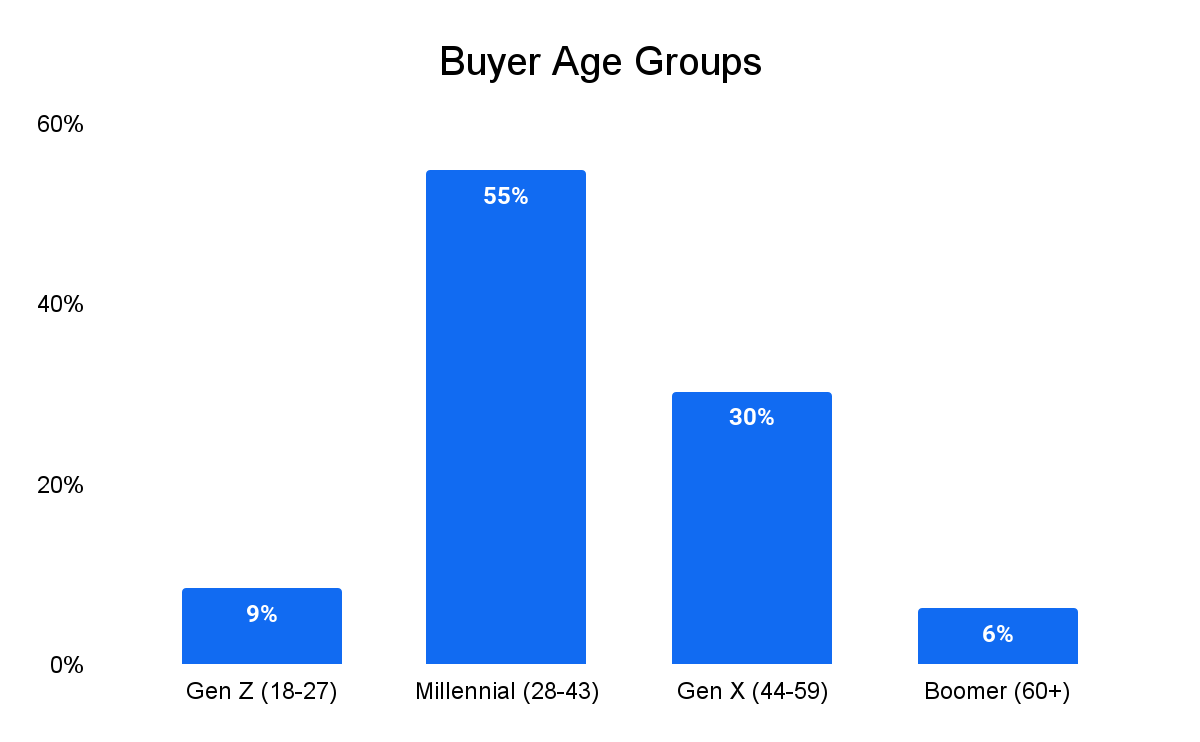

Several years ago, we reported on the rise of the millennial software buyer and how their preferences differed from previous generations. Now it’s Gen Z’s turn. While millennials still make up the majority of software buyers (55%), Gen Z is making its presence known.

And in 2025, for the first time, Gen Z buyers (born between 1997 and 2005) surpassed baby boomers in our annual

Buyer Research Report. 9% of our respondents were Gen Z software buyers, and this number will continue to rise as more Gen Zs enter the workforce (and as Boomers continue to retire). Every generation has unique preferences and habits compared to those who came before. Gen Z has been raised in a post-internet world where new tech innovations pop up every day. They are more online and more technologically savvy than any generation before. What does that mean for tech sellers? What are Gen Z’s preferences, and how can you adapt your marketing strategy to appeal to this new generation?

Gen Z Sofware buyers: who are they?

Gen Z buyers aren’t automatically inexperienced. Though they are the youngest generation currently participating in the professional world, the oldest of Gen Z are in their late 20s and likely have a job or two under their belt.

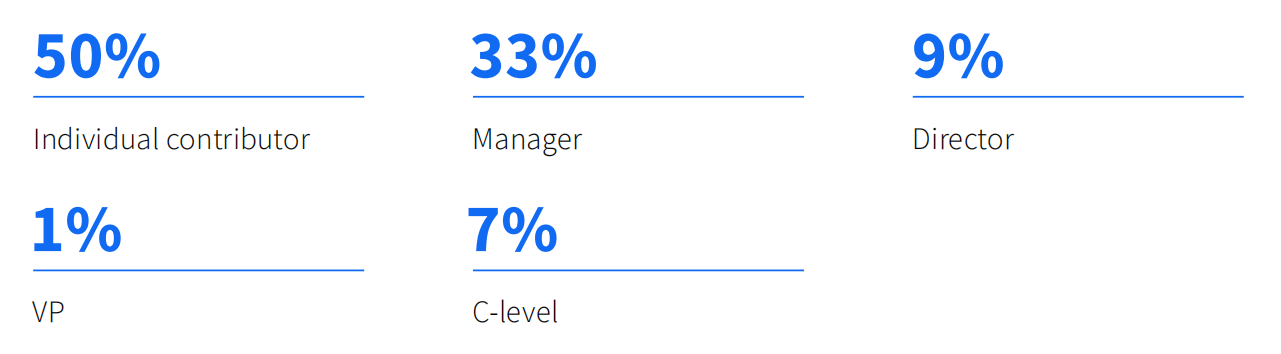

The Gen Zs in our sample ranged in age from 20 to 27 years old (born between 1997–2005). Half of them hold individual contributor roles (versus 24% of the general sample) and they have fewer high-level titles than other age groups, as expected:

More Gen Z respondents worked at small businesses and fewer worked at enterprise companies versus the general sample. Interestingly, they had this in common with Boomers. Our Gen Z sample was divided as follows:

Gen Z and the proliferation of AI

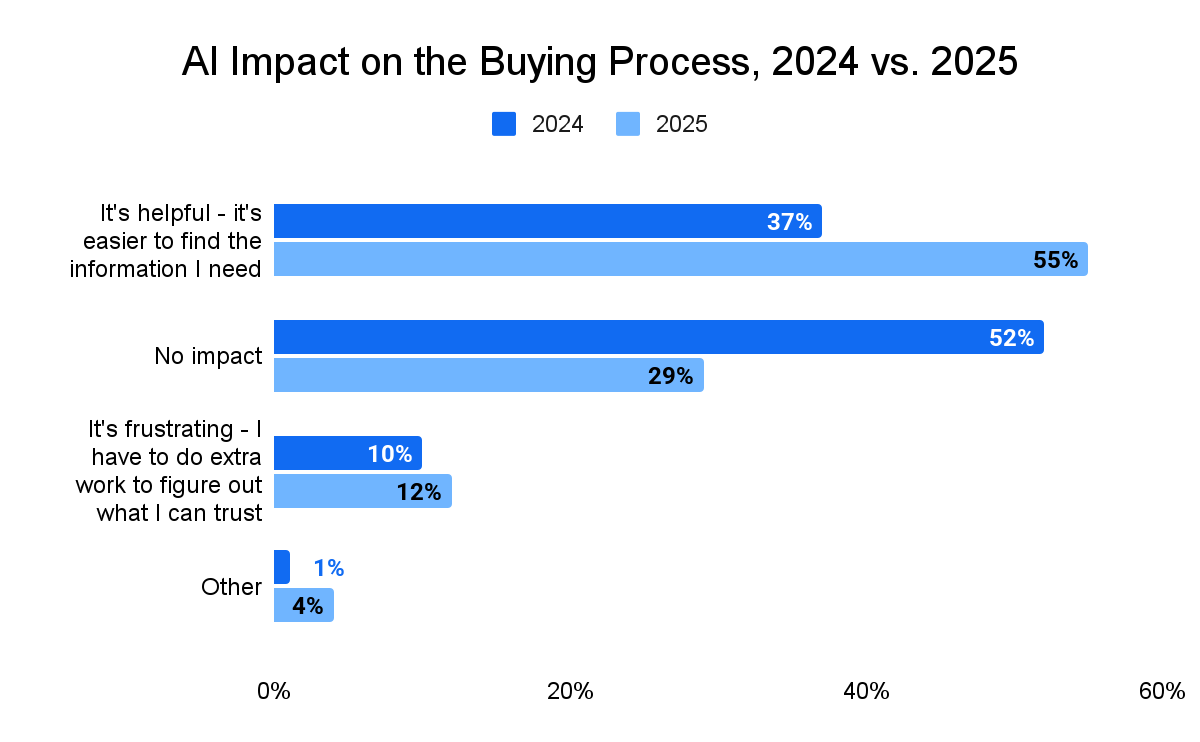

According to our research, Gen Z buyers use AI tools more than any other generation. 15% of Gen Z buyers use AI a lot — that’s nearly double the 8% of all surveyed buyers who said the same. There are also fewer non-users: 41% of Gen Z say they don’t use AI at all versus 53% of the total sample. The number of Gen Z buyers who find AI helpful in the buying process also saw a big jump over the last year, increasing by 18 percentage points.

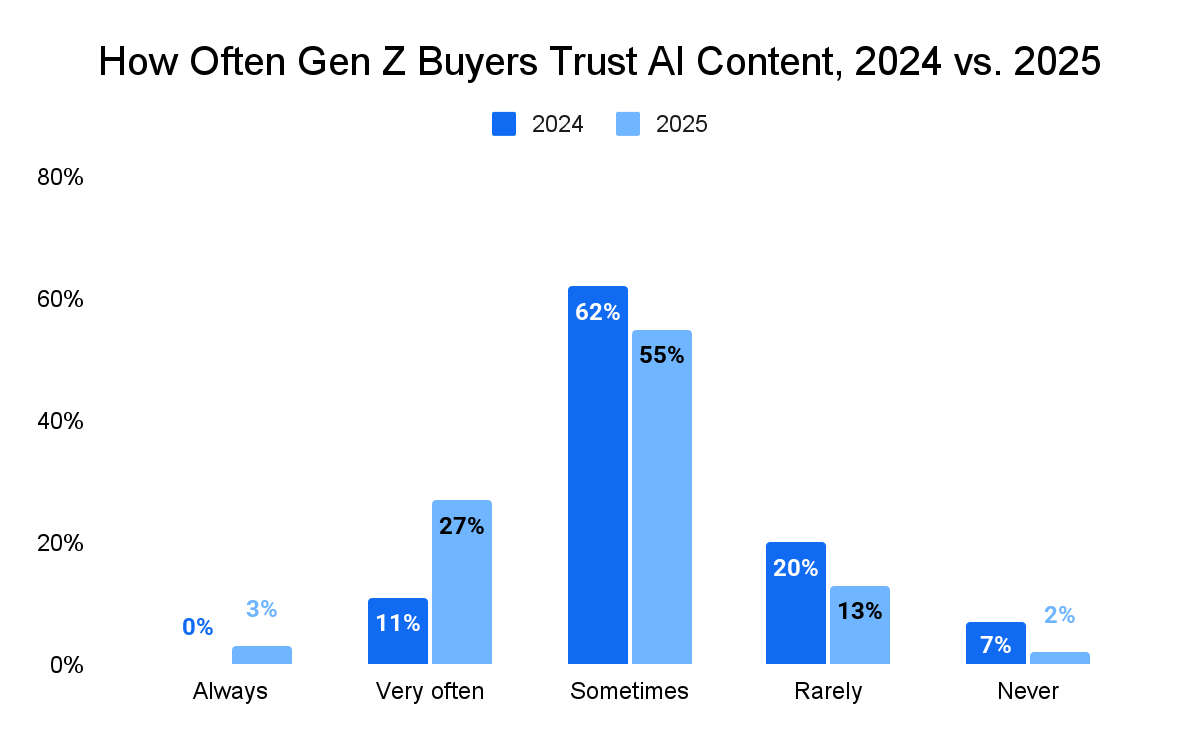

Gen Z also trusts the AI tools they’re using more than any other generation. 30% of Gen Z buyers say they “always” or “very often” trust AI-generated content, versus 20% of all surveyed buyers.

This makes perfect sense, given this generation grew up in the technology age and is considerably more online versus other generations. They’ve spent their entire lives learning new technologies, and that savviness now extends to their careers.

Always or very often

“Usually it lines up with other information I find on different websites.”

—27-year-old manager at an enterprise company (1001+ employees)

Sometimes

“It can be very helpful when trying to do a specific thing, but general advice or searches return mixed results.”

—27-year-old individual contributor at a mid-sized company (51-1000 employees)

Rarely or never

“I still prefer watching YouTube tutorials or reviews of a product, where I can see their interface and how they are working with that software or technology.”

—26-year-old director at a small business (1-50 employees)

As Gen Z professionals move up in the workforce and gain influence in the coming years, we expect AI usage will continue to increase — but will they continue to trust it?

New generation, new preferences: how Gen Z’s preferences differ

Software buying is a riskier prospect for Gen Z buyers than for other generations. Most Gen Zs are new(ish) to the workforce, and while they may have a couple of full-time jobs and even a promotion or two under their belt, these folks don’t have the seniority that their older colleagues do. This means they likely don’t get to make the final decision — that typically sits with VP and C-level professionals, most of whom are older — but they play a large role in the research process and the formulation of the short list.

This also means that the consequences of making the wrong recommendation are even higher. After all, making an expensive mistake isn’t the best way to advance your career. If the employer goes with the Gen Z’s recommendation and it’s the wrong one, that’s more than just the cost of the tool down the drain, it’s a loss of the investment (time, money, effort) that went into the decision plus the investment required to try again and get it right. Not to mention the hit to their reputation for making a bad impression on the higher-ups.

Needless to say, the trust gap is wider with Gen Z. 57% of Gen Z buyers talk to someone who uses (or used) the product, but only 28% speak to a vendor-supplied reference. That means they are looking to their professional networks and communities, forums, and social media to find people for these conversations, as well as relying on AI tools and peer reviews.

So, if they’re not consulting vendor-produced resources, how does Gen Z approach the buying process, and how does that differ from other generations? Beyond their usage of AI tools, Gen Z buyers rely more heavily on social proof.

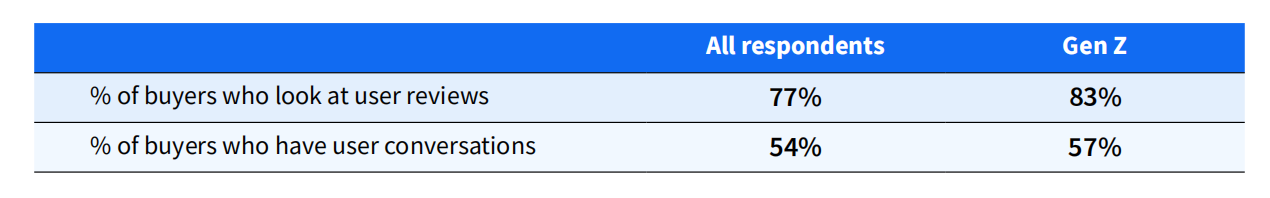

Gen Z and social proofing our buyer research report, we focused on both peer reviews and user conversations as key resources for software buyers. Gen Z uses these resources more than the general sample.

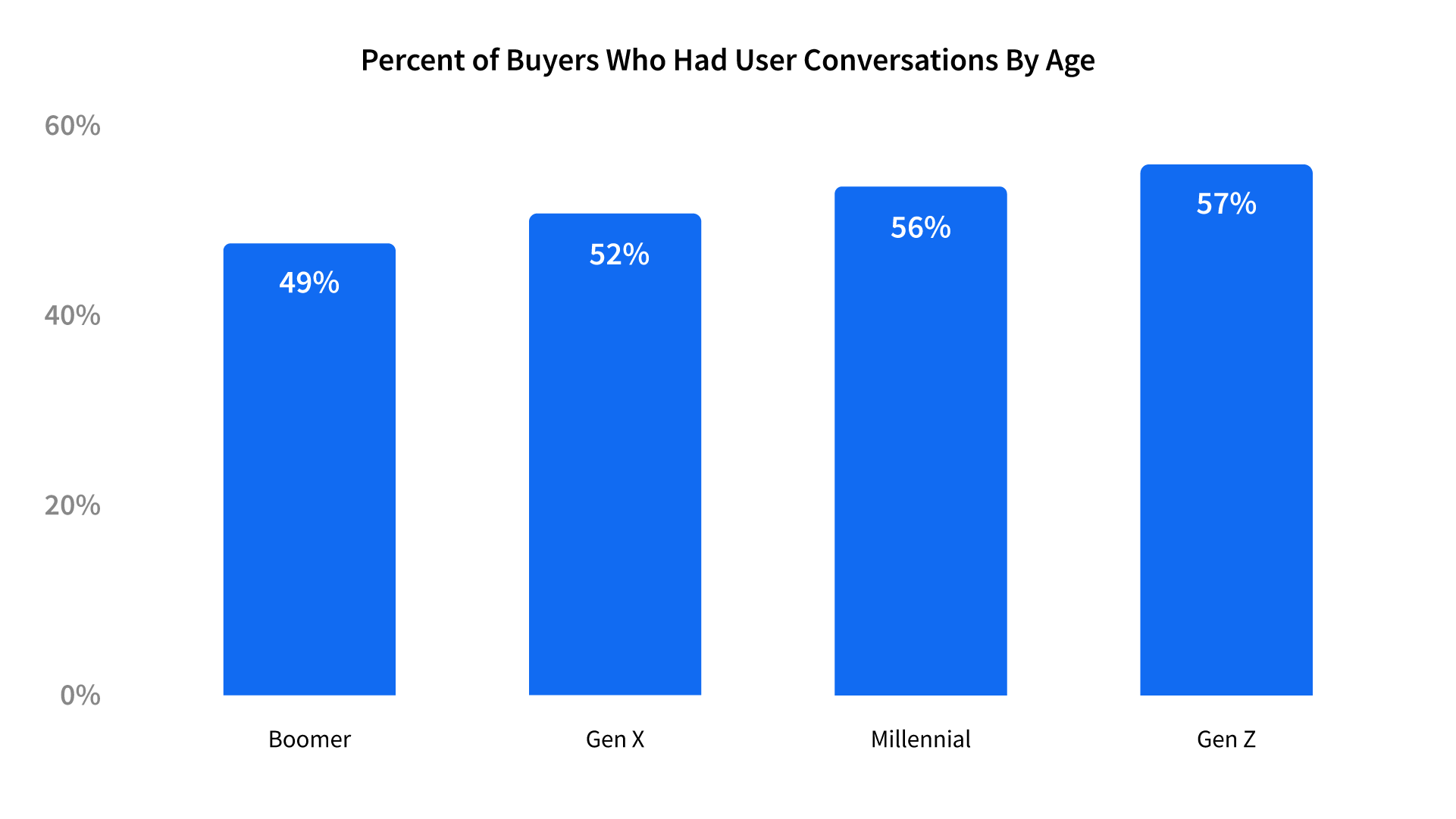

77% of all buyers looked at user reviews versus 83% of Gen Z, and 54% of all buyers spoke with someone who had used the product before versus a slightly higher proportion (57%) of Gen Z.

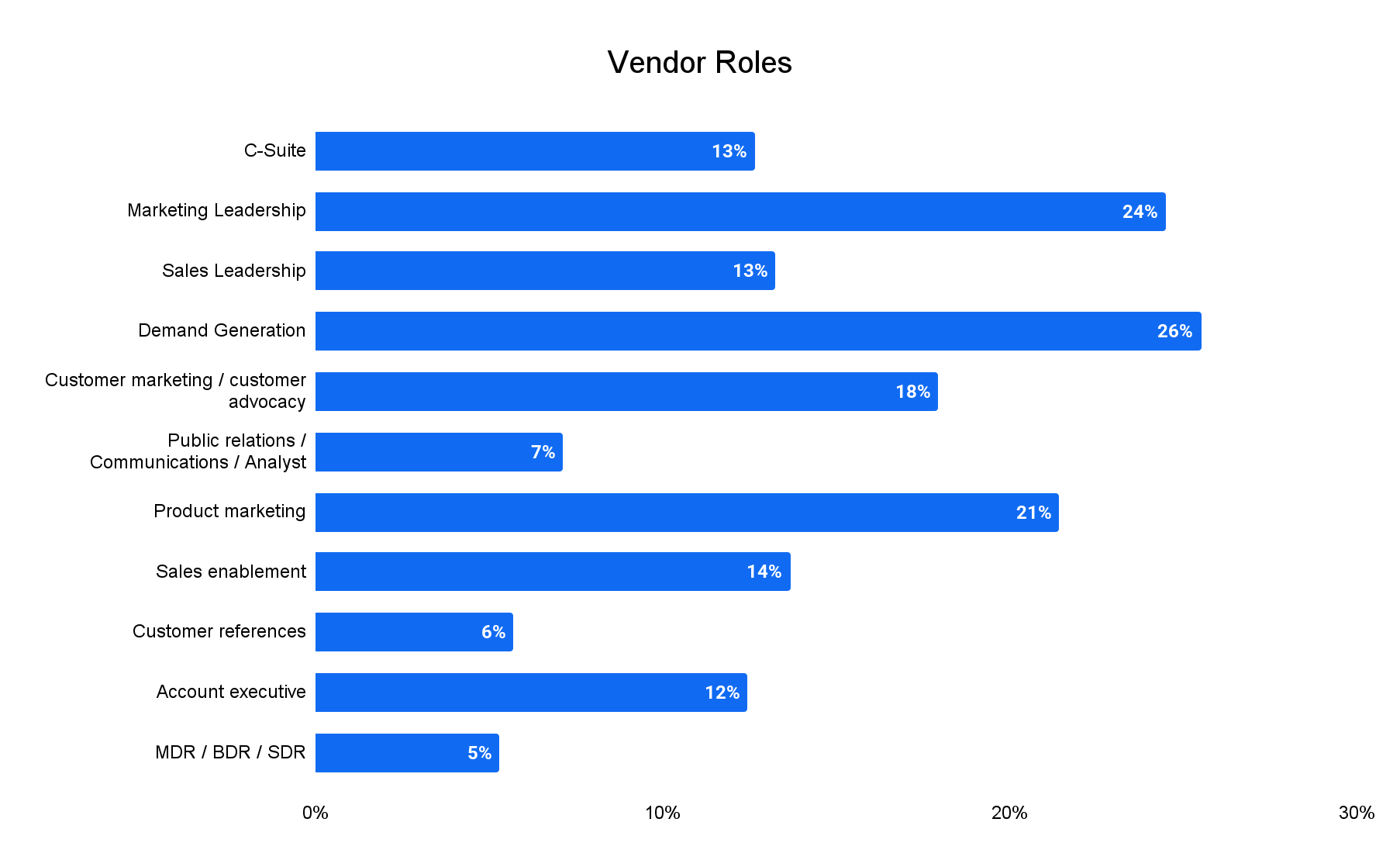

Only 23% of surveyed buyers (28% of Gen Z) who had a conversation with a user chose to speak with vendor-supplied references, while the vast majority found peers to talk to through professional networks or coworkers. This perhaps explains the disconnect between what is actually happening and what vendors think is happening. Vendors believe only 38% of buyers are speaking with a user of the product, but that number is 49% or higher across every generation.

Even as new AI-based sources make a splash, the number of sources buyers used to make purchase decisions stayed the same versus last year across all generations. This supports our hypothesis that Gen Z buyers are relying less over time on sources they perceive as more biased, e.g., vendor-supplied resources and analyst reports.

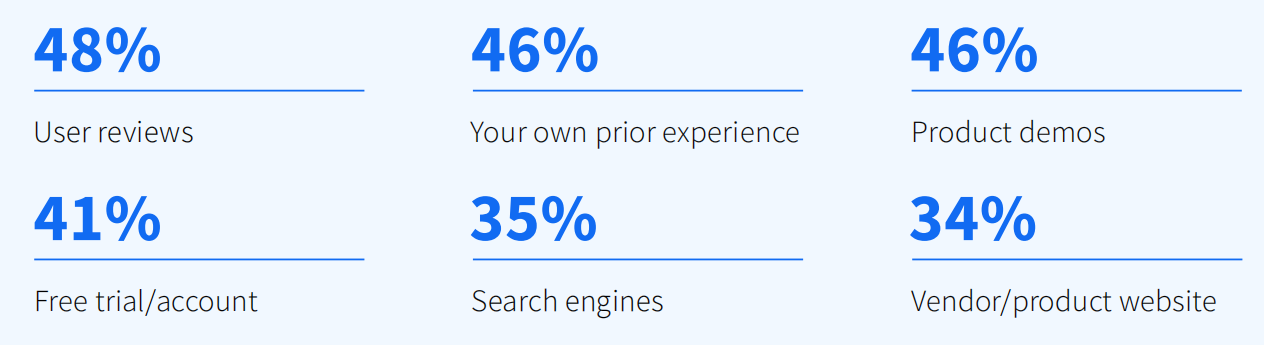

Top resources consulted by Gen Z:

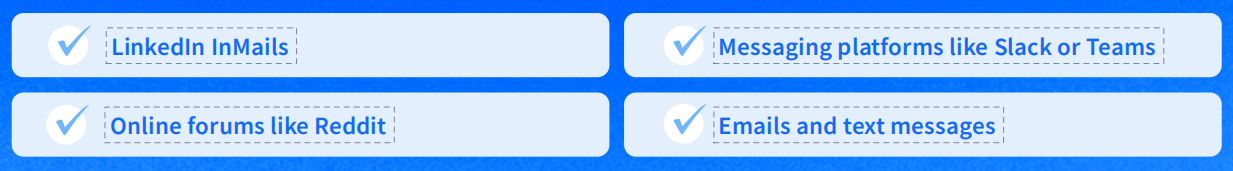

Where do buyers find users to talk to, aside from vendor-supplied references?

We’d guess that the majority of these conversations happen in communities and in “untraceable” research sources such as:

In 2025, prior experience overtook product demos to become the most frequent and most influential resource consulted this year by the general sample. 52% of all surveyed buyers use their own prior experience to make purchase decisions. But among Gen Z, that figure was 46%. For older generations who have used several products in a particular category, it makes sense to rely on your own historical use of those products, but leveraging prior experience can be more challenging for Gen Z software buyers whose experience may be more limited.

We speculate that part of the reason this generation relies on social proof is that they see it as a way to fill in the gaps when they haven’t used a product themselves.

If you want to make an impression on the up-and-coming generation, now is the time to do it. Create a brand that Gen Zs trust by making social proof easy to find, making return on investment (ROI) calculations as simple as possible, and making it clear why recommending your product will boost their reputation.

What gives Gen Z buyers confidence?

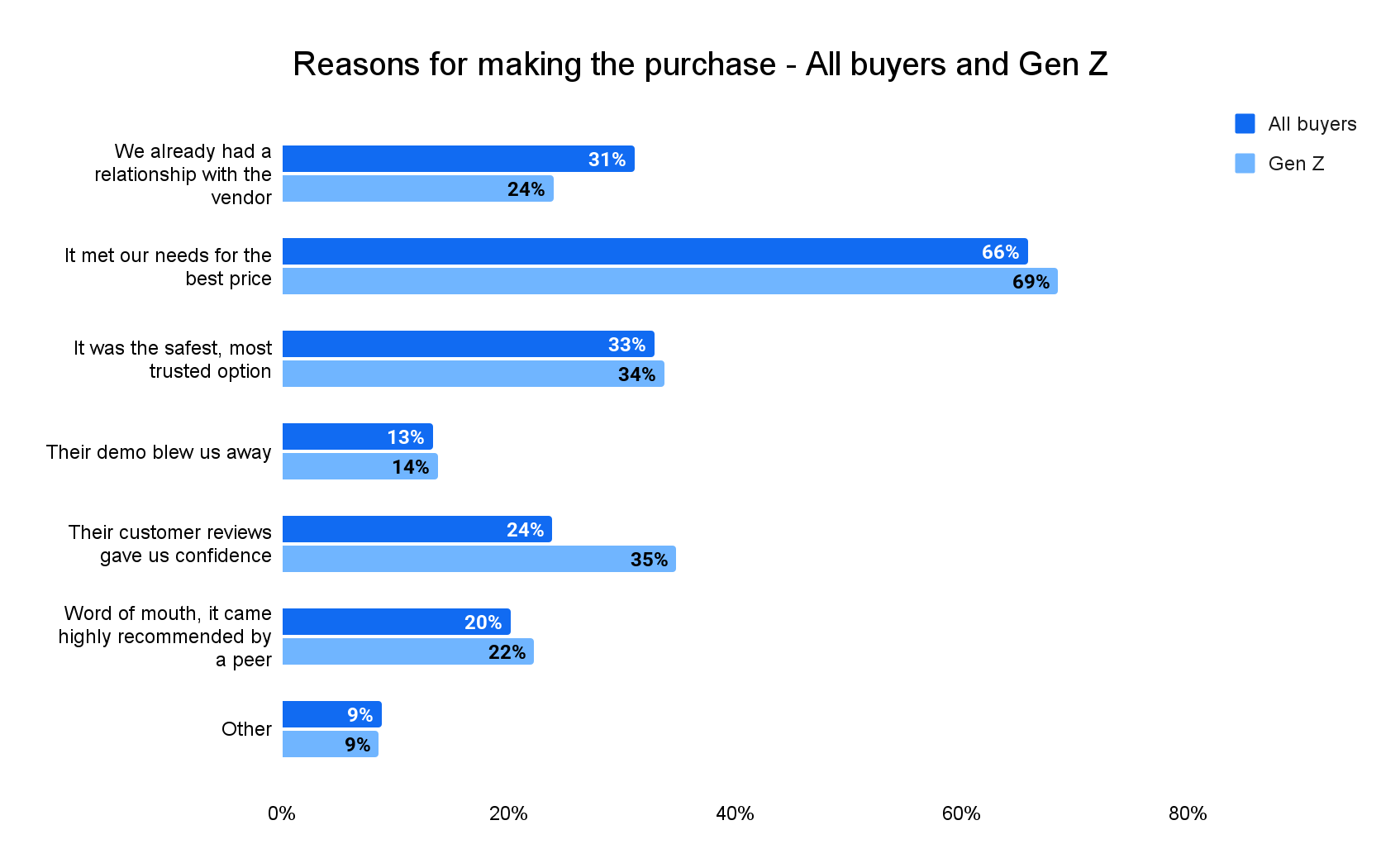

Since their prior experience may be more limited, Gen Z buyers look to other factors to give them confidence in their purchase. They are less likely to rely on previous relationships with vendors (24% versus 31% of all buyers). Instead, they prioritize getting the best price (69%), confidence from customer reviews (35%), and the product having a safe, trustworthy reputation (34%).

“Gen Z has a highly tuned BS filter. The instinct they use to fag an Instagram post as doctored is now fagging polished case studies and gamified review sites as untrustworthy. If vendors want to credibly prove their product works to Gen Z buyers, they need to provide highly relevant, substantive, and verified customer

evidence, and deliver that proof in a consumable, personalized, snackable package. A bunch of impressive logos and 15-page PDF case studies don’t cut it for the LLM generation. They expect to learn very quickly how a product has helped peers that look exactly like them (ie, same industry, use-case, tech-stack, etc).””

—Evan Huck, CEO, UserEvidence

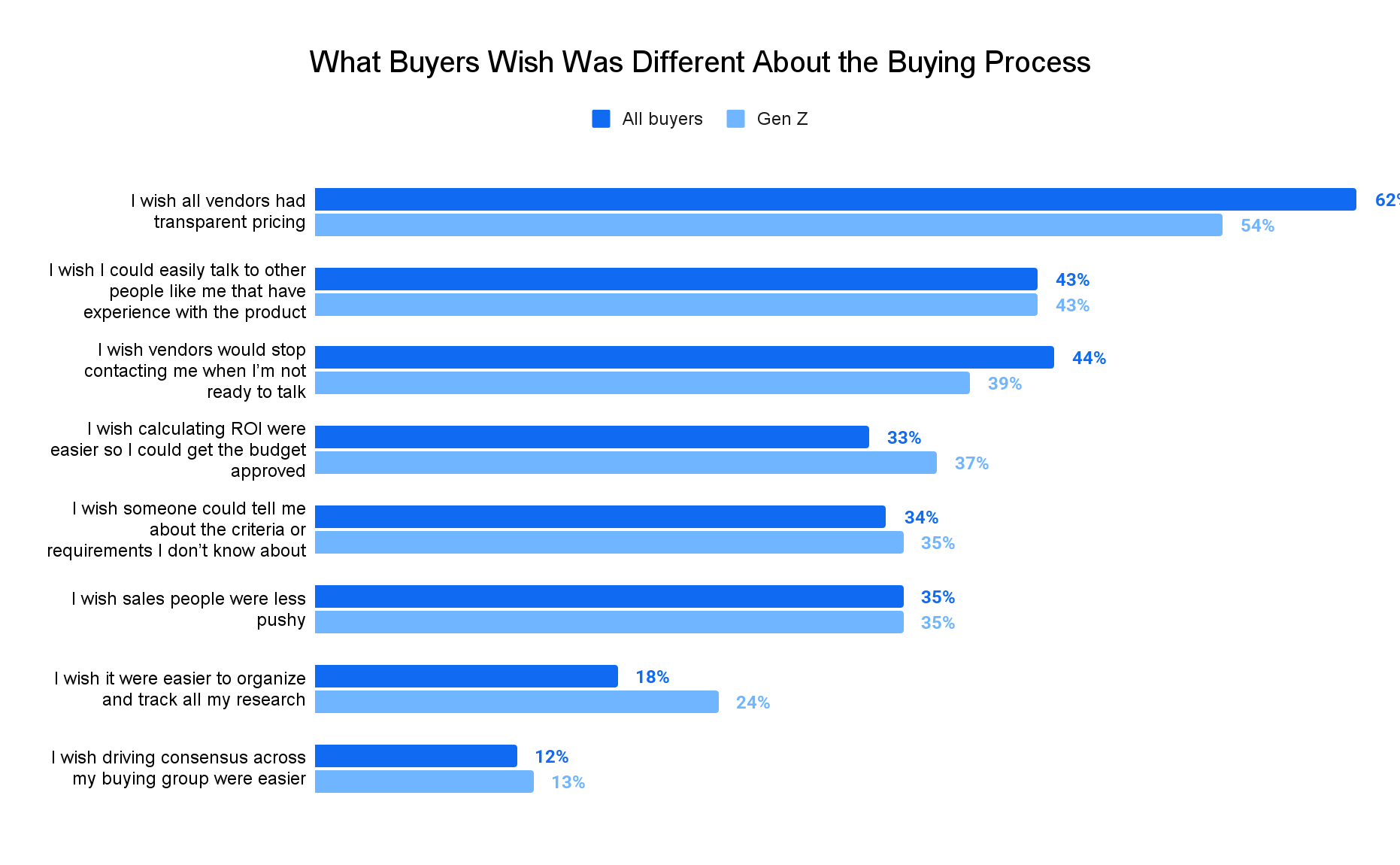

Is Gen Z fully satisfied with the current software buying process? Not quite. When asked what they would change about the buying process if they could, 33% of the general sample said they wished for easier ROI calculations. Among Gen Z buyers, this number was 37%.

This fits our earlier hypothesis about software buying feeling riskier for younger generations. If a Gen Z buyer can demonstrate that the company benefited from their recommendation, i.e., positive ROI — it certainly would make them look good in the eyes of their higher-ups.

Versus older generations, we noticed a few other interesting differences:

Gen Z cares slightly less about transparent pricing from vendors — 54% versus 62% of all buyers — but it’s still the thing they wish for the most. Since Gen Z buyers are more likely to be in research roles, they are probably expecting to speak to the vendor at some point to get the info they need. An older buyer who has used the product probably doesn’t want to sit through a demo of a product they know how to use just to find out the price.

They aren’t as concerned about vendors contacting them before they’re ready to talk — 39% versus 44% of all buyers. Since Gen Z buyers don’t usually control the budget, we think it’s less likely that vendors are reaching out to them proactively due to this lack of final decision-making power.

They are more interested in organizing and tracking their research — 24% versus 18% of all buyers. Gen Z buyers are more likely to be in junior positions where they get delegated the research grunt work. Of course, older generations aren’t as worried about this because they’re asking their Gen Z colleagues to handle it for them.

Future-proof your marketing: how to capture Gen Z mindshare

The importance of Gen Z in the software market will only build from here. They’ve already eclipsed Boomers to become the third-largest generation in the workforce, and they’ll inch ever closer to Gen X in the next decade.

And since the trust gap is wider with Gen Z, vendors will need to prioritize alternative channels and strategies that reach Gen Z buyers indirectly.

AI SEARCH AND LLMS

Search engine optimization (SEO) is not dead, but people are putting their inquiries directly into AI search and large language models (LLMs) more often these days. Vendors should prioritize showing up in these spaces, whether a ChatGPT search or an AI Overview at the top of the Google results page — especially since Gen Z uses AI more frequently and trusts its results more often than other generations.

To do this, ensure you’re creating content that is likely to answer the questions buyers have. Remember, writing for LLMs is like writing for humans, not an algorithm. You’ll need to build out your online presence, beyond just your website, to increase the chances that an LLM or AI search engine will pick up mentions of your product and cite your content. 90% of buyers mentioned they clicked through to sources from AI summaries. Make sure you’re one of those sources.

DEFINE AND MEASURE ROI

Gen Z cares more about proving ROI than any other generation. Make it easy for them to get that budget approved by demonstrating how they can measure ROI with your product to make a business case. With these purchase decisions having such high stakes for younger employees, the goal should be to build their confidence that choosing your product will reflect well on them.

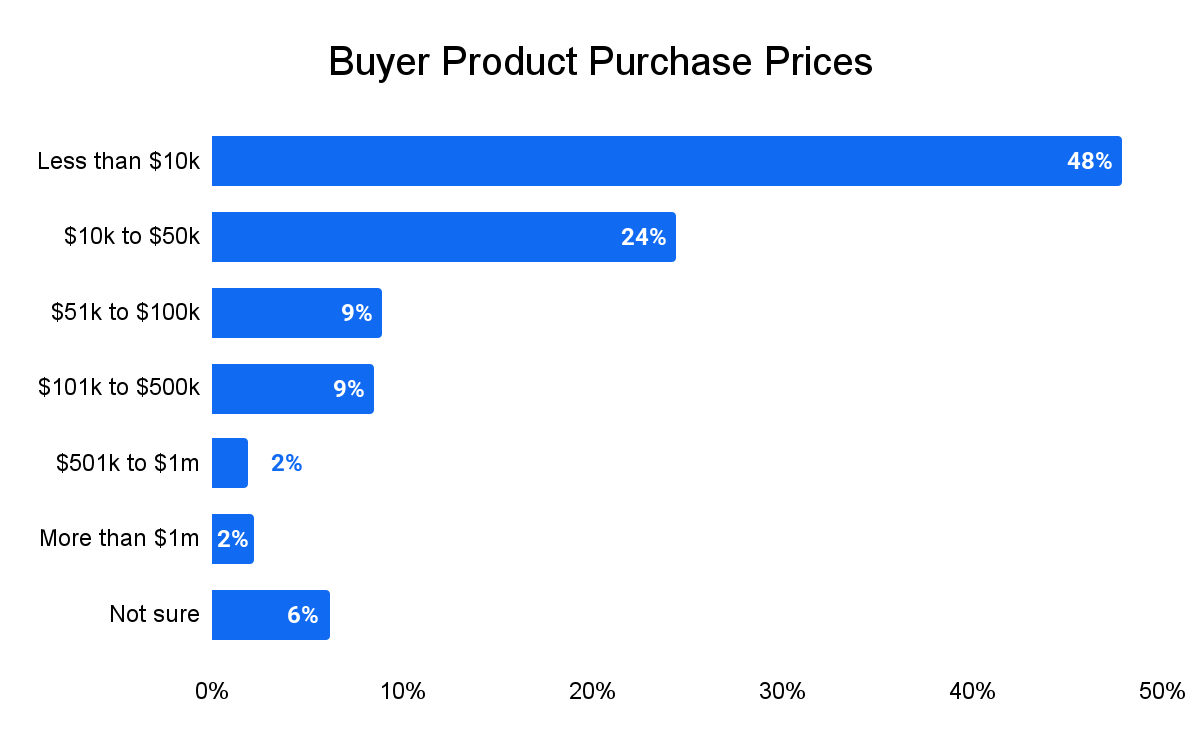

This is even more important if you target enterprise buyers. 33% of Gen Z buyers purchasing high-priced software wish it was easier to calculate ROI. The larger the investment, the more crucial it is to prove returns.

USER-GENERATED CONTENT (UGC) IS A GOLD MINE

Gen Z places more trust in direct insight from other users via conversations, reviews, and forums. Rather than just waiting for these conversations to happen and reviews to appear, companies should boost efforts to source user-generated content (UGC). We know from previous research that buyers want to read reviews from users similar to them. This means it is essential to source reviews across industries, uses cases, roles, and company sizes. 32% of software vendors don’t allocate any spend to review generation, but that’s a huge missed opportunity for not only brand awareness and building preference, but also demand generation and capture. Three-fourths (77%) of all buyers and 83% of Gen Z buyers reference user reviews in their decision-making process.

Don’t forget to keep an eye on less structured communities and locations to see what others are saying about your company and products as well. Reddit, for example, is a forum where many prospects will look for past posts about products during their research. They might even ask questions of their own. It can be helpful to have a presence on Reddit where you can answer questions and collect feedback.

Methodology

The data referenced here was sourced from the TrustRadius global network via an online survey. In January 2025, we sent online surveys to professionals who were involved in a software or hardware purchase for their organization in the past year. We sent a separate survey to members of go-to-market teams for technology vendors. We received complete, verified responses from 2,058

technology buyers and 490 technology vendors. All respondents were offered a nominal incentive ($10 gift card) as a thank-you for their time. We’ve included information below on the demographics of our survey respondents. For a full list of survey questions and answer choices, or if you have any questions about the data, email us at research@trustradius.com.