With an economic downturn hitting tech, it’s more important than ever to innovate faster than the competition.

Product teams may find themselves asking which markets are the most lucrative, and which accounts to prioritize within those target markets. By replicating competitor features and capabilities, product teams can feel confident they are prepared for a successful launch.

Understanding New Markets

When product teams plan their roadmap, understanding market trends is a key factor in strategy. The same features that make a successful launch today may become obsolete a year from now. Knowing the current market size and structure is less important than being able to anticipate what an industry or geography will look like down the road. According to the CPO of a large database management company, understanding his market is key to determining where they should focus for the next two to three years.

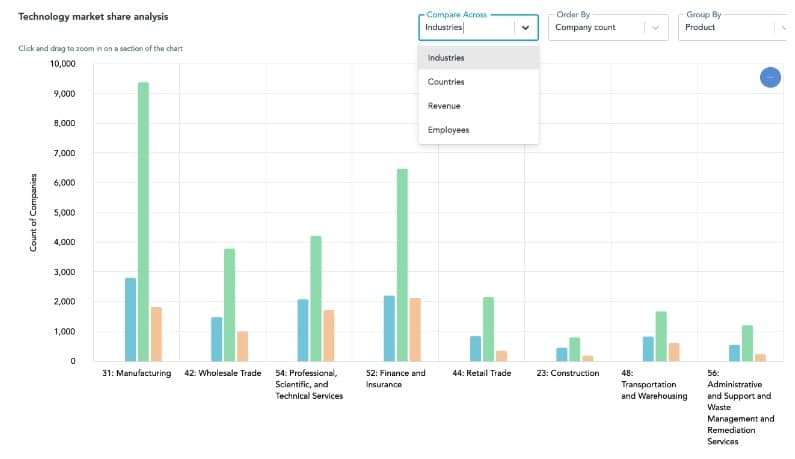

With traditional datasets like IDC and Gartner, assessing market size was possible, but segmenting into specific regions and verticals—with an emphasis on competitor penetration and greenfield opportunities—has always been a gamble for product teams. Segmented market data should be used to determine “regions we should focus on to get growth,” says the CPO.

HG Insights helps product teams establish their Ideal Customer Technology Profile (ICtP) based on what products are used by their existing customer base. Tracking specific products and vendors across different GEOs and verticals, an ICtP will tell product teams which features to build now and which capabilities they may need to create.

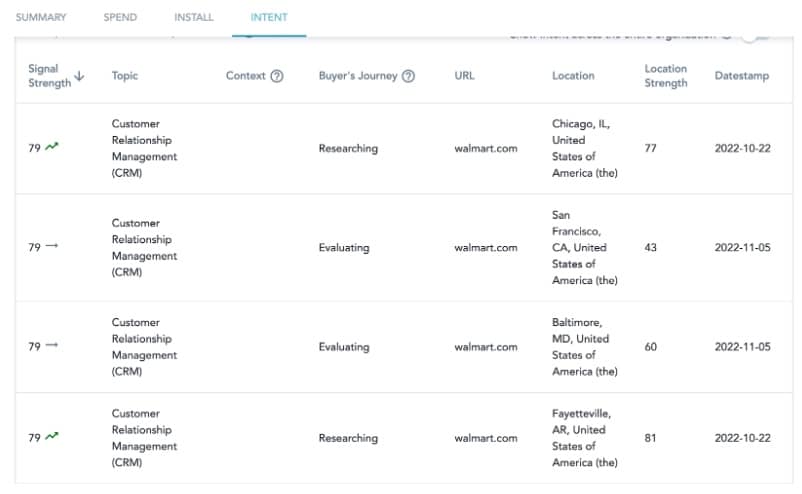

Identifying market trends and customer intent is essential to product development. Understanding competitor penetration and which vendors have the largest market share gives product teams an on-demand view of each market, segmented down to an account level. Additionally, the ability to see what customers are researching allows product teams to recognize features and capabilities they should build.

Focusing on vendor penetration in a market allows product teams to prioritize and deprioritize specific features. The ability to understand market share for competing products enables teams to build the ideal product at the right cost based on market demand. If a competitor has a low penetration in a certain market or industry, deprioritizing the capabilities of that product may be a cost-effective strategy.

HG Insights provides actionable account intelligence that gives product teams the ability to build the ideal product for their existing customers at the most efficient cost. In addition to appealing to potential customers, Go-To-Market teams can collaborate on upselling competing solutions by viewing an account’s existing IT infrastructure. Using HG Insights’ install and intent data, Wipro was able to turn a $15M cloud migration deal into a $75M digital transformation project by accurately determining their customer’s needs.

The capability to see what their existing and potential customers have installed and are currently researching equips product teams with the necessary tools for cross-functional collaboration and, ultimately, a more marketable product.

Greenfield Opportunities

By developing a company’s ICtP, Go-To-Market teams can expand into previously unknown markets. Finding compatible technologies enables teams to identify patterns in their existing customer base and pursue accounts that have yet to be contacted by competitors, defining an entirely new market.

Recognizing untapped markets based on their existing IT infrastructure, industry, geography, and annual revenue, product teams can then design an ideal product adapted to their new market’s needs. One HG Customer used their ICtP to build Project Edison, a business intelligence tool that allowed them to identify and capture an $80M new market solution in EMEA in 2020 and ensured their product team could develop the right features and functionality to attract these customers.

Developing an ICtP that’s segmented down to the account level facilitates successful product launches in previously untapped markets by identifying necessary solutions for compatible products. By surfacing these untapped markets, product teams can effectively monopolize the market.

TAM, SAM, SOM in Product Innovation

When creating a product for a new market, building the most capabilities to fit the largest pool of potential customers is not always a cost-effective strategy and often forces product teams to create solutions for only a specific segment of the market that they can realistically obtain. Selecting which accounts to pursue when developing a new product can be a risk product leaders face if they are not armed with the right data.

HG Insights’ Market Intelligence offers the most granular understanding of a company’s Total Addressable Market (TAM) by drilling into the market from a bottom-up approach. By examining the market from an account view, product leaders can assess which sub-markets represent the best opportunities for growth, giving them their Serviceable Addressable Market (SAM). The ability to view which markets are saturated by competitors within this segment and which accounts have the highest potential to become customers gives product leaders their Service Obtainable Market (SOM).

Having more granular information on target accounts helps product leaders plan more effectively so they understand what markets to enter or exit, and how to allocate budgets and resources. Identifying a company’s SOM enables product teams to hyper-focus on specific capabilities and fits, ultimately creating the perfect cost-effective product for their customers.

Product Innovation For the Right Audience

For both existing accounts and prospective customers, having a holistic understanding of their tech stack and Contextualized Intent ensures product teams can develop the ideal product for their market. Customers using HG have a better understanding of who their customers are and who they should target. Visibility into an account’s tech stack allows for cross-functional collaboration across the Go-To-Market teams to identify both expansion opportunities and whitespace based on a customer showing interest in leaving a competitor.

Understanding market demand before a launch and knowing which accounts make up an ICtP allows product leadership to minimize the number of market bets being made while reducing misalignment with go-to-market teams after launches. Arming product teams with the right market insights ensures the optimization of every level of a product’s roadmap, from vision to release.

About HG Insights

HG Insights, the provider of data-driven insights to 75% of tech companies in the Fortune 100, is your go-to-market Technology Intelligence partner.

We use advanced insights into Technology Intelligence — on IT spend, technographics, cloud usage, intent signals, Functional Area Intelligence, contract details, and AI maturity — to provide global B2B companies with a better way to analyze markets and target prospects. Our customers achieve unprecedented results in their marketing and sales programs thanks to the indexing of billions of unstructured documents each day with insights into product adoption, usage, spend data, and more to build high-resolution maps of activity across an organization’s entire digital infrastructure to power business decisions with precision and confidence.