In 2023, the “Cloud Wars” continue to add turbulence to the market as top cloud providers vye for market share. One of the biggest players in the cloud computing industry, Google Cloud Platform (GCP) continues to be the go-to platform for businesses looking to leverage cloud technology to improve their operations. In fact, according to HG Insights’ data, GCP achieved an impressive $26.3 billion in revenue in 2022, representing a 32% increase year-over-year.

“Google Cloud Platform achieved $26.3B in revenue in 2022, representing a 33% year-over-year increase.”

However, the competition in the cloud computing space is heating up, with Amazon Web Services (AWS) and Microsoft Azure both making significant strides to unseat GCP and become the leading cloud provider. With AWS emerging as a clear leader in the cloud market, and Azure gaining ground, the race for supremacy has become even more intense.

The following insights are key takeaways from the Market Report: Google Cloud Platform Ecosystem in 2023.

2023 Buyer Landscape of GCP

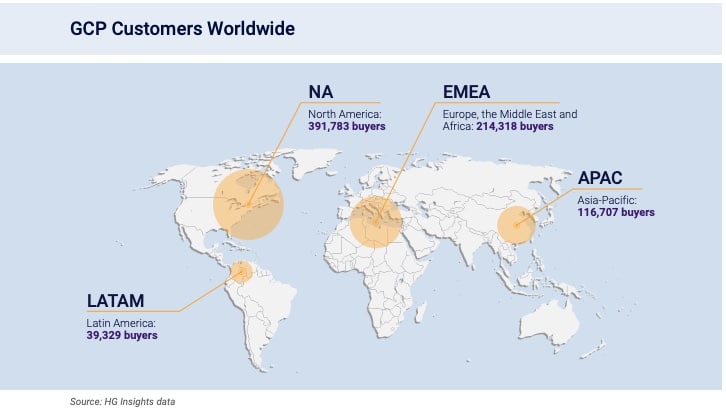

HG Insights took a deep dive into our proprietary data to deliver a high-resolution view into specific cloud adoption, usage, and spend. Our Global Sensor Network collected data on 760K Google Cloud Platform customers. Here’s what we found:

Although still operating at a loss, in Q4 2022, Google Cloud brought in $7.32 billion — including both Google Cloud Platform and Google Workspace. This represents a 32% year-over-year increase.

The map shows that North America and Europe, the Middle East, and Africa are the regions with the highest volume of Google Cloud Platform (GCP) customers. These numbers correspond with the estimated total of cloud buyers worldwide. Additionally, GCP has been rapidly expanding its physical cloud infrastructure, announcing several new regions in 2022, such as Austria, Czech Republic, Greece, Norway, South Africa, and Sweden. It has also announced the addition of Kuwait in 2023.

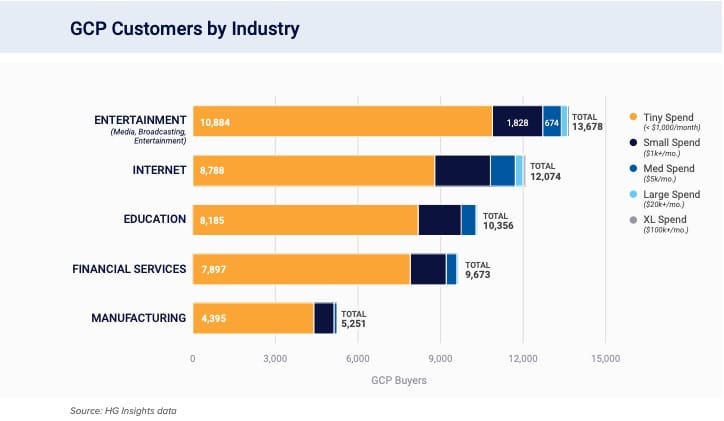

The Industries Investing in Google Cloud Platform

According to data from HG Insights, some of the top industries investing in Google Cloud Platform (GCP) are Entertainment, Internet, Education, Financial Services, and Manufacturing. The data shows that the entertainment and internet industries led the charge in cloud investing with 13,678 companies in the entertainment industry using GCP, and 12,074 companies in the internet industry are also investing in the platform.

GCP is becoming increasingly popular among a diverse range of industries, with potential for further growth and expansion in the future.

The combination of detailed usage and spend data with industry-level detail provides insight into adoption rates and the potential for growth in each industry. These statistics suggest that GCP is becoming increasingly popular among a diverse range of industries, with potential for further growth and expansion in the future.

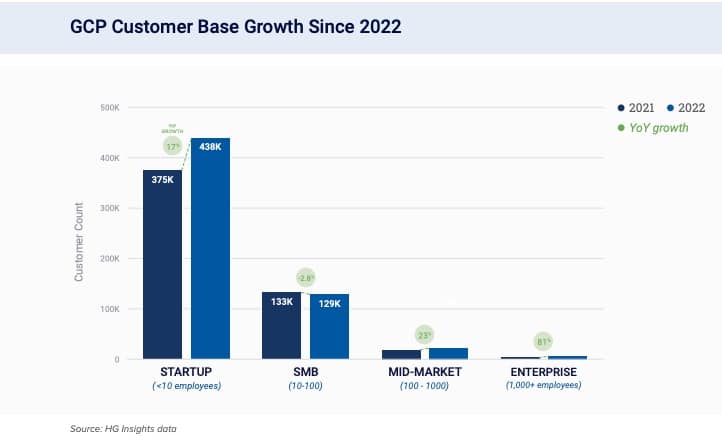

GCP Customer Growth Across Company Sizes

Since 2022, GCP achieved positive year-over-year customer growth across the startup (17%), mid-market (23%) and enterprise (81%) segments. While top enterprises invested significantly in Google Cloud, the number of startup companies buying the platform rapidly increased.

The overall growth in GCP’s customer base is trending toward increased market share. Over the past five years, Google’s share of the cloud market has nearly doubled from 6% Q4 2017 to 11% in Q4 2022.

Growth of Leading Cloud Providers in 2023

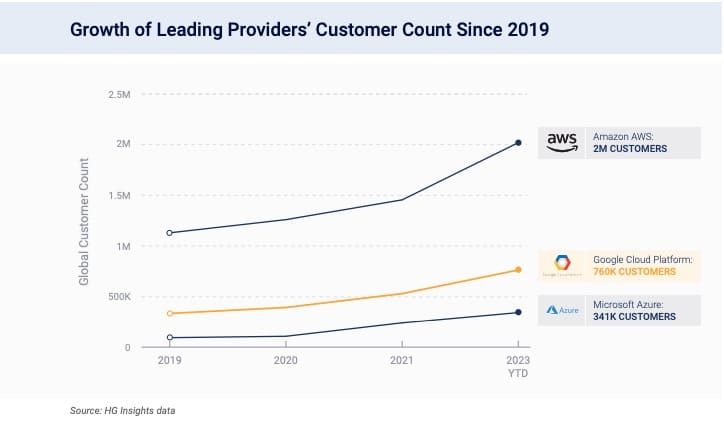

Despite continuing to lead in cloud services, Google Cloud Platform (GCP) is facing stiff competition from other cloud providers, such as Amazon Web Services (AWS) and Microsoft Azure.

While GCP is in second place in terms of the number of customers, the majority of its customers are in smaller spending tiers, which puts the company in a distant third in market share. Since 2019, AWS has gained 2 million customers, while GCP only gained 760,000, showing a marked rise in competition from AWS. In response to this, Alphabet CFO Ruth Porat has said that GCP will continue to increase the pace of investment across the board, including headcount, computing, sales, and marketing, in an effort to close the gap.

Cloud Providers Gain a Competitive Edge. But GCP Still Leads the Cloud Wars.

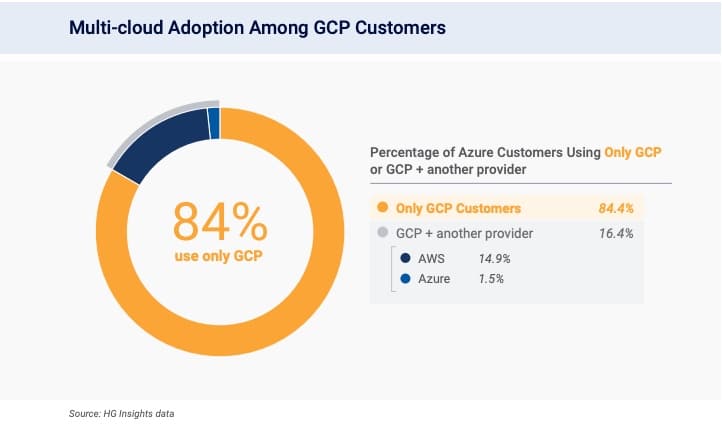

According to HG Insights data, approximately 84% of Google Cloud Platform (GCP) customers use GCP exclusively, while 16% use multiple providers, such as AWS or Azure, alongside GCP.

This is on par with AWS’s multi-cloud adoption rate of 15%, but Microsoft Azure has a higher multi-cloud adoption rate of 25%. While enterprises typically have some level of multi-cloud adoption, winning multi-cloud accounts will be key to growing GCP’s market share among enterprises.

The good news for GCP is that it is making progress, as evidenced by Uber’s dual seven-year deals with GCP and Oracle in February 2023 to move fully into the (multi-) cloud. As GCP continues to make inroads in multi-cloud adoption, it has the potential to further solidify its position as a leading cloud provider.

Get More Insights in the Market Report!

HG Insights provides unequaled market intelligence to help you understand the cloud services market. To get more detailed data and market insights, download the market report.

HG Insights delivers the world’s largest set of tech install and IT spend data to empower your data-driven decision-making. Learn how you can put our data to work at your company to empower your sales, strategy, and marketing teams with competitive intelligence. Schedule a demo to see our proprietary data in action.