Key Takeaways:

- $291 billion in projected IT spend by the Insurance industry in the next 12 months.

- 49.8% of the Insurance market size for IT comes from the AMER region.

- 47% of IT spending by Insurance companies will go toward IT Services, 31% will be spent on Software, 13% on Hardware, and 9% on Communications.

- IT innovation in Insurance is being driven by AI, with applications in claims processing, customer experience, risk assessment, personalized offers, and more.

The global Insurance industry is massive, encompassing a huge range of sub-categories like health insurance, life insurance, embedded insurance, auto insurance, and even cyber insurance. These companies play a significant role in society, protecting individuals and businesses against countless types of unexpected financial losses.

So just how big is the insurance industry? The global Insurance market size is projected to grow to $9.3 trillion in 2025, with the United States accounting for more than half of that value.

Our data illustrates how much the Insurance industry is spending in the IT market, from services and software to hardware and communications: According to the HG platform, 48,000 companies in the Insurance industry will spend $291 billion on IT over a forecast period of the next 12 months.

Innovation in technology – especially artificial intelligence (AI) – is shaking things up for companies with this business model, as new opportunities arise to automate processes, improve customer experience, and even predict (or prevent) certain events.

In this report, we analyze IT adoption, usage, and spending, as well as Insurance Industry trends in IT. We’ll also dive into the leading vendors and products across five key categories. All data and insights were uncovered with our Market Intelligence Platform to help you identify your distinct opportunities in the market.

Insurance Market Size for IT

According to HG data, the global Insurance market size for IT is projected to reach $291 billion over the coming 12 months. The HG database includes 4.3 million companies with registered addresses, and our analysis identified 48,083 businesses in the Insurance industry who are buying IT solutions.

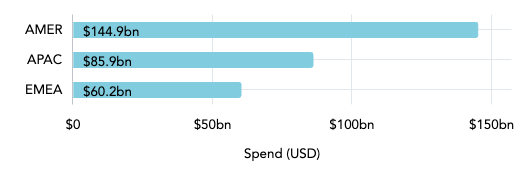

IT Spend in Insurance Industry (by Region)

Insurance companies in the AMER region (North, Central, and South America) will spend nearly $145 billion on IT in the next 12 months – just under half of global IT spending in the Insurance industry. APAC (Asia Pacific) accounts for more than 29% of global spend, while about 21% comes from companies in EMEA (Europe, Middle East, and Africa).

Insurance Market Size for IT (by Country)

| Country | Total Spend | Total Companies |

| United States of America | $128,102,027,724 | 29,721 |

| Japan | $34,009,837,315 | 725 |

| China | $20,661,325,937 | 344 |

| Germany | $12,532,797,576 | 1,162 |

| Canada | $10,883,917,679 | 2,165 |

| South Korea | $9,855,548,952 | 127 |

| United Kingdom | $8,982,947,827 | 3,138 |

| France | $7,378,008,938 | 952 |

| India | $7,304,789,947 | 377 |

| Switzerland | $6,309,948,482 | 338 |

The United States – which makes up more than half of the nominal value in the Insurance market – is correspondingly the largest market for IT spending in the Insurance sector, with 29,721 companies projected to spend $128.1 billion in the next 12 months (about 44% of IT spend in Insurance).

APAC accounts for four of the top ten markets (Japan, China, South Korea, and India), as does EMEA (Germany, United Kingdom, France, and Switzerland).

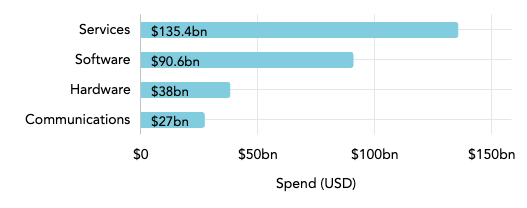

Insurance Market Size by IT Category

IT buyers in the Insurance market are projected to spend $135.4 billion on IT Services in the next 12 months, the highest of any category and 47% of total spend. Total IT investment will be split across the other three categories as follows: 31% will be spent on Software, 13% on Hardware, and 9% on Communications.

HG Insights can help you size markets and identify untapped market potential with whitespace analysis. Learn more about our Market Intelligence platform →

Insurance Industry Trends in IT

The Insurance industry continues to evolve, after pulling through the COVID-19 period surprisingly well. But what comes next, and what role will IT play in the next phase of this global market’s long-term transformation? Here are three Insurance industry trends we’re watching, all of which center around AI:

1. Increased process automation

Artificial Intelligence (AI) and Machine Learning (ML) technologies are transforming claims processing, enhancing fraud detection, and improving customer service in the Insurance industry. The changes in claims are especially noteworthy, as McKinsey asserts that 1) claims processing will be the most important function in the Insurance industry by 2030, and 2) automation can reduce the cost of a claims journey by up to 30%.

Using AI to automate claims can speed up verification and resolution times, improving customer experience while boosting insurer productivity and reducing costs.

2. Evolving customer expectations

In 2025, insurers will increasingly focus on meeting evolving customer expectations, driven by demand for faster, more personalized, and seamless digital experiences.

In the post-COVID period especially, customers expect insurers to provide real-time updates, transparent processes, and omnichannel support, mirroring the convenience offered by tech companies in other sectors.

AI is working its way into this trend, with Generative AI (GenAI) solutions such as personalized chatbots becoming a common tool for retaining customers and maintaining competitive advantage.

Learn more about GenAI and see our list of the 1000 most AI-mature companies in 2024. →

3. Advanced analytics

Pairing AI with advanced analytics can also help insurers create a more complete picture of their customers, making it easier to personalize and target the right people with the right products and services (see trend 2).

But in order to maximize value from AI-driven analytics, the data sources they are pulling from must be modernized. As Deloitte puts it, “This may include enhanced master data management, integrating, managing, governing, and using both company data and large unstructured data sets and third-party data.”

Insurance Industry: Leading IT Vendors and Products

This section explores the leading vendors and products in five key IT categories for buyers in the Insurance industry: Cloud Services, Security Software, Core ERP, Data Management, and Business Intelligence.

Leading Cloud Services Vendors and Products

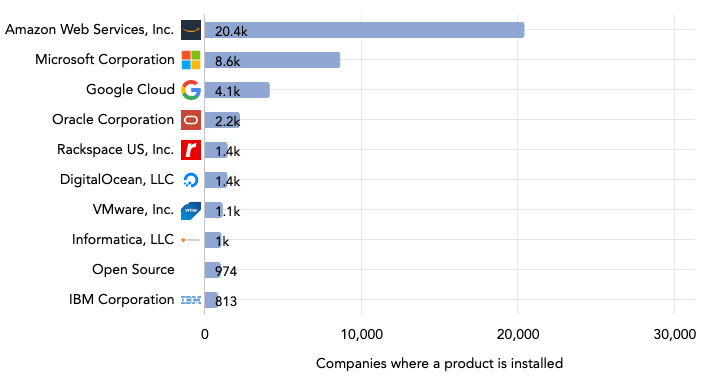

Top Cloud Services Vendors

This chart illustrates the ten Cloud Services vendors with the most installations at Insurance companies. Unsurprisingly, the three largest cloud companies locked in the so-called “Cloud Wars” – Amazon Web Services (AWS), Microsoft, and Google Cloud – are the leading vendors in this category. AWS has the largest Cloud Services customer base in Insurance with 20,360 buyers, more than double the count of the next highest vendor.

In fourth place is another established tech giant – Oracle Corporation – with 2,195 Cloud Services buyers in Insurance.

We’ve covered the “Cloud Wars” and the big three cloud companies extensively in our market reports. Read more below:

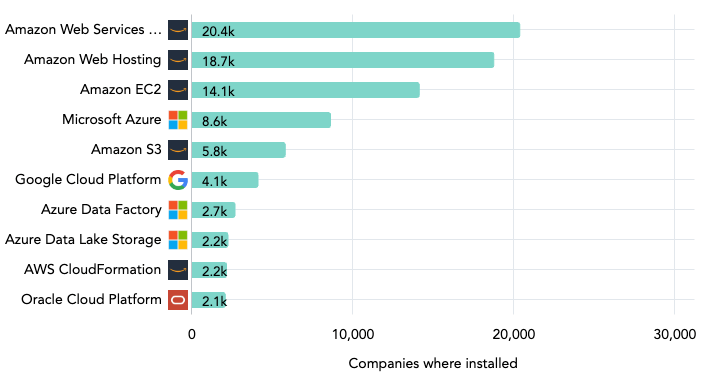

Top Cloud Services Products

Breaking the Cloud Services category into individual products tells a similar story: AWS is still the clear winner, claiming four of the top five spots by installations. Many of these products are bundled or purchased together, which explains why the top AWS products have high installations relative to others in the category.

Leading Security Software Vendors and Products

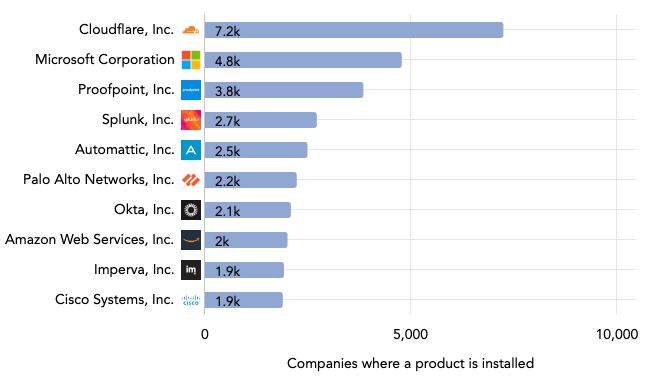

Top Security Software Vendors

Insurance is one of a number of industries (like Financial Services) where security is even more important than usual: These industries must process and store sensitive customer data, protect against cyberattacks and fraud, and ensure compliance. This analysis shows the top ten vendors across three Security Software subcategories: Identity and Access Management, Information and Threat Management, and Vulnerability Management.

Cloudflare leads the pack in Security Software with 7,230 customers. Other leaders for the Insurance sector include Microsoft (4,762), Proofpoint (3,832), and Splunk (2,700).

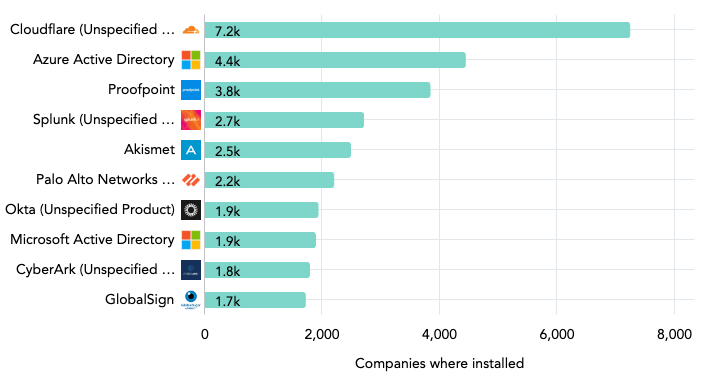

Top Security Software Products

The top three Security Software products for IT buyers in Insurance are Cloudflare, Azure Active Directory, and Proofpoint. This product breakdown tells a similar story to the previous chart, with the leading six products aligning exactly with the vendors who sell them.

Read more in our Cloud Security Market Report →

Leading Core ERP Vendors and Products

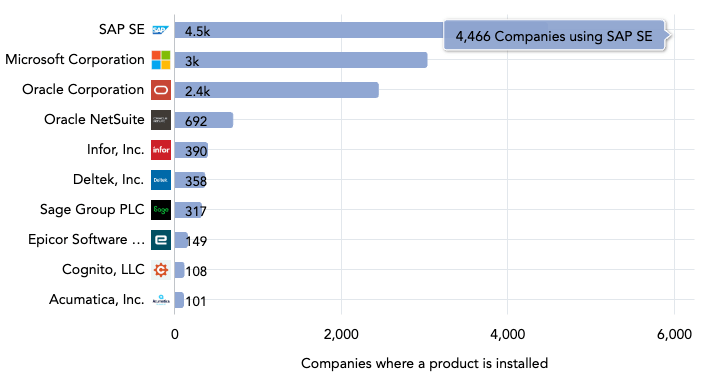

Top Core ERP Vendors

Enterprise Resource Planning (ERP) systems are known for being one of the stickiest products a company can invest in. For buyers in the Insurance market, the top two Core ERP vendors are SAP (4,466 installs) and Microsoft (3,025 installs). Oracle Corporation, which acquired NetSuite in 2016, has a total of 3,131 installs when combined.

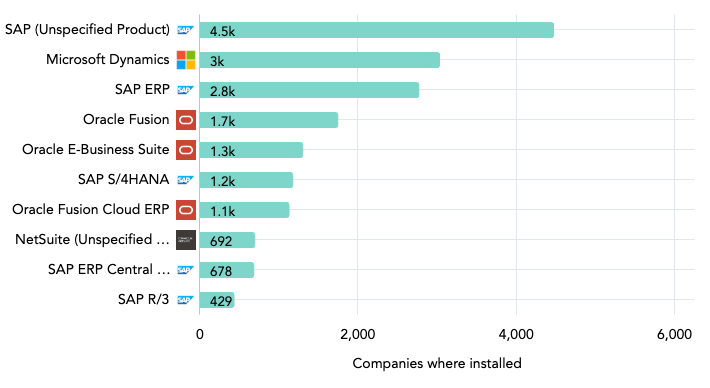

Top Core ERP Products

Nine of the top ten Core ERP products in the Insurance industry come from two leading vendors:

- SAP – ERP, S/4HANA, ERP Central Component (ECC), R/3, etc.

- Oracle – Fusion, E-Business Suite, Fusion Cloud ERP, NetSuite

The 2nd place product overall, Microsoft Dynamics, is installed at 3,025 Insurance companies.

Learn more about this category in our ERP Market Report →

Leading Data Management Vendors and Products

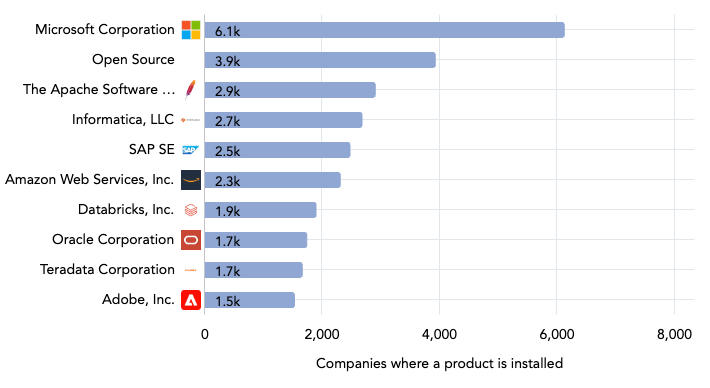

Top Data Management Vendors

The most used Data Management vendors among Insurance companies are Microsoft (6,114 installs), The Apache Software Foundation (2,896), Informatica (2,673), and SAP (2,466). The second vendor on this list is actually not a vendor at all, but a summation of all the Insurance companies using open source Data Management solutions (3,920).

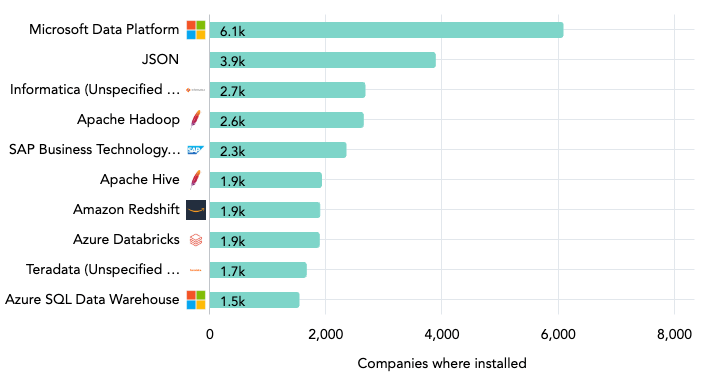

Top Data Management Products

Eight of the top ten Data Management vendors have at least one of the top products installed at Insurance companies globally. Microsoft Data Platform leads the group with 6,074 installs.

JavaScript Object Notation, or JSON, is a data interchange format that works natively with most modern programming languages. JSON accounts for nearly all of the installs listed under the Open Source “vendor” on the previous chart (3,877).

Leading Business Intelligence Vendors and Products

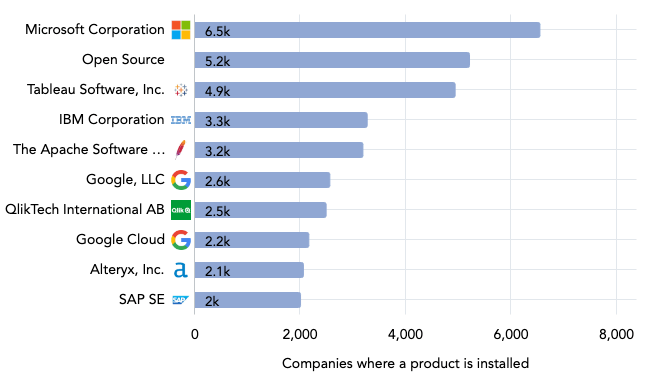

Top Business Intelligence Vendors

Microsoft tops the list of BI vendors with 6,538 installations at Insurance businesses. As with some other categories, one of the top “vendors” is a combination of Open Source BI solutions (5,204 installs).

Top Business Intelligence Products

Leading vendor Microsoft is the developer of four of the top ten BI products for the Insurance industry:

- Power BI – 6,243 installs

- SQL Server Reporting Services – 3,322 installs

- Power Platform – 2,357 installs

- SQL Server Analysis Services – 2,159 installs

(Disclaimer: These are HG detections of installations. The actual number may differ)

Want to learn more about the leading providers and products for other markets beyond Insurance? Check out our Business Intelligence market report →

Uncover Insurance Industry Opportunities with HG Insights

This report features data and insights uncovered using the award-winning HG Market Intelligence platform, which enables go-to-market teams to uncover the answers they need, whether it’s identifying their Ideal Customer Profile, sizing their Total Addressable Market (TAM), planning sales territories, or account scoring and prioritization for sales and marketing teams.

HG data can help you uncover your distinct opportunities within the Insurance industry. Schedule a demo with one of our solutions experts to see which of your accounts in the Insurance industry have the highest propensity to buy.