Each year, when the go-to-market planning cycle begins, the crucial question leaders must answer is — where should we place the bets? Do we double down on the virtualization market or focus on expanding into cybersecurity? Which markets should we enter and where should we allocate sales?

Even though go-to-market (GTM) strategy isn’t a betting sport, it often feels like one. Because just like at the blackjack table, go-to-market planning discussions usually boil down to one thing: where to place the bets.

However, the key element to any successful go-to-market plan is not having made the right bets, but having a plan in place that allows you to operationalize those bets. Because regardless of how you play the cards, it’s up to you to bring your GTM plan to life.

In this article, I’ll share the four pillars of a go-to-market plan and how to leverage the right insights in your sales strategy to know the markets to enter, where to allocate headcount, and which accounts to prioritize. I’ll also share a few go-to-market plan examples from use cases in which this framework is applied. This four-pillar methodology focuses on building ROI and productivity results and will help you become a lot more scientific in your approach to GTM planning.

What is a Go To Market Plan?

A go-to-market plan is the roadmap for launching a product or service. It defines messaging, pricing, and distribution to ensure a focused and successful market entry. The goal of a GTM plan is to drive marketplace adoption, minimize risk, and ensure the organization doesn’t waste resources, time or money when introducing a new product to the market.

A GTM plan involves a range of business functions company-wide — from product and customer success to sales and marketing — to align on a value proposition, measure demand, and activate a plan to launch and scale a product. By understanding the Ideal Customer Profile (ICP), competitive positioning, market trends, and target segments, businesses can create a solid GTM strategy that maximizes their chance of success.

The Importance of Optimizing Your GTM Plan

With the current economic climate, the wriggle room businesses once had in budget, KPIs, OKRs, or performance in general, has evaporated. Everyone is being forced to run their business on a much tighter basis, yet hit the same amount of revenue from a smaller budget than in the past. To hit the same targets with fewer resources, you have to become a lot more scientific in your go-to-market planning process.

The idea that we do the same GTM strategy, then apply a smaller budget and expect the same results, doesn’t stick. Moreover, on an organizational basis, you lose productivity when you do this. That’s not a sustainable GTM plan in the long run and why optimization is crucial.

Today, you must take an integrated approach to your planning process if you want to hit your targets. This is how to bridge the gap between knowing where to place the bets and manifesting your plan throughout the business — from your marketing, business development, and sales teams, all the way down to your enterprise reps, customer success, and account planning.

The Four Pillars of a Go To Market Plan

To optimize your go-to-market plan, start by looking at your business as a whole. Whether you’re the CEO or the head of field marketing for one region, look at your business systematically and how the parts interact and compound.

There are four key components in go-to-market planning. These four pillars are very simple and repeatable. And the idea is that you can apply these general practice principles and scale them, whether you’re looking to disrupt a market or capture wallet share. The four pillars of a go-to-market plan are:

- Profile

- Prioritize

- Segment

- Operationalize

Let’s dive into each of these pillars in more detail.

Pillar 1: Profile Your Customer

The first pillar of a GTM plan is centered on customer profiling. While companies are becoming more data-driven in how they profile, they tend to follow the same path in how a potential customer is scored. For example, if an offering is scored as a value proposition, it is usually scored generically and is only given one score.

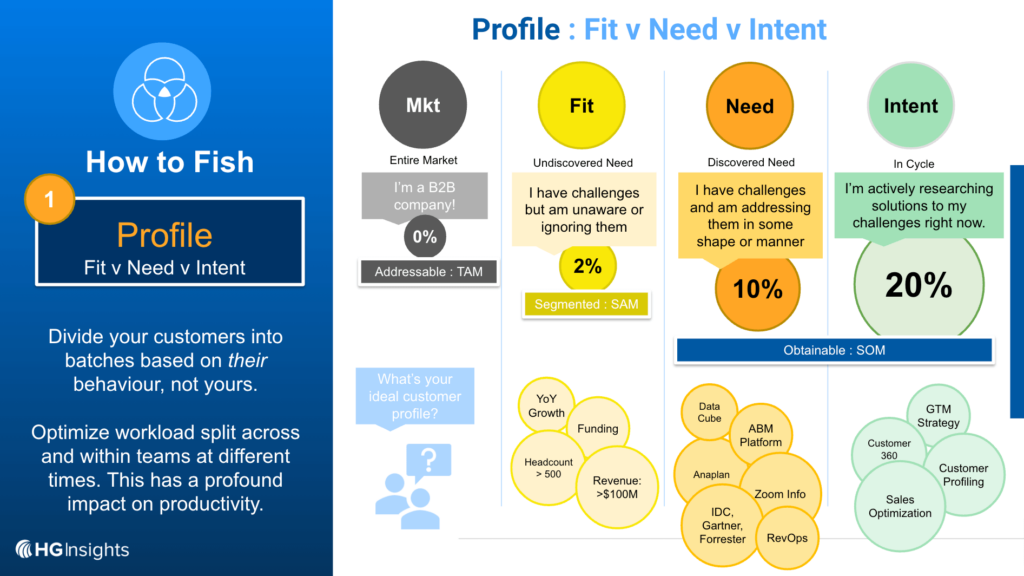

However, no one pursues their entire TAM, SAM, SOM. To hone in on your target market, you have to identify the customers most likely to buy your product or service. You can efficiently profile your customer, and each offering within a customer, in three steps:

1. Score your target customer

Score each customer based on how well they fit your ICP. Ask yourself:

- Do they fit your value proposition?

- Do they fit the archetype of an organization with a problem your business can help solve?

If the customer meets these criteria, the next step is to determine how much undiscovered need they have. For instance, the customer may have a problem, but that doesn’t mean they know they have one, or acknowledge it. This is called “undiscovered need.”

For example, if you’re selling a cloud application, you could identify customers who have on-premise workloads. Could you help solve their pain points? Yes. But do they want your help? Do they recognize their pain points? Maybe not. That’s why the first thing to do in customer profiling is to score accounts based on whether or not they fit your business archetype, and whether they have an undiscovered need.

2. Understand the customer’s need

The second step is to break down your target customer based on need. For account profiling, ask yourself these questions:

- Do they need you?

- Do they recognize they have a problem?

- Are they starting to marshal internal resources, so you can see evidence that they’re tackling this business problem?

If the account checks all of these boxes they have what we call discovered need, which is much easier to act on than undiscovered need.

For example, if we can see an organization has Anaplan, we know this organization is likely solidifying its operations. It’s trying to structure its territory planning and deploy quotas in a more structured way. If it’s a startup, they’ve got other competitors, so we know they’re already on the way to becoming data-driven. Then, we use data to see if they have an ABM platform, which makes the company a good fit for our product or services.

These observations are leading indicators that a target customer has discovered need. Not only can we see that they are growing in a space we can help with, but they’re already starting to solve problems.

3. Know when the customer is in a buying cycle

The third, and perhaps the most critical component of customer profiling is to identify whether a potential customer is in a buying cycle.

Just because a client has discovered need, it doesn’t mean they’re in a buying cycle. Industry data shows that 10% of the market is in-market and searching for a product or service like yours at any given time. This makes it critical to distinguish which customers are in-market in Q1, versus Q2, and versus Q3. This can be made visible using HG’s Contextual Intent data.

The reason this is so critical is because when you target in-market customers it has a profound impact on your conversion rates. If you only do a homogeneous score, without considering a customer’s actual propensity to buy, you’ll struggle to get above a 2% conversion rate.

However, if you shift to scoring accounts for fit, need, and buyer intent, I guarantee you will get a 10% conversion rate. Because when you use intent data, you can see the customers who are in the market right now, and they will usually convert at a rate of 20%.

Pillar 2: Prioritize Accounts

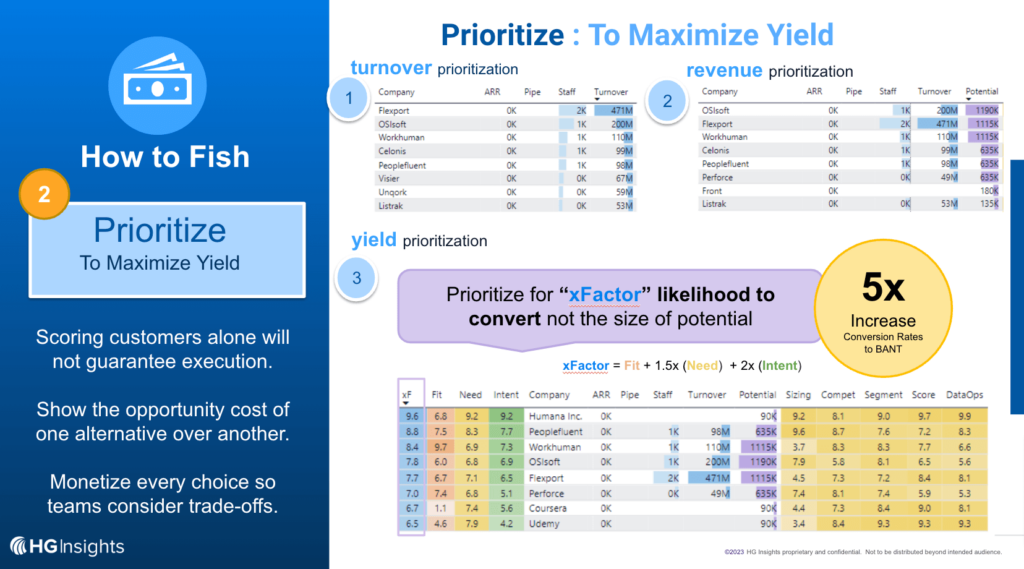

Now that you’ve scored your customers for fit, need, and intent, the next step in optimizing your go-to-market plan is to prioritize accounts.

Traditionally, organizations take a standard approach, which is to prioritize accounts that are the biggest. But this strategy will deflate your conversion rates. A more evolved approach is to determine what each customer is worth to your organization.

To do this, you need to prioritize customers based on the services or products they’re already using and what you could sell them. This is how much each customer is potentially worth. You can uncover this information using Technology Intelligence tools.

When you prioritize accounts based on fit, instead of targeting the customers who are the biggest, you’re focused on the customers most likely to convert. And a high conversion rate, even of smaller potential value, aggregates over time.

To illustrate, let’s take a list of customers and score them for fit, need, and intent across a portfolio of offerings. In this case, I use the HG Platform to see this information. Then, we combine it into an x-factor.

As you can see in the example above, the x-factor calculates the customer who fits your archetype the best, has discovered need, is marshaling resources, and is in a buying cycle. Those customers are practically waiting for you with a purchase order — they will convert at very high rates. If you prioritize accounts like this, you can optimize for pipeline or revenue in any given quarter.

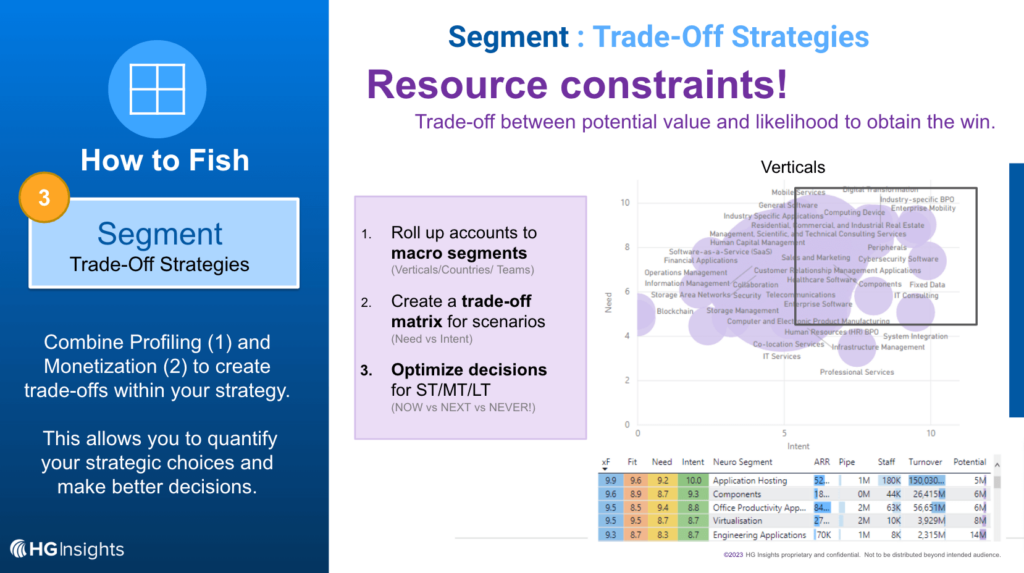

Pillar 3: Segment Your Accounts

The third pillar of go-to-market planning is around segmentation. This is different from the traditional way of segmentation, which divides target accounts by small business vs. mid-market vs. enterprise. Instead, think about segmentation in terms of resource constraints and how to help decision-makers choose between competing trade-off options.

Consider this go to market strategy dilemma: You have a $200k marketing budget for the quarter and you’ve got 20 SDRs,. How do you prioritize the bandwidth you have, including thinking about headcount and how many calls your sales team can make?

To determine which accounts you can feasibly pursue with a high win rate, take your need and intent scores and put them on an axis. Always go after the customers in the top right-hand corner. These are the target accounts that have the highest discovered need and the ones that have the highest buying signals. I determine this using HG Insights’ Platform.

Think of segmentation as a trade-off position. As you can see in the example above, the white space bucket is really big, but the expansion bucket is also large, and that’s what you’re after. Target customers who have the most compelling problems that they’re trying to solve, and the ones who are in the most aggressive buying cycles.

You may be wondering, what vertical or industry should you focus on? Indeed, there are lots of different industries and verticals.

To decide where to focus your efforts, create your map again, but render it based on the vertical. Suppose now it says, “enterprise mobility, cyber security software, peripherals, and fixed data.” These are your customers. These are the industries with the most compelling problems and the ones in the most aggressive buying cycles. They’re the companies that will convert. Whether you’re an SDR or marketing leader, or in sales ops and designing a territory for next year, this is where the money is.

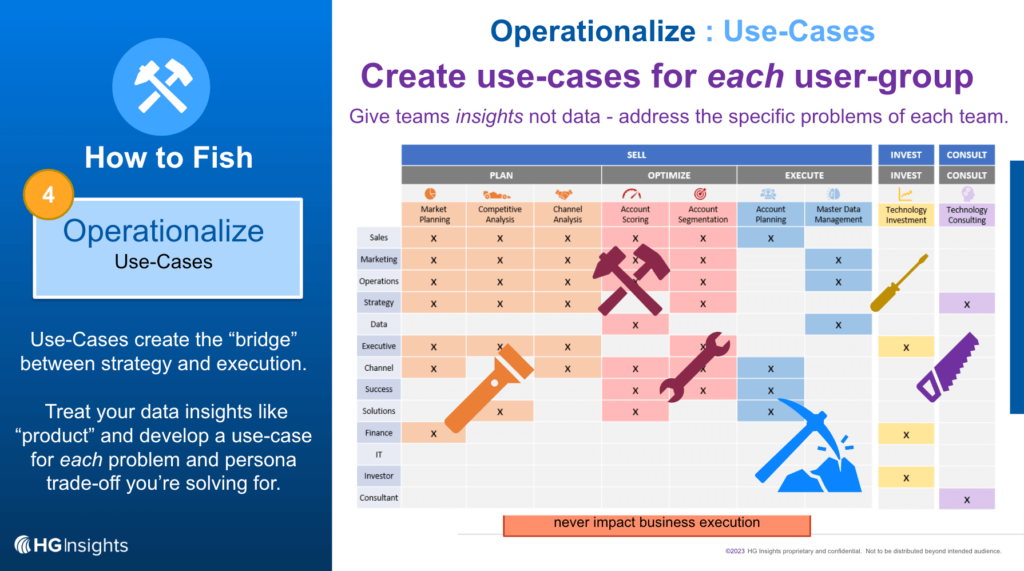

Pillar 4: Operationalize Your Go To Market Plan

So you’ve done all the calculations, thinking, and scoring — how do you put these insights into the hands of your SDRs, marketers, CSMs, or the head of strategy? It’s time to bring your go-to-market to life.

The fourth pillar of a successful GTM plan is to operationalize your strategy.

No one wants another spreadsheet, frankly. No one needs more data. But everyone at your organization needs the insights the data can give.

To operationalize your GTM strategy, think like a product manager. Ask yourself, “Who are the people I’m trying to help with my data, and what are they trying to solve?” Are you helping a seller, marketer, strategy person, or executive? Are you helping them with market planning and competitive analysis, or segmentation and account planning?

Based on your answers, create a unique view for each department at your company. Because if you’re a marketer, you need different strategies for solving a segmentation problem vs. an ABM problem. When you approach the data like a product manager, you can successfully operationalize your go-to-market plan across your entire organization.

Key Takeaways for Building Your Go To Market Strategy

To summarize, bring these four elements together to build an efficient go-to-market plan.

- Profile each customer based on your company’s offerings and the customer’s fit vs. need vs. intent

- Prioritize accounts to maximize yield. Even if it’s a small account, prioritize the accounts that have the highest probability of converting

- Segment your accounts in terms of resource trade-offs. Focus on the accounts that have the highest potential to convert, because that’s where the money is

- Operationalize your go-to-market plan by treating your data as if it’s an internal product in its own right

Lastly, you can use ROI calculators to see the potential impact on your organization if you execute your GTM plan in this manner. This proven methodology can help you get the exacting precision needed to build a successful go-to-market and operationalize it across your entire organization. Good luck and happy planning!

About HG Insights

HG Insights, the provider of data-driven insights to 75% of tech companies in the Fortune 100, is your go-to-market Technology Intelligence partner.

We use advanced insights into Technology Intelligence — on IT spend, technographics, cloud usage, intent signals, Functional Area Intelligence, contract details, and AI maturity — to provide global B2B companies with a better way to analyze markets and target prospects. Our customers achieve unprecedented results in their marketing and sales programs thanks to the indexing of billions of unstructured documents each day with insights into product adoption, usage, spend data, and more to build high-resolution maps of activity across an organization’s entire digital infrastructure to power business decisions with precision and confidence.

To learn more about our Technology Intelligence and how to use it in your go-to-market planning, reach out! Our team is standing by.