“Uncertainty in the market” is a worn-out phrase, but there’s no denying the past three years have been unique, presenting B2B businesses with new challenges for developing successful, data-driven sales strategies. Over the past six to 12 months, there’s been a significant shift in how companies think about growth goals – particularly the objectives handed down to Sales teams by the Board.

In challenging macroeconomic conditions, how can companies balance the tension between reaching top-line growth objectives and doing it with less resources?

In this article, we’ll discuss the most successful sales strategy trends, how to use a Value Creation Compass to execute against growth imperatives, and six proven strategies to hit your growth targets.

How to approach sales strategy in economic downturns

For the past six years, SBI Growth has been running a quarterly CEO growth forum. One of the questions posed in the spring of 2022 was, “How do CEOs expect demand to trend over into 2023?” At the time, about 50% of CEOs expected demand to accelerate; in early 2023, however, this number dropped to about 25%.

Now, the question business leaders face is how to rebound through the rest of the year and try to meet, if not exceed, ambitious sales targets — with less resources.

SBI Growth identified two types of company approaches to managing the current economic landscape:

- Low momentum: Companies that are highly protective of any gains achieved in recent quarters. Many of these are taking the “wait and see” approach and biding time to see how hard the recession is going to hit.

- High momentum: Companies that seek “targeted but substantive opportunities to build on their gains.” This is the “no regrets” approach: These leaders are focused on recovery, not recession.

The data-driven sales strategies we’ll address are those used by high-momentum companies across industries. When asked if some companies are almost immune to the impact of the downturn, Adam Sheehan, SBI Growth Advisor, summarized how they keep the pace:

“Some companies may seem counter-cyclical or immune to what’s going on. Some of these companies have a different level of objectives coming from the top that requires them to think differently about how they run the business. This means not only optimizing Go-To-Market, but also shifting emphasis from focusing on newer growth bets toward what we call ‘horizon one’, or your near-term growth objectives over 6-12 months. It’s helpful to focus on where you perform really well, and double down on those.”

Understanding the Value Creation Compass

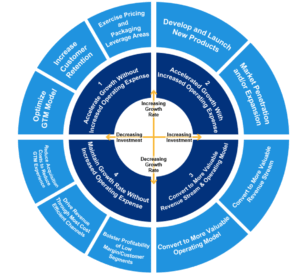

SBI Growth’s Value Creation Compass is a great tool for helping GTM strategists focus on specific growth imperatives to reach their company’s growth thesis. The compass is separated into four quadrants, with each company’s location deriving from:

- X-axis: The amount of planned investment to drive growth, relative to the prior period

- Y-axis: Growth expectations based on that level of spend

Based on these two decisions, companies can see which quadrant they fall in (dark blue):

- Accelerate growth without increased operating expense

- Accelerate growth increased operating expense

- Convert to more valuable revenue stream and operating model

- Maintain growth rate without increased operating expense

Over the past two to three years, most organizations fell into the second and third quadrants. However, the past six months has moved (or started to move) quite a few businesses to quadrant one, where teams are being asked to continue accelerating growth year-over-year, but with less investment in sales and marketing.

The light blue outer ring of the compass offers Go-To-Market strategy ideas to meet those growth imperatives while staying profitable.

6 data-driven sales strategies to achieve your growth targets

Within the Value Creation Compass, no quadrant is necessarily “better” than another. However, there are several strategies that are better suited for specific growth, while others can apply to any team. Here are six proven tactics for building a sales strategy that can meet even the most aggressive sales goals:

1) Optimize your GTM model

This may be one of the more obvious strategies in B2B sales, but it’s worth discussing as it’s especially important for quadrant one companies.

First, look at how your organization coverage model can be optimized to boost productivity within the sales team. Alignment should be based on the revenue potential you’ve calculated. Along those same lines, you should take a deeper look at sales territory planning and ask yourself:

- How are your territories aligned with quotas and compensation structures?

- Would territory changes improve productivity and Sales rep retention?

Next, take a high-level look at the demand generation metrics and end-to-end processes to answer these questions:

- Can more opportunities be uncovered?

- Can you decrease customer acquisition cost (CAC)?

- How do your metrics compare to the rest of the market?

- If the return on marketing and sales investment isn’t leading to growth, but others in the market are growing, what can you do differently that hasn’t been tried yet?

Other tactics like updating the sales process with the latest technology, prioritizing value-selling, coaching reps, and improving your sales enablement strategy can all boost closing and conversion rates and get you closer to those growth targets.

2) Increase customer retention

Retaining recurring revenue is the fastest way to reach growth targets year after year. If your company falls in quadrant one of the Value Creation Compass, you may want to consider reprioritizing existing account coverage and customer marketing (versus marketing for potential customers) to boost NRR.

Streamlining the onboarding process to ramp adoption and expansion is key, along with commercializing Customer Success to capture more revenue from upsell opportunities and renewals.

3) Leverage pricing and packaging

Value-based selling and pricing play a huge role in retention, expansion and new logo acquisition. For expansion, teams should work together to develop a data-driven strategy for pricing and bundling – e.g. margin leakage analysis – to maximize value captured from the existing customer base. Rather than looking at renewals as opportunities only for cross-selling or new product introductions, present it to customers as building them a broader solution set for how you’re helping the organization solve its challenge long-term.

Pairing value-based conversations—i.e. focusing on outcomes versus features and benefits—with value-based pricing strategies can significantly increase customer lifetime value (CLTV).

To win new logos and encourage legacy customers to migrate to SaaS, focus on optimizing pricing and packaging offers such as trials.

“Companies with a solid talk track from marketing through sales through CS reinforcement are the ones that are successful in maintaining their price level, rather than relying on discounting,” says Sheehan. “These companies don’t see their retention numbers drop because they can communicate the value they provide once an organization signs up.”

4) Align teams across the whole customer life cycle

People often talk about conflict between sales and marketing teams, but companies can’t afford to have a breakdown in communication between these teams, especially when facing difficult economic conditions.

Team members must be aligned across the entire customer life cycle: from marketing driving the top funnel, to sales taking the identified opportunity and closing the deal, to CS nurturing customer relationships, driving adoption and expanding the account over time. It doesn’t always have to be linear, either—CS can send cross-sell opportunities back to sales, marketing can work with CS to develop customer marketing programs, and sales can work with marketing to develop messaging that matches what reps are seeing on the ground.

All teams can be responsible for customer data collection, and all teams can integrate to drive the commercial engine forward.

5) Go back to basics

Many companies are finding success with simplifying their sales strategy to survive the downturn. This means leveraging available technology to increase the amount of data you have and using this information to make strategic, data-driven decisions. Data should be driving choices around the types of target customer accounts, industries and segments that teams focus on:

- Where have you had the most success so far?

- How can you use that information to predict future successes?

Use this information to guide your future sales planning.

6) Increase sales team efficiency

Many businesses face the unfortunate reality of headcount reduction right now. For sales managers, this requires strategic planning to ensure the team you have on the ground can be as productive as possible. Arming sales reps with the proper tools and technology can make them more efficient and increase selling time. Working with sales operations and enablement can help make the sales process more effective, ensuring that active opportunities are capitalized on.

Avoiding leakage from the sales pipeline to keep close rates high and sales cycle times low is key for the current landscape.

Businesses may also want to take a closer look at the allocation of sales reps in two ways:

- What is the ratio of reps to sales managers? SBI Growth found that in high momentum companies, the number of reps per manager was 8.1, while low momentum companies assigned nearly double that (15.4 reps) to each manager.

- Are the same reps covering both existing customers and new logos? Sheehan suggests bifurcating your sales org, with some sellers working on expanding the base and cross-selling and others working on new logo motion. Take a look at the competencies of each member of the sales team and assign them accordingly.

Key takeaways for building a data-driven sales strategy

As mentioned, no one quadrant of the Value Creation Compass is better than another; what’s most important is having clarity as an organization on where you are now, what your goals are, and what the data says. Once you know these, you can align teams across commercial functions and build a blueprint to reach growth targets.

When sales, marketing and CS are marching in the same direction, your business is much more effective in achieving growth imperatives versus siloed activity without data-driven decision making.

There’s no doubt that many sales orgs are currently in quadrant one and being asked to do more with less. Even if you are in quadrant two, with increased investment to drive growth, it’s still a challenging environment to grow a business.

“No matter which quadrant you’re in, have clarity as an organization on where you are and what your initiatives are; align across the revenue life cycle; and be effective with the resources you do have available.”

For more insights, watch the full webinar here.