DataFox users know that account-level intelligence is the fuel that drives their revenue engine forward, but they’re going to need a replacement soon. Oracle has announced that DataFox will be sunsetted as of August 31, 2023. We want to offer some ideas for a potential alternative to your account-level intelligence needs and provide some relevant and objective information to help you make the best business decisions.

Account intelligence is made up of multiple types of data, which all have the same goal: To help you better understand accounts and prospects in order to inform how you score accounts, build territories, build audiences for marketing campaigns, and more. This article will look at multiple types of data, their importance, and how HG delivers high-quality data-driven insights to fuel account engagement.

Technology Intelligence

Did you know that HG Insights first coined the term ‘technographic data’ way back in 2010?

When it comes to technographic data—data on the various technologies an account uses—DataFox only provides simple “yes/no” answers that offer no nuance beyond “the account has the tool or does not.” But when you’re developing and executing a Go-To-Market strategy, you need more than binary “yes/no” answers to be effective. You need a multidimensional understanding of accounts that answers all the questions around technologies used—who, what, why, and when. HG Insights gives you that granular understanding, beyond just technographics. We call this “Technology Intelligence,” and it empowers you to precisely target accounts and drive revenue.

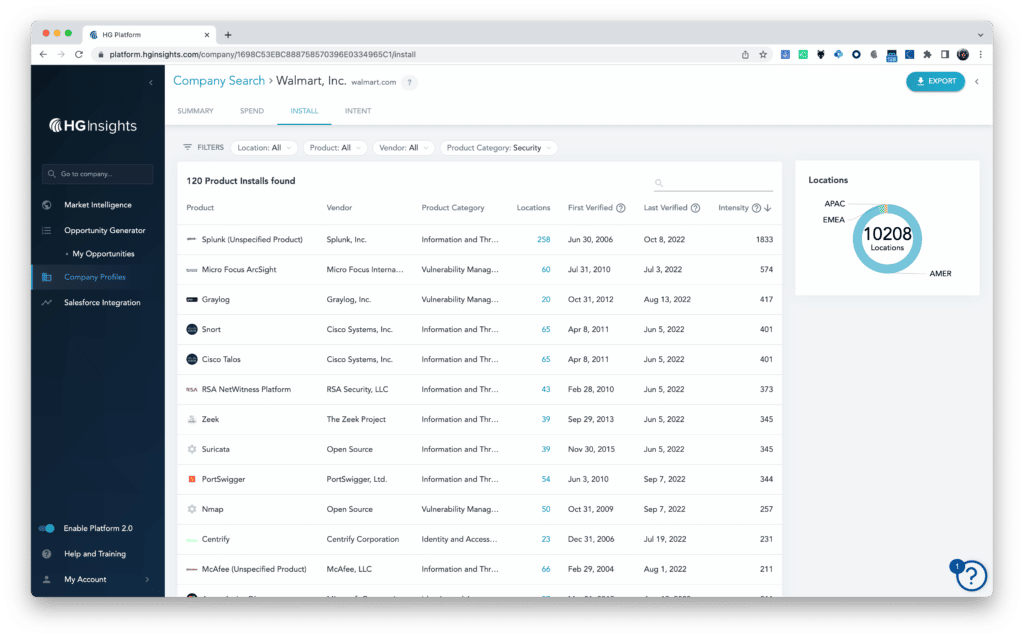

For example, in addition to telling you whether or not a product is installed, HG tells you the exact location it’s installed, the date it was first detected, the date that it was last verified, in what functional department, and much more.

HG also provides a deep understanding of a company’s organizational structure. Global organizations have complex subsidiary structures, where the tech stack within child accounts can be completely different than that of the parent corporation. HG gives you clear visibility into these subsidiary relationships and the unique technology profiles of each one, helping you identify cross-sell/expansion opportunities that you’d normally miss if you were to just view the entire organization as one.

Spend Data

In addition to its incredibly granular install data, another key HG dataset Datafox users will appreciate is our spend data. HG tracks how much companies are spending across 140 IT categories, from hardware, software, services, and communications. This spend data is vital for prioritizing accounts, building equitable sales territories, and understanding share of wallet.

Let’s say you sell an enterprise solution and you’re getting $200k in annual contract value from an account. Great, but that’s not enough. HG shows you that the account is actually spending over $2 million in that category, meaning you’re only 10% penetrated in that account. This spend data is a goldmine for identifying expansion opportunities or gaining wallet share, and also forms the backbone of another HG feature that Datafox users will love — Market Intelligence.

Market Intelligence

Our Market Intelligence solution is a huge differentiator for HG Insights. We empower you with the unique, massively valuable capacity to size your markets, understand which markets and products to prioritize, and where to allocate your resources to optimize ROI. Market Intelligence is something Datafox simply does not offer. While traditional analyst firms like Gartner and IDC offer market intelligence, HG’s goes much deeper, unlocking more value.

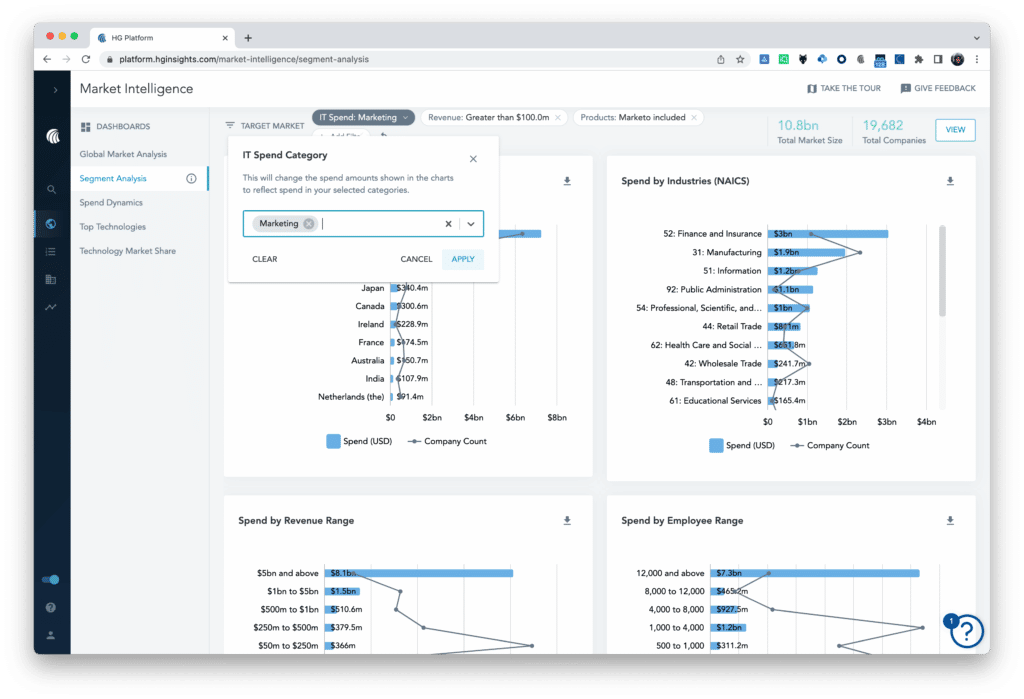

Market Intelligence helps you understand your accounts’ entire market. We do that by rolling up all of the extensive individual company information we have into a larger market-based context. HG enables you to filter market information into your list building and segment accounts by market region.

For example, you can look at accounts in the EMEA region (Europe, Middle East, and Africa) and select all companies with a revenue range greater than $100 million who also have one of three specified software products installed. With that filtering capability, you can see the size of that potential market with incredible accuracy. In an example output of HG’s Market Intelligence, you would see 19,682 companies in EMEA with over $100 million in revenue that also have one of three selected software products in the exact category you are selling into.

Then you can select from over 140 spend categories across hardware, software, services, and communications to see the size of the opportunity for just that category.

What that capability gives you is your TAM, or Total Addressable Market. HG also helps you understand that market-level spend, broken down by region and by country. So you can move from focusing on EMEA to looking at Germany or the UK. The ability to quickly identify your TAM by region and country enables you to better allocate resources, better locate your sales reps, identify and precisely engage opportunities, and more.

Contextual Intent

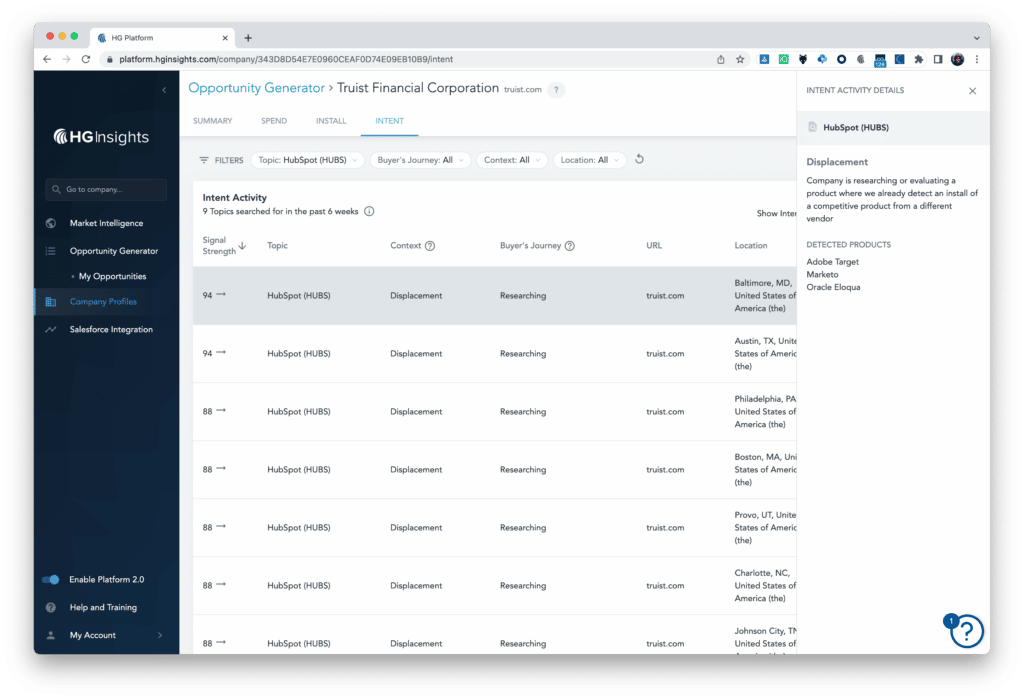

HG not only offers you intent data, but offers you “Contextual Intent” while DataFox provides no intent data at all. Most intent data providers will show you that an account is searching for a specified topic, but what does that signal mean within the larger account context? You simply don’t know.

HG’s Contextual Intent data takes specific intent signals (i.e., an account is searching on topic X) and layers them on top of HG’s deep insights into an account’s technology infrastructure. Combining the specific signal with the account context provides HG users with more “meaning,” which provides sales with a firm basis for personalized follow-up. For example, HG tells you if a signal represents a displacement opportunity. In other words, this account/company has a competitor’s product already installed, such as Marketo, but is now researching other products (maybe Hubspot or Oracle Eloqua) within the same category.

Or maybe an intent signal represents a “white space” opportunity where the account has no existing vendor in a category, but is looking around for one. HG’s Contextual Intent data gives sales teams that larger picture, which helps inform when and how they engage with an account. You can also layer this data into your account scoring to make your scoring more accurate, dynamic, and actionable.

Account Scoring

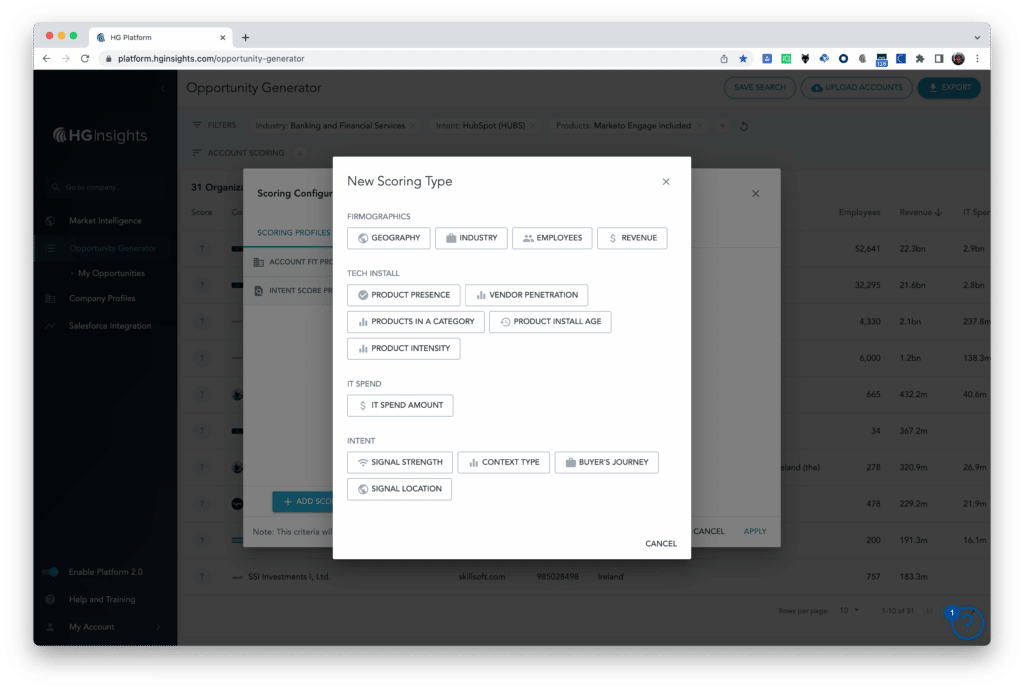

Both DataFox and HG Insights provide an account scoring engine. With DataFox you can score based on any number of attributes, such as specific firmographic or technographic data. While DataFox offers a helpful “yes/no” level of technographic data (as discussed above), HG enables you to score on multiple, non-binary dimensions of technographics in a highly granular way—Technology Intelligence. With HG, for example, you can see product penetration, how many products the account uses in a specified technology category, how long each product has been installed, various dimensions of account spend, and more. That’s deep and highly-actionable Technology Intelligence.

HG’s breadth and granularity of data gives you a deep understanding of accounts, which directly informs account scoring and prioritization.

More Opportunities Generated = More Revenue

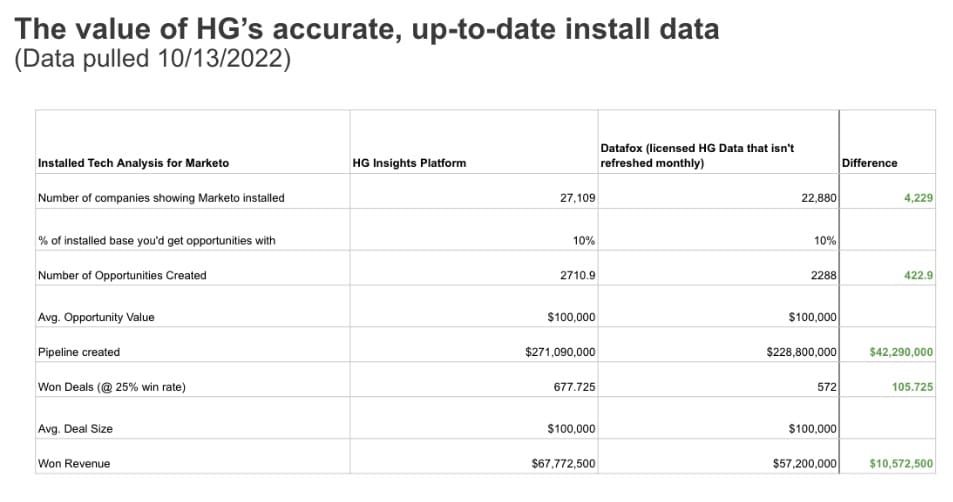

All account intelligence providers say their data is comprehensive and accurate, but there can be important differences that lead to more (or less) sales opportunities and revenues. To illustrate, we did a comparison where we went into HG Insights and asked to query, ‘companies using Eloqua.’ HG returned around 27,000 companies. We did the same search in DataFox, which showed around 22,000 companies.

If you were able to get opportunities with 10% of those additional opportunities (numbered in the thousands in this example), and you had an average deal size of $100,000, you’d be gaining $40-50 million in additional pipeline. If you closed 25% of those deals, that’d be $10-12 million in additional revenue.

A Final Word

The bottom line is:

- Oracle DataFox is going away, and current users will need to find an alternative provider of account intelligence before August 31, 2023

- DataFox users should seek out an alternative provider who offers the highest quality account intelligence, especially when it comes to the volume and granularity of technographic data (including spend data)

- HG Insights provides more than just technographic data—Technology Intelligence, by offering more—the volume of technographic data, and its granularity, making HG an ideal alternative for both your account intelligence and Technology Intelligence needs

There are so many ways to leverage our data and glean even more actionable insights in order to help you hit your goals, find competitive and complementary market opportunities, and increase revenue. The more granular you go, the better you’ll be able to find markets for your offering, target companies with a high propensity to buy, and close more deals, faster. Since our high-quality data-driven insights fuel these high-quality outcomes, consider HG Insights as your next account intelligence provider.

To learn more, reach out to us here.