Discover the Sales AI Landscape in our full report here

The Sales and Marketing industry, once dominated by just a few companies, has seen an explosion in MarTech apps in recent years. According to chiefmartec, since 2011, the field has grown 9,304% to 14,106 apps, with a 27.8% increase between 2023 and 2024 alone.

The next phase of growth in this market? Artificial intelligence in Sales and Marketing tools. Gartner expects Generative AI technologies will execute 60% of sales reps’ work by 2028.

Growth in Marketing and Sales AI comes both from AI-native new entrants, as well as incumbent vendors developing new tools and upgrading their products with AI capabilities.

In this report, we focus on the rapidly changing world of Sales AI. We analyze data from our Platform to give a clear view of the AI Sales landscape, adoption of GenAI and Sales software across buyer groups, and the top 75 Sales AI solutions.

Trends in Sales AI

The applications for AI in Sales are endless. From conversational chatbots to automated pipeline nurturing, these new solutions speed up the sales process and sales cycles. As the Sales AI market continues to expand, we’re keeping our eye on a few interesting trends:

1. Similarity of offerings

At least for now, many tools on the market are covering the same capabilities or a combination of them. Common applications for AI in Sales include:

- Supporting content creation

- Analyzing content (e.g., calls and videos) and providing notes and sentiment analysis

- Conversational functionality like chatbots or even virtual assistants

- Simplifying data enrichment or prospecting functionality

- Combining contact data with data analysis

- Lead scoring and prioritization

- Sales team coaching and training

We’re watching for new use cases in the coming years as GenAI adoption becomes more mainstream and companies work to differentiate from the rest of the market.

2. David vs. Goliath

There are a handful of large incumbents in the Sales and MarTech space who have built AI into their established products: for example, Salesforce, HubSpot, Outreach, Salesloft, etc.

But you’ll find hundreds – if not thousands – of startups tackling similar problems. Only time will tell which of these new entrants will prove to be real competitors to the market giants.

3. The cost to compete

How will costs shake out over time in the AI Sales market? AI functionality is expensive and discussions about the ideal pricing model for AI-powered products are ongoing. Some

companies are implementing usage-based pricing to align costs with customer value. Others bake the price of AI into a traditional subscription or seat fee. We expect experimentation around AI pricing to be a key topic.

4. Overcoming buyer resistance

Not all AI solutions are created equal: Much like the software category overall, quality can vary significantly. Many buyers remain skeptical about GenAI offerings, often due to concerns about data security, ownership, and the true value of the solutions. Vendors must be prepared to address critical questions from prospective customers, such as:

- How is my data treated? Who owns the data and is it used to train models for other customers? Which sub-processors do you share my data with?

- How do I know my data is secure? What measures are in place to protect my sensitive information from breaches or misuse?

- How customizable is the solution? Can the model be trained on my specific data to meet the unique needs of my business?

- What is the ROI of the solution? Is it realized through efficiency gains, cost savings, or revenue increase? Is it measurable?

- What is the time and effort required for implementation? How much time does it take to get the solution up and running?

- What ongoing maintenance is required? What amount of time and resources will be needed to maintain the solution over time?

Addressing these concerns directly and transparently is crucial for building trust and demonstrating the tangible benefits of an AI solution.

The Future of AI in Sales and Marketing

ReplayzIQ is an emerging tech company making waves in Conversational Intelligence. They’ve developed AI-powered coaching software that analyzes sales calls and evaluates a rep’s performance. Sales leaders no longer need to spend time reviewing calls. ReplayzIQ’s technology can analyze a one-hour sales call in seconds. It scores over 150 skills for just a few dollars per call.

Dave Kennett, their Founder and CEO, is bullish on the future role of AI in Sales & Marketing:

“Sales AI is not just about automation; it’s about augmenting human potential. AI is still in it’s early days. Collectively, we’re only scratching the surface of what’s possible. Our team is eager to keep pushing the boundaries. I’m excited to see how AI will continue to add significant value in the Sales and Marketing space.”

Categories of Sales AI

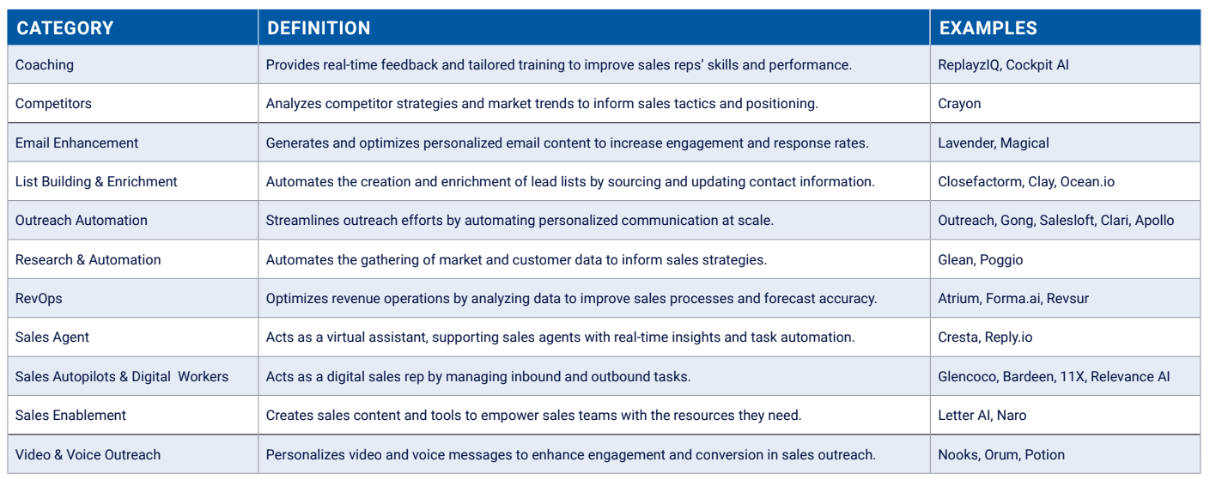

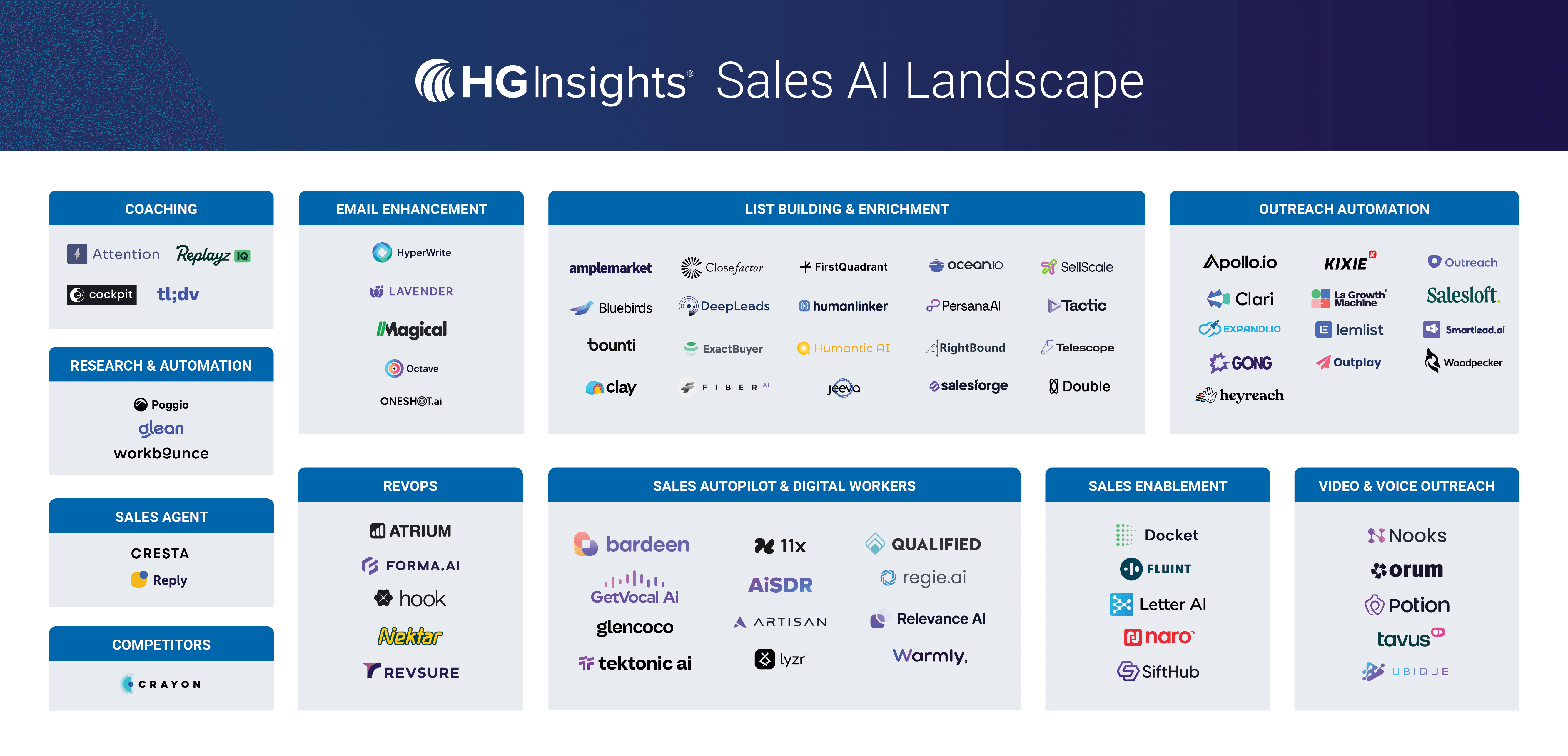

For the purposes of our analysis, we’ve divided Sales AI solutions into eleven categories: All categories existed before AI and are being optimized and enhanced with the addition of AI capabilities.

Adoption of Sales and GenAI Products

While GenAI is growing rapidly, there is still plenty of room for adoption to increase. HG’s data detects 60,000 companies deploying GenAI products, which equates to only 1.4% of the HG database of companies with registered addresses. This is a reminder that most companies are still just talking about GenAI or exploring tools like ChatGPT, but they haven’t figured out how to fully leverage GenAI and integrate AI tools into their operations.

Among companies that deploy a Sales product, 37% are also deploying at least one GenAI product.

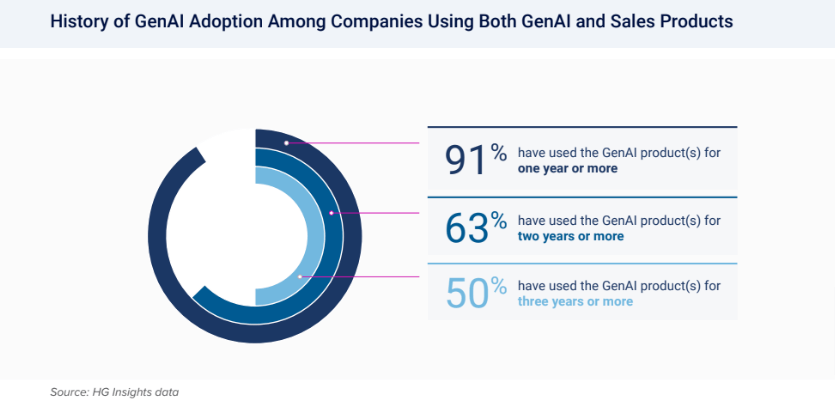

This chart shows the history of GenAI adoption among companies also deploying a Sales product.

Within the cohort of companies using both types of tools, 91% have used the GenAI product(s) for one year or more; 63% have used the product(s) for two years or more; and about half (50%) have used the product(s) for three years or more. OpenAI’s ChatGPT launched in November 2022, so all of the companies using Sales products and GenAI with adoption of two years or less coincide with this release.

Higher Adoption of Sales & GenAI Among Larger Companies

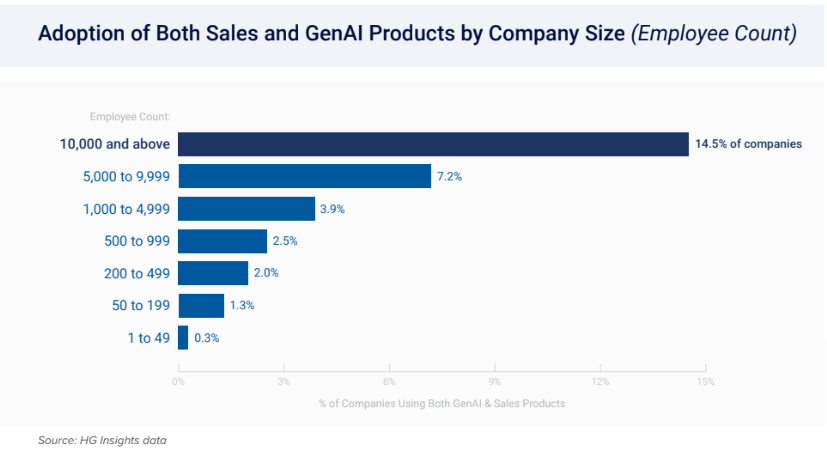

According to HG’s data, adoption of Sales and GenAI products together is much more prevalent in larger companies. Among large enterprises with 10K employees or more, 14.5% are deploying both Sales and GenAI products.

The adoption of both types of tools together decreases in smaller businesses. While about 1% of companies with fewer than 50 employees deploy a Sales tool, only one-third of those (0.3% overall) deploy both Sales and GenAI products.

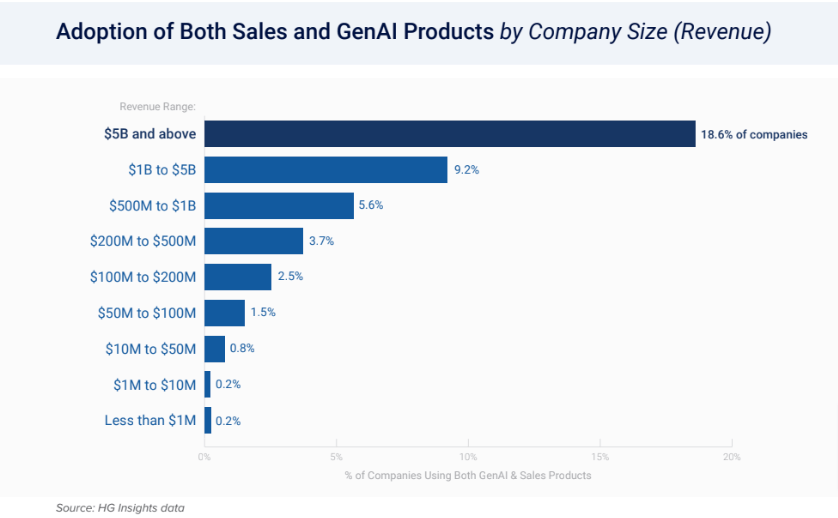

Similar to the adoption patterns by number of employees, HG’s data indicates that enterprises with higher revenue are deploying GenAI and Sales products together at a higher rate.

Among companies earning $5 billion or more in revenue, 18.6% deploy at least one Sales product and one GenAI product. In the smaller revenue tiers (i.e., companies earning less than $50 million), adoption of GenAI and Sales products together is at less than 1%.

AI in Sales Tech Leaders

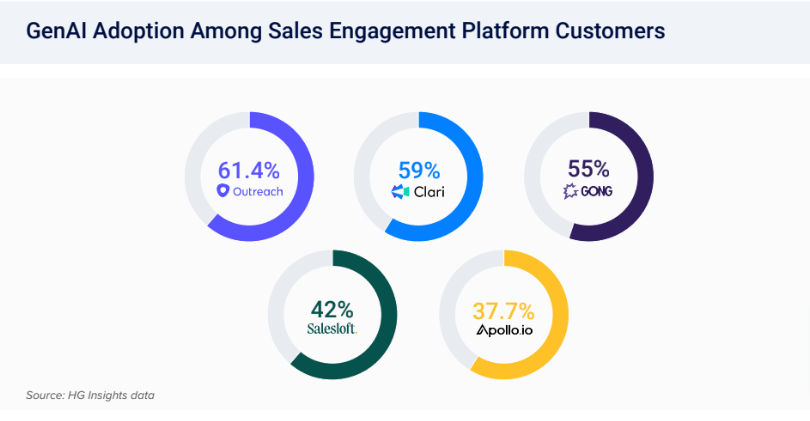

Some of the biggest names in Sales engagement are Outreach, Clari, Gong, Salesloft, and Apollo.io. All five of these incumbents are viewed as leaders in the Sales tech industry and leverage AI in their products:

- Outreach: AI-driven workflows across the customer journey and Kaia (Knowledge AI Assistant)

- Clari: AI-powered platform to streamline RevOps, sales engagement, and conversational intelligence

- Gong: AI-powered revenue intelligence, coaching, engagement, and forecasting

- Salesloft: AI-powered revenue orchestration and Rhythm (AI signal-to-action engine)

- Apollo.io: Go-to-Market copilot for contact & account search, sales engagement, workflows, and deal management

HG’s data can be used to identify GenAI adoption rates among the customers for these five vendors. Salesloft and Apollo.io have a major market opportunity — less than half of their customer bases have deployed GenAI so far.

The Top 75 AI Sales Tools

According to our data, these are the 75 most-widely adopted Sales AI tools today.

For a full breakdown of these companies and the services they offer, check out The Top 75 AI Sales Tools for Smarter Selling.

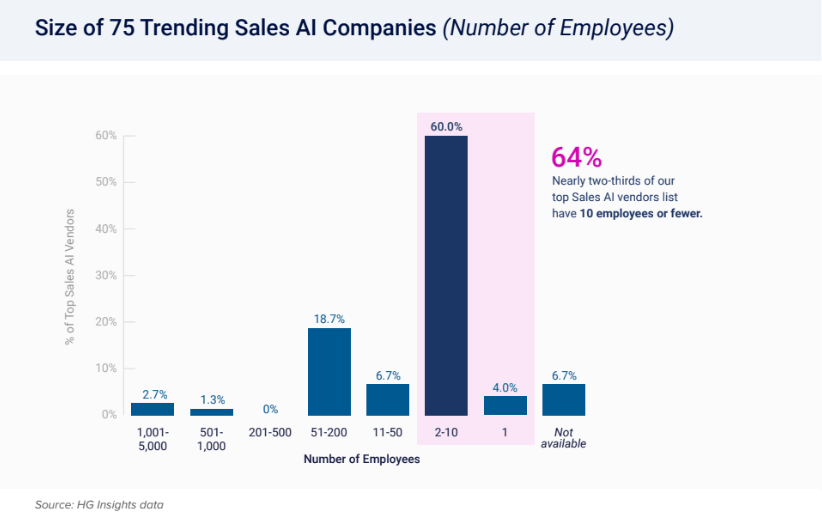

Startups Lead the Charge in Sales AI

To better understand how the top 75 vendors in Sales AI are operating – and where they’re heading next – we dug into the data on their size (by employee count and estimated revenue) as well as their technology adoption and areas of investment.

Nearly two-thirds (64%) of our top Sales AI vendors list have 10 employees or fewer. Only 2 companies (2.7% of the list) have greater than 1,000 employees. The dominance of these early-stage startups in the Sales AI space reflects the recent surge in AI adoption. This also indicates the significant market opportunities for newcomers and incumbents looking to modernize their legacy products with AI.

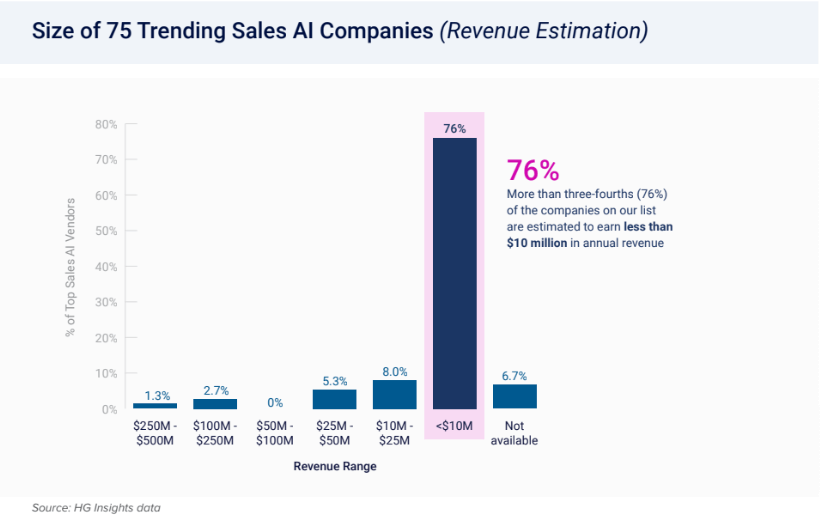

Because the market for AI in Sales is a bit newer and generally includes more startups that rely on VC funding, more than three- fourths (76%) of the companies on our list are estimated to earn less than $10 million in annual revenue.

With the widespread adoption of GenAI, we expect significant revenue growth for these companies over the next few years, propelling the Sales AI industry forward.

Uncover the Sales AI Landscape

For the complete breakdown of the Sales AI landscape, view HG’s report: The Next Generation of Sales AI.

HG Insights uses advanced data science to process billions of unstructured digital documents to produce the world’s most sophisticated technology installation information, IT spend, contract intelligence, and intent data. If you’d like to learn more, book a demo with one of our solution experts.