa (EMEA).

GCP has 40 cloud regions, 121 zones, 187 network edge locations, and is available in more than 200 countries and territories. In 2023 and the beginning of 2024, GCP added four new regions in Berlin, Germany; Doha, Qatar; Dammam, Saudi Arabia; and Johannesburg, South Africa. Regions coming soon include Mexico, Malaysia, Thailand, New Zealand, Greece, Norway, Austria and Sweden.

GCP has seen consistent YoY customer growth across all company sizes. From 2023 to 2024, the fastest-growing segment was Startups, with a 28.1% jump in customer count. The second highest customer growth rate was among SMBs at 8.7%, making GCP a champion of small and growing businesses.

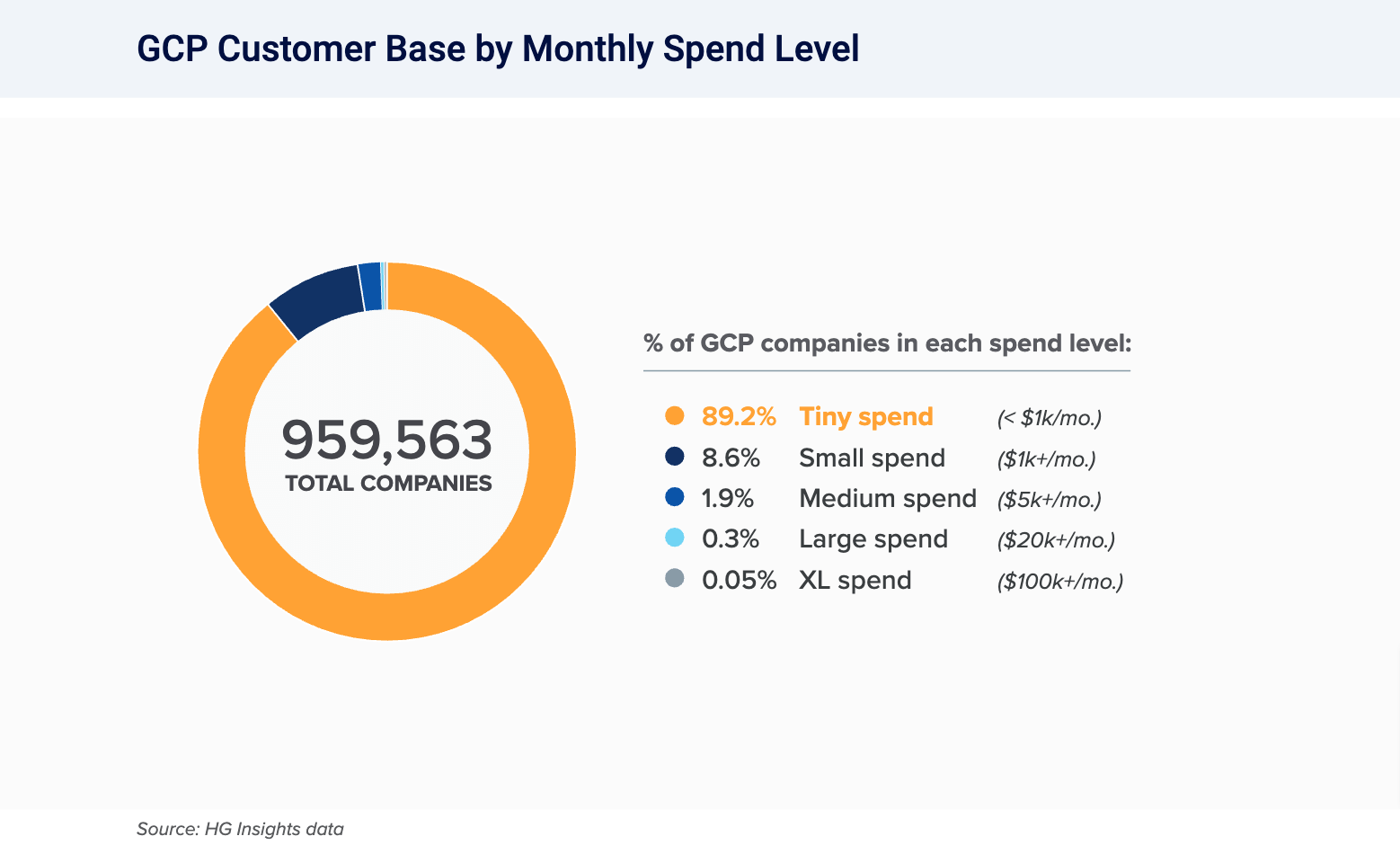

GCP’s customer base is highly skewed toward smaller spenders. Nine out of every ten GCP customers (89.2%) are in the lowest spending tier, with less than $1k in monthly spend. A further 10.8% of customers are spending between $1k–$20k monthly (small and medium tiers).

Many of the companies in the larger spend tiers ($20k+/ month) are enterprises. Although they make up less than 1% of the total customer base, their contribution to GCP’s total revenue is much higher.

Google Cloud Spending Across Key Industries

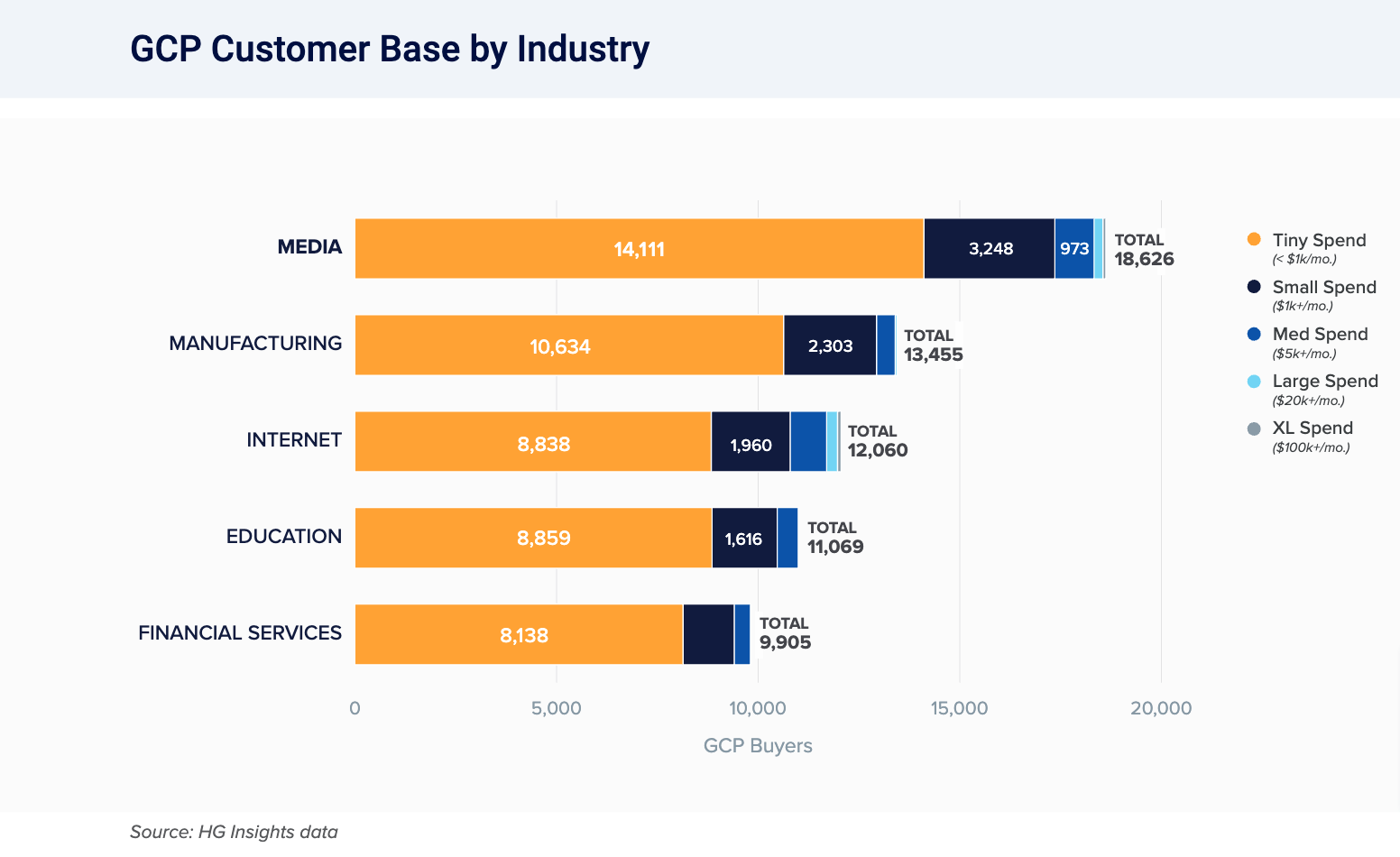

HG Insights’ combination of detailed usage and spend data with industry-level detail allows us to understand adoption rates and potential by business type. To dig in deeper, we analyzed the spending of GCP customers in five of the company’s top industries: Media, Manufacturing, Internet, Education, and Financial Services.

This chart shows the number of companies with detected GCP installs, grouped by industry and estimated monthly spend on Google Cloud. GCP customers in the Internet sector skew toward larger spending compared to other industries, with 10.5% of these buyers spending $5k or more per month.

Trends Shaping the GCP Market

The GCP ecosystem is greatly influenced by what the company prioritizes internally and trends in the cloud services market. Here’s what we are watching in 2024:

GCP Multi-Cloud Strategies

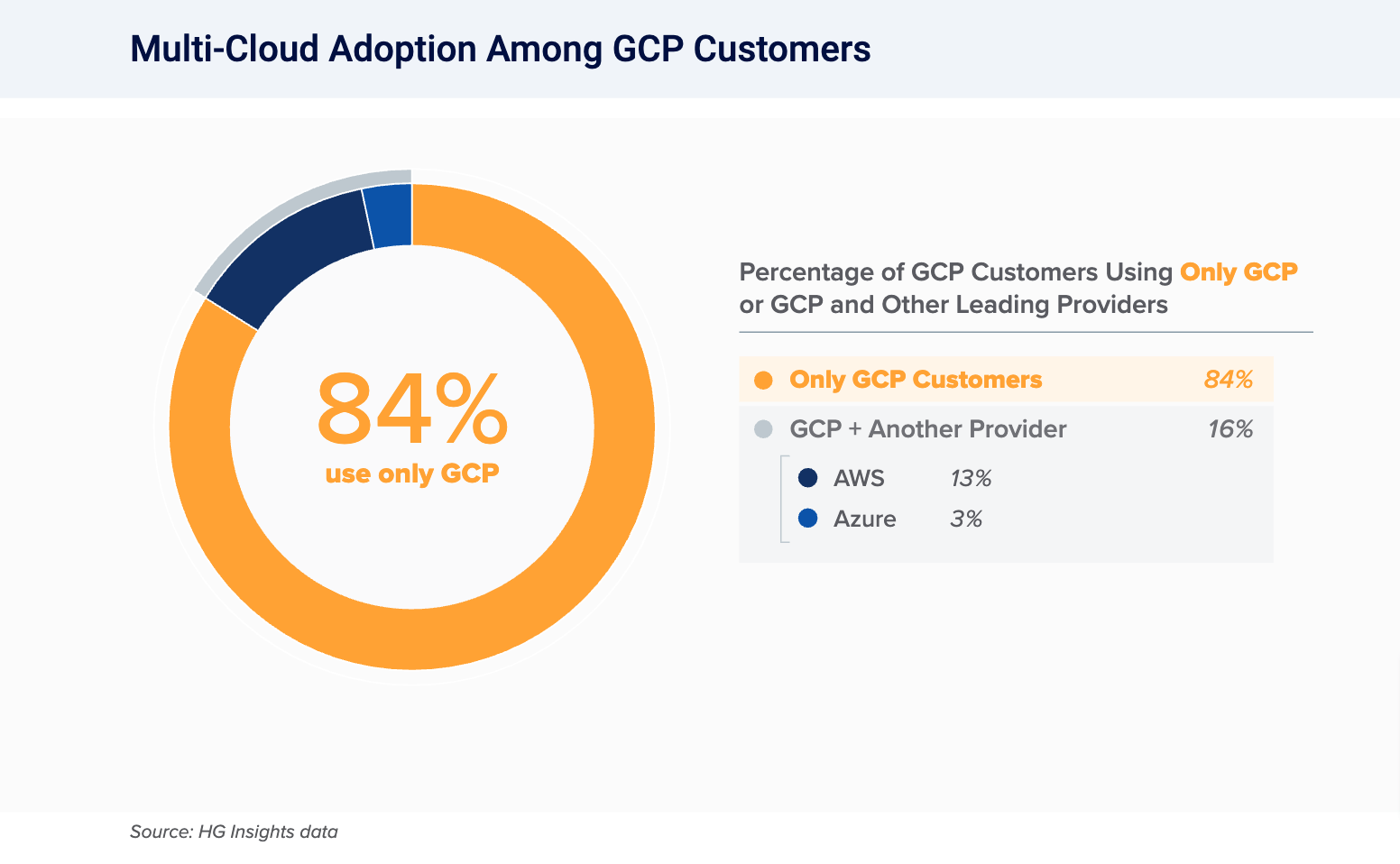

This chart illustrates multi-cloud usage among GCP customers; specifically, what percentage are using GCP exclusively versus those combining GCP with AWS or Azure.

HG’s data reveals that 84% of GCP customers use the platform exclusively, while about 16% have a multi-cloud strategy: 13% use both GCP and AWS and 3% use both GCP and Azure.

Among the three leading providers, GCP customers fall in the middle in terms of multi-cloud adoption. Out of AWS customers, 8% buy from multiple cloud leaders, while Microsoft Azure customers have much higher multi-cloud adoption (36%).

GCP Buyer Trends: Hybrid Cloud vs Cloud Leaders

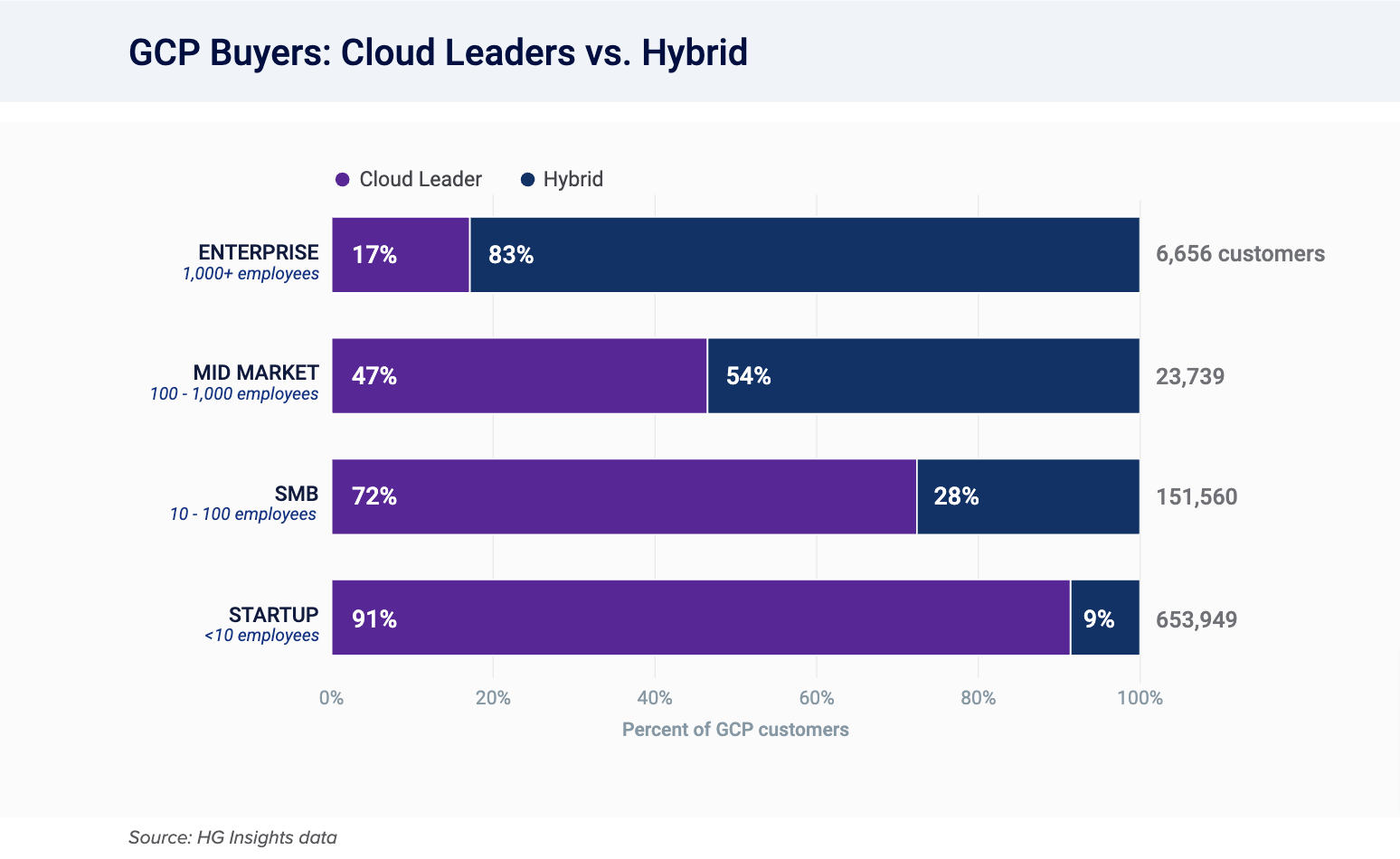

HG Insights collects data on the IT infrastructure of more than 11 million companies worldwide. The data can be used to identify where Google Cloud customers are on the digital transformation curve. This chart segments GCP buyers, by company size, into two distinct groups:

Cloud Leaders: Cloud-native; the majority of their infrastructure spend is with the three leading cloud providers (GCP, AWS, and Azure) and almost no data center spend.

Hybrid Cloud: Companies with high spend on both cloud and data center solutions.

Artificial Intelligence (AI)

In 2023 we saw generative AI explode across the scene, particularly after OpenAI’s introduction of ChatGPT in late 2022. While OpenAI falls under the Microsoft umbrella, Google is not shying away from the AI movement and has been making major moves of its own. According to Google Cloud CEO Thomas Kurian, investment in data analytics and AI is at the top of the company’s priority list for 2024.

Google Cloud is the only major cloud provider that offers its own AI models alongside third-party AI models on equal footing. “We are not ‘all in’ or dependent on any particular model, but are committed to offering broad choices,” Kurian said.

The company’s current AI offerings include the generative AI chatbot Gemini, the machine learning Ops tool called Vertex AI, and Duet AI, which embeds in Google Workspace to help users streamline tasks.

Uncover Cloud Revenue Opportunities with HG Insights

Identify the accounts most likely to buy your solutions with HG Cloud Dynamics. We provide companies with account-level data on cloud product adoption, usage, and spend for over 7 million businesses around the world, and 21,000+ cloud products.

HG is a global provider of data-driven insights to 75% of Fortune 100 tech companies. We use advanced technology intelligence to deliver insights on technographics, IT spend, buyer intent, and contract renewal dates — providing B2B companies with a better way to analyze markets, find and acquire new customers, and shorten sales cycles. If you have questions or want to learn more about HG insights, reach out!