Key Takeaways:

- $279.5 billion in projected IT spend by healthcare organizations in the next 12 months

- 63% of the healthcare IT market size comes from the United States

- 51% of healthcare IT spend comes from companies with revenue of $1 billion or more

- Some of the top trends in the healthcare IT industry can be mapped to five categories: Storage Management, Security Hardware, Security Software, Cloud IaaS, and Business Intelligence

- Artificial intelligence is a top technology trend in healthcare, as organizations aim to improve margins and alleviate difficulties from the pandemic years

Around the globe, the healthcare IT industry continues to drive toward exciting innovations, creating more efficiency and better patient outcomes. The technologies that support healthcare organizations span categories — from IT services and software to hardware and communications. According to HG’s data, companies in the healthcare market will spend $279.5 billion on IT in the next 12 months. Due to the market’s growth and cutting-edge healthcare IT industry trends like AI, HG Insights wanted to dive deeper into this sector.

This report provides research on IT spending and usage in the global healthcare market and covers leading vendors, solutions, and buyer profiles. This data was uncovered with the HG Market Intelligence Platform to help you identify trends in the healthcare IT industry and your distinct opportunities in the market.

Health IT Market Size

According to HG’s data, the total health IT industry market size (i.e. total spend on IT solutions by healthcare organizations) is projected to reach $279.5 billion in 2025. Out of the 9M+ companies in the HG database, our data analysis identifies approximately 357,000 healthcare organizations spending on IT solutions (this data includes only businesses with registered addresses).

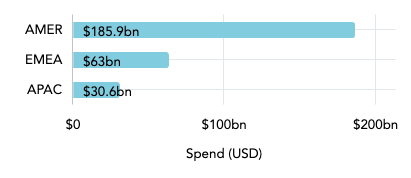

Total Healthcare IT Spend by Region

This chart shows the total healthcare IT spend in the three global regions. Healthcare organizations in AMER (North, Central, and South America) spend the most on IT solutions, accounting for 66% of global spend. EMEA (Europe, Middle East, and Africa) accounts for 23% of global spend and 11% comes from APAC (Asia Pacific).

US Healthcare Market Size for IT and Other Top Countries

| Country | Total Spend | Companies |

| United States | $176,608,139,843 | 285,117 |

| United Kingdom | $17,310,839,572 | 11,325 |

| Germany | $12,771,241,702 | 6,804 |

| Japan | $11,911,427,787 | 2,974 |

| Canada | $5,927,581,267 | 11,370 |

| France | $5,625,392,793 | 2,569 |

| Netherlands | $5,348,320,072 | 2,836 |

| China | $5,174,788,000 | 1,429 |

| Australia | $5,153,402,654 | 9,065 |

| Italy | $2,747,519,753 | 1,481 |

According to HG’s data, the US healthcare market size for IT is $176.6 billion, comprised of 285,117 healthcare companies buying IT solutions. This accounts for 63% of global healthcare IT industry spend. Other key markets include the United Kingdom (6% of global spend), Germany (5%), and Japan (4%).

Buyer Landscape of the Health IT Industry

As the global healthcare market grows, the number of buyers in the health IT industry — and the need for innovative healthcare technology — continues to expand. This section digs deeper into technology trends in the health IT industry including spending by category and the number of buyers (classified by company size in employee count and revenue) and their average spend.

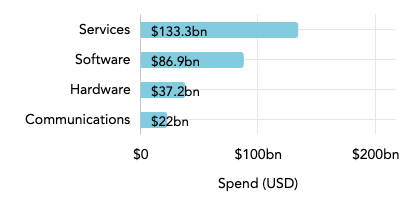

Healthcare IT Spending by Category

Out of the $279.5 billion in healthcare IT spending, nearly half (48%) will be spent on IT services, 31% will be spent on software, 13% on hardware, and 8% on communications.

Healthcare IT Spending by Company Size (Number of Employees)

| Employees | Total Spend | Companies |

| 10,000+ | $99,686,240,402 | 748 |

| 5,000 to 9,999 | $32,451,712,682 | 972 |

| 1,000 to 4,999 | $86,599,244,258 | 8,225 |

| 500 to 999 | $21,726,359,056 | 6,144 |

| 200 to 499 | $18,356,653,860 | 15,151 |

| 50 to 199 | $9,924,888,148 | 42,812 |

| 1 to 49 | $5,703,804,377 | 253,723 |

This chart shows spending within the healthcare IT industry by organization size (number of employees). The largest tiers for IT spend in healthcare are companies with greater than 10,000 employees ($99.7 billion), and those with between 1,000 and 4,999 employees ($86.6 billion). However, three in four IT buyers in the healthcare industry (77%) are small companies, with fewer than 50 employees.

Healthcare IT Spending by Company Size (Revenue Range)

| Revenue | Total Spend | Companies |

| $5bn and above | $61,971,106,395 | 142 |

| $1bn to $5bn | $79,416,117,436 | 755 |

| $500m to $1bn | $33,979,344,140 | 1,244 |

| $200m to $500m | $46,197,661,408 | 2,916 |

| $100m to $200m | $27,360,924,288 | 3,840 |

| $50m to $100m | $21,058,946,462 | 7,621 |

| $10m to $50m | $7,963,949,378 | 48,203 |

| $1m to $10m | $1,318,123,222 | 192,019 |

| Less than $1m | $217,868,955 | 89,283 |

Companies making more than $1 billion in revenue make up more than half (51%) of the total healthcare IT industry size. However, only 897 buyers fall in these revenue tiers.

An additional 46% of total IT spend comes from 15,621 healthcare organizations making between $50 million and $1 billion in revenue. The final 3% comes from the largest group of companies (329,505) with less than $50 million in revenue.

Healthcare IT Solutions: Market Share Breakdown

IT vendors across all categories constantly battle to dominate the growing healthcare market. These vendors range from cloud giants like AWS, Microsoft, and Google to successful niche players offering specific healthcare IT solutions. This section explores the leading vendors in five trending IT categories for healthcare buyers: Storage Management, Security Hardware, Security Software, Cloud IaaS, and Business Intelligence.

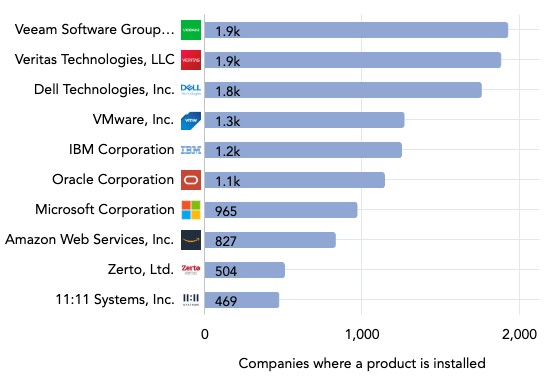

Leading Storage Management Vendors in the Health IT Industry

The storage of private healthcare data and electronic health records (EHR) is one of the most crucial IT processes for healthcare organizations as they ensure patient data remains both confidential and accessible.

This chart shows the ten leading vendors for Storage Management among healthcare companies. Unlike some other IT categories, HG data shows a more splintered market among healthcare buyers, with six vendors having more than 1,000 detected healthcare installations.

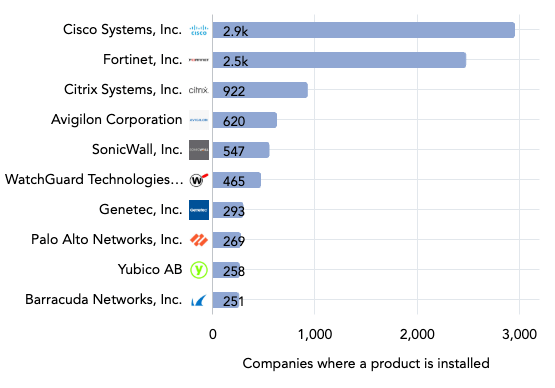

Leading Security Hardware Vendors in the Health IT Industry

Healthcare data is extremely private and must be protected from unauthorized viewers – that’s where Health IT industry providers like these Security Hardware vendors come in.

The two leading Security Hardware vendors — Cisco Systems and Fortinet — are winning the healthcare industry, with 5,415 installs detected altogether.

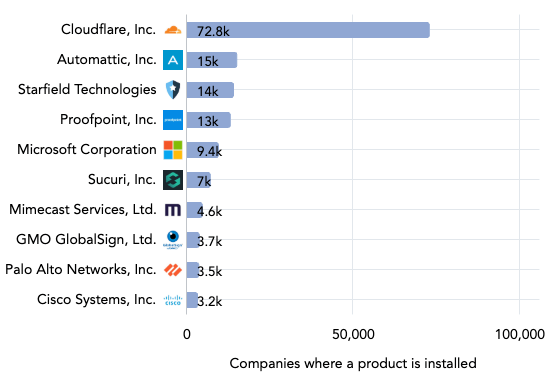

Leading Security Software Vendors in the Health IT Industry

The Security Software category has a much higher customer base than the previous two categories, with the leading vendor (Cloudflare) capturing 72,773 installations. The second and third largest Cloud Security vendors, Automattic and Starfield Technologies, have won the business of 14,972 and 13,958 healthcare organizations, respectively.

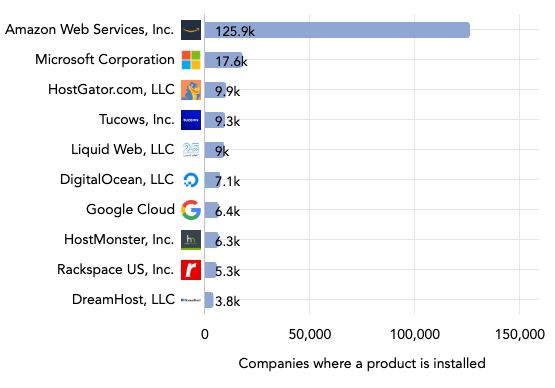

Leading Cloud IaaS Vendors in the Health IT Industry

The Infrastructure-as-a-Service (IaaS) market is massive and projected to grow to $232 billion (total) in 2025. Amazon Web Services (AWS) dominates the market with nearly 130,000 installations, while the other two cloud giants – Microsoft Azure and Google Cloud Platform – capture the business of 17,592 and 6,350 healthcare organizations, respectively.

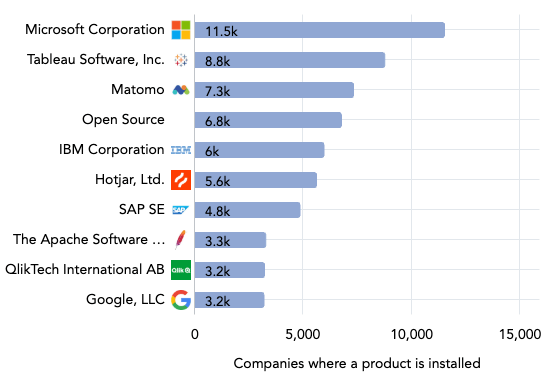

Leading Business Intelligence Vendors in the Health IT Industry

This chart shows the 10 leading Business Intelligence vendors by company installs. Microsoft’s Power BI tops the list with 11,514 installs at healthcare organizations. Other key players include Tableau (8,756 installs), Matomo (7,318), and IBM (5,951).

The fourth largest “vendor” by number of installs is not a vendor at all, but an amalgamation of all open source Business Intelligence solutions.

Want to learn more about leading Business Intelligence providers and products? Check out our market report here →

The Top Healthcare Technology Trend: Artificial Intelligence (AI)

Almost every industry has been impacted by the rise of AI in the last few years, and healthcare is no exception.

The timing is beneficial; although COVID-19 is no longer the top news story, the pandemic period was extremely difficult for the healthcare industry — organizations dealt with numerous COVID waves, canceled non-urgent procedures, implemented remote care, and are navigating a mental health crisis that is projected to be long-lasting. In the US, more than half of all hospitals ended 2022 with a negative margin, making it an even more difficult year than 2020 and 2021.

Healthcare organizations need to increase their margins and productivity across all stages of patient care. Generative AI can help.

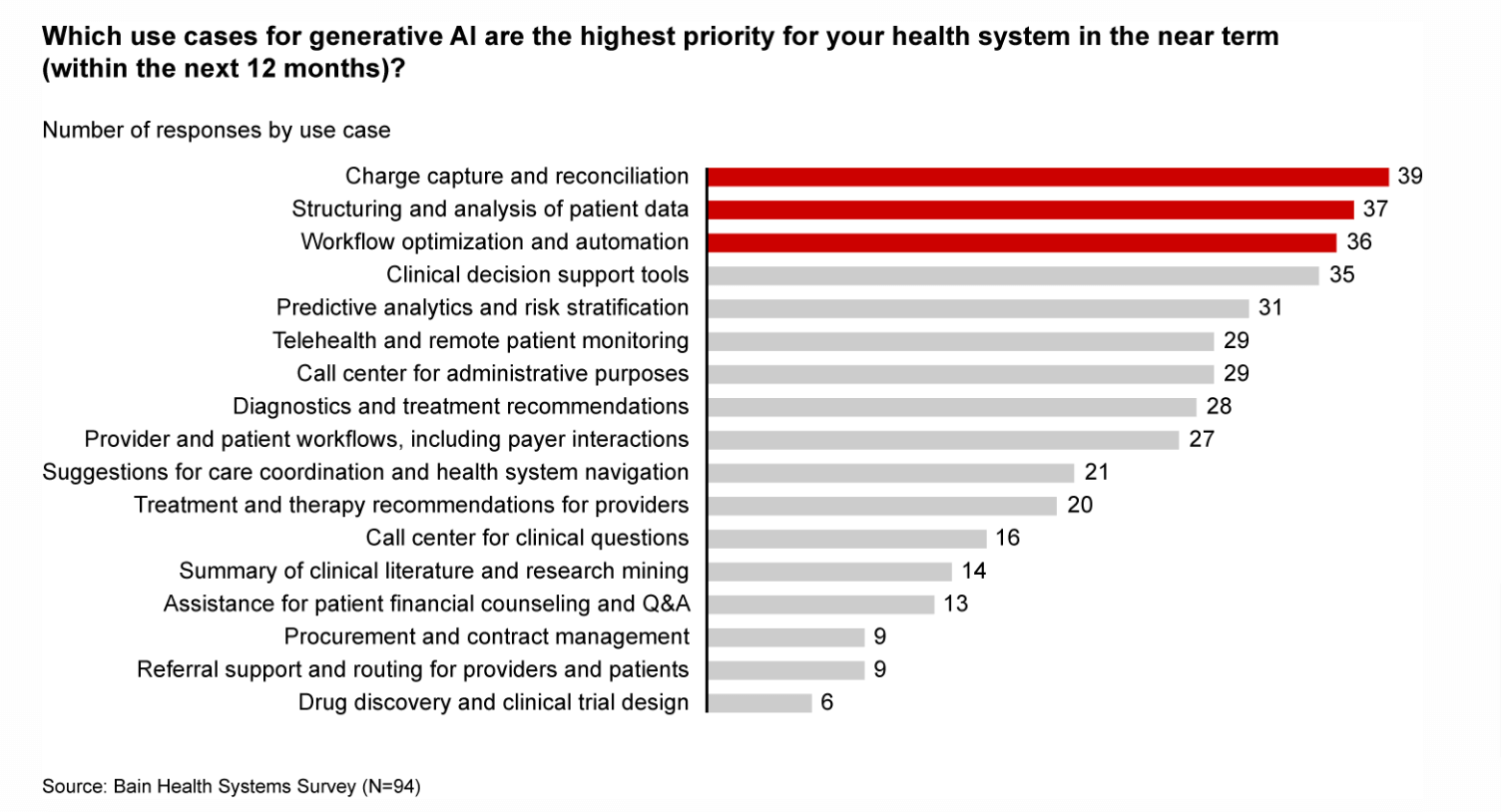

A Bain & Company survey found that 75% of health system executives believe generative AI “has reached a turning point in its ability to reshape the industry,” but only 6% have established a generative AI strategy so far.

According to the Bain survey, some of the key use cases for AI in healthcare are reducing administrative burdens and enhancing efficiency. Other use cases include improving patient outcomes through clinical decision support, remote patient monitoring, treatment recommendations, and even new drug discovery.

The impact of AI on the healthcare industry remains to be seen, but organizations are embracing it — investing heavily in this healthcare technology trend.

While 5.5% of healthcare sector costs were dedicated to AI and machine learning in 2022, this number was projected to exceed 10.5% by the end of 2024. The payoff could be significant: In the US specifically, “AI, traditional machine learning, and deep learning are projected to result in net savings of up to $360 billion in healthcare spending.”

Whether organizations invest enough to capture those opportunities remains to be seen, but one C-suite survey did find that 73% of health system and health plan executives are increasing their investments in the technology.

Uncover Healthcare IT Industry Trends & Opportunities with HG Insights

All of the data in this report was uncovered using the HG Platform, which enables go-to-market teams – like those in the healthcare IT industry – to pinpoint target markets (TAM, SAM, and SOM) and ideal customers (ICP).

Unlock HG’s data to size your markets, understand vendor penetration, identify your ICP accounts, and uncover your distinct opportunities in the healthcare market. Schedule a demo with one of our solutions experts to see your best-fit accounts and capitalize on these healthcare IT trends.