View HG Insights’ full market report: The Microsoft Azure Ecosystem in 2024

Microsoft’s revenue growth is up 17.7% year-over-year — reaching $96.2 billion — for its Intelligent Cloud offerings in 2023. This includes Azure and other cloud services, Office 365 Commercial, the commercial portion of LinkedIn, Dynamics 365, and other commercial cloud businesses (Microsoft does not report Azure revenue separately).

Azure’s share of the cloud market has seen steady growth. In 2024, Azure market share reached 24% of the global cloud computing market and their customer base grew by 14.2% from 2023 to 2024. HG Insights identified nearly 350,000 businesses using Azure cloud computing solutions.

Microsoft launched Azure, an open and flexible cloud computing platform, in 2010 and positioned it as an alternative to Amazon EC2 and Google App Engine. To this day, Azure is locked in a heated competition — the so-called “Cloud Wars” — with the other two cloud giants: Amazon Web Services (AWS) and Google Cloud Platform (GCP).

However, the cloud infrastructure services market remains highly dynamic as AWS and Google compete with Microsoft for increased cloud spending. Gartner says that in 2022, the worldwide Infrastructure-as-a-Service (IaaS) market grew 30%, exceeding $100 billion for the first time.

In this report, you’ll find a detailed overview of the Azure market and trends shaping the ecosystem today.

2024 Azure Market Insights

HG Insights collects data on the businesses buying Azure cloud services. Here are a few key takeaways from the 2024 Azure Market Report:

- Nearly 350,000 customers are buying Azure cloud computing services

- Azure market share reached 24% of the global cloud market in Q1 2024

- From 2023 to 2024, Azure’s customer base grew by 14.2%

Microsoft Azure Market Share

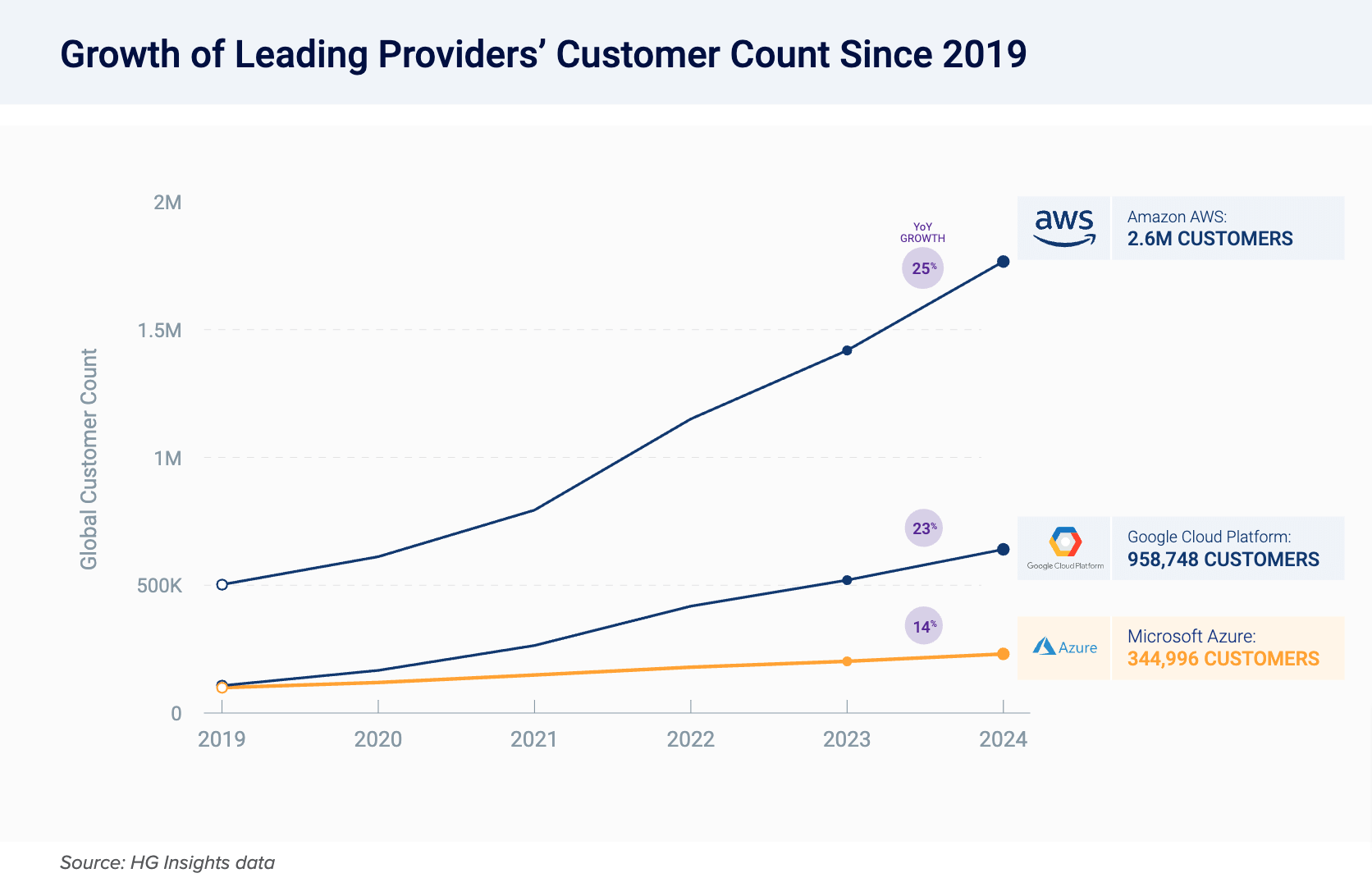

As has been the case every year since the first cloud product was introduced, the “Cloud Wars” between AWS, Microsoft Azure, and Google Cloud is a huge driver for the industry’s overall trajectory. All three of the leading providers have shown positive YoY growth in customer count every year since 2019, illustrating the intensity of competition to capture market share.

GCP vs AWS vs Azure market share

Microsoft Azure market share reached 24% of the cloud computing market in Q1 2024. Meanwhile, AWS retained 31% and GCP came in a distant third, capturing 11% market share. From 2023 to 2024, Azure’s customer base grew by 14.2%, while AWS and GCP grew by 24.6% and 23.2%, respectively.

While Azure’s customer base grew the least year-over-year out of the top three cloud providers, the influence of 310 new enterprise customers had an outsized impact on Azure market share.

The Microsoft Azure Buyer Landscape in 2024

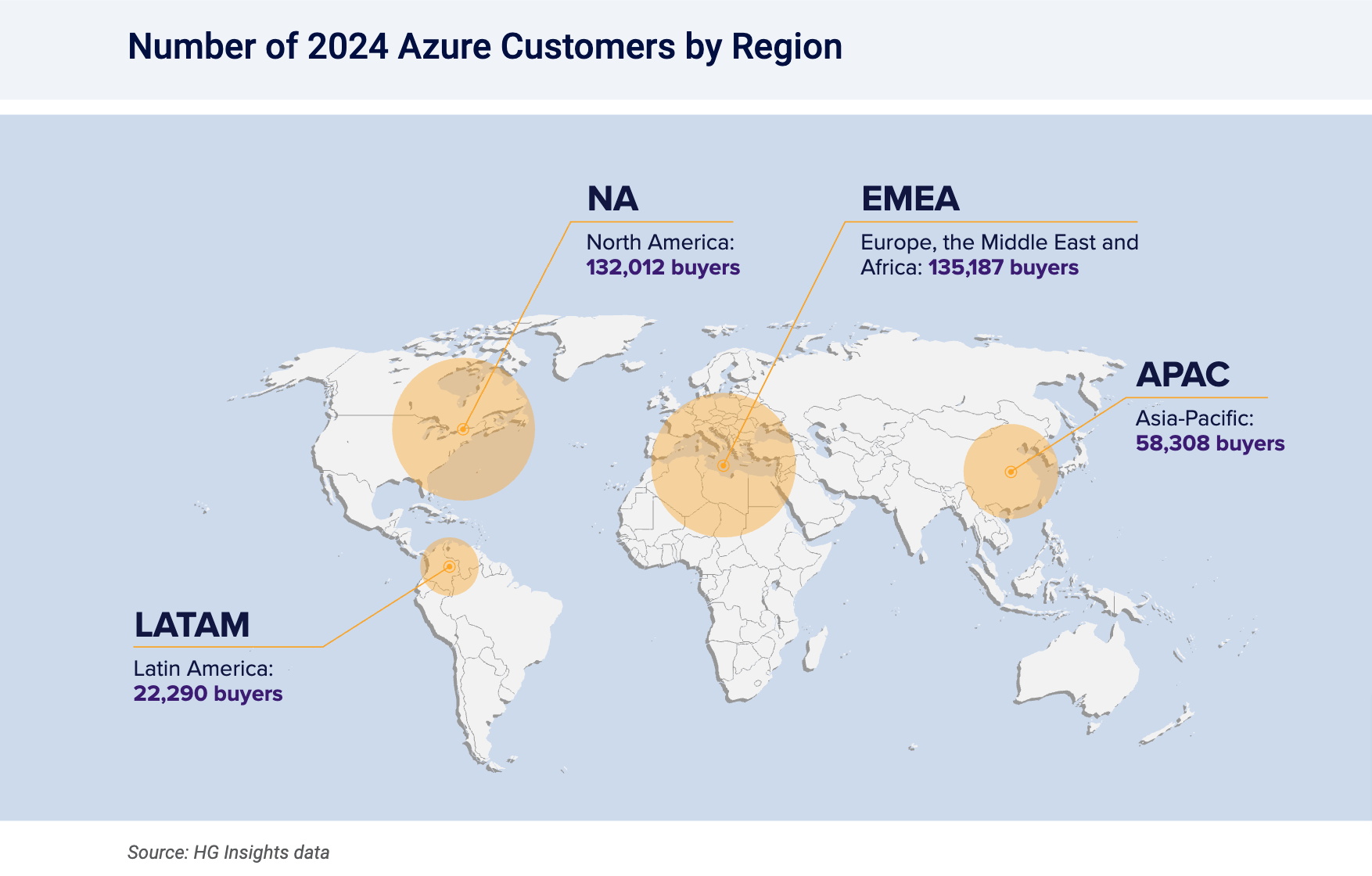

The highest volume of Azure customers are in Europe, the Middle East, and Africa (EMEA), and North America (NA), with more than 130,000 buyers in each region.

Microsoft has over 60 global data center regions, more than any other cloud provider. The company has been expanding cloud infrastructure to support demand “as organizations focus on migrating to the cloud and building new solutions that take advantage of AI.”

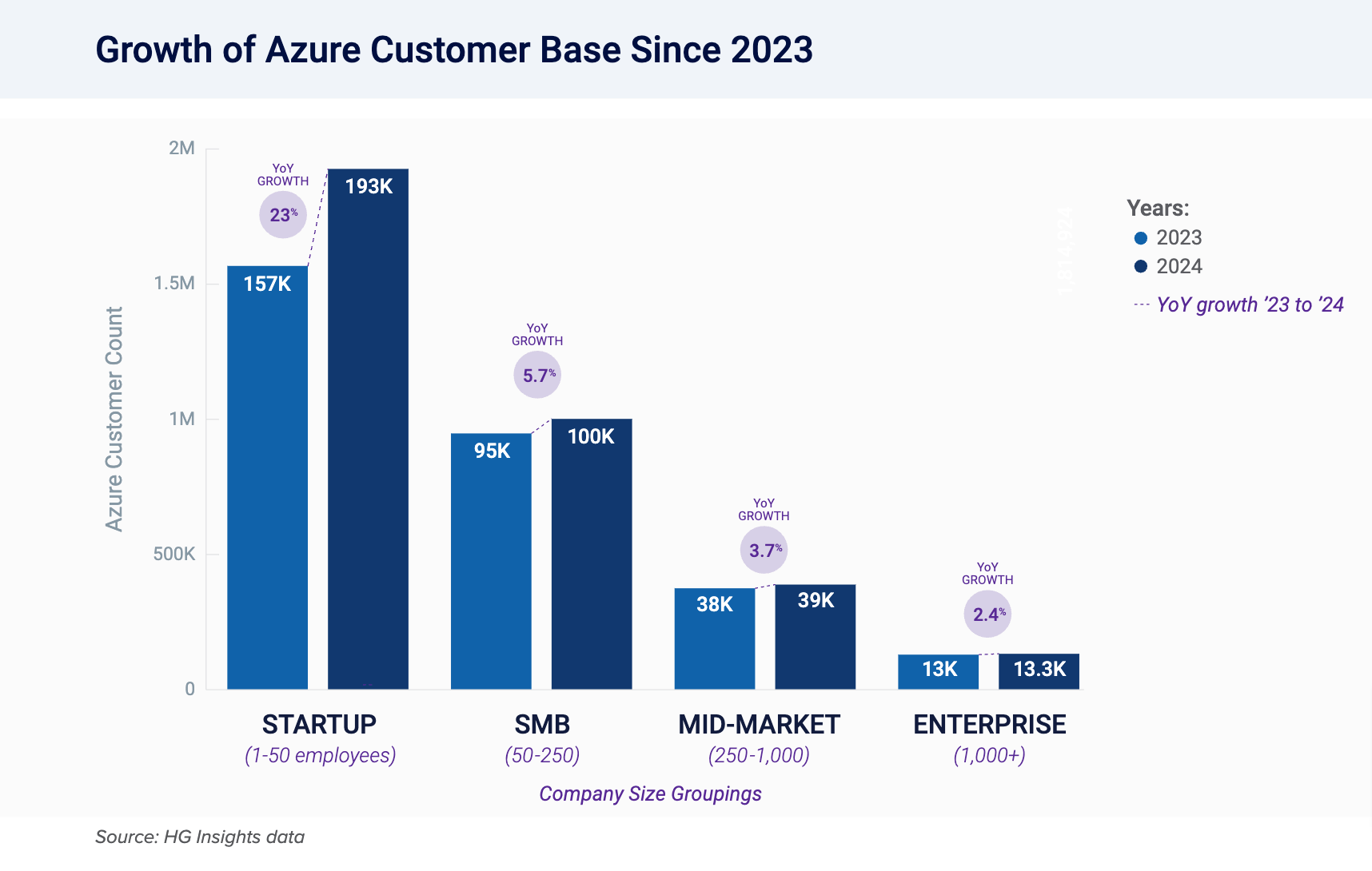

Microsoft Azure achieved positive year-over- year (YoY) customer growth across all company sizes from 2023 to 2024, with the Startup segment growing the fastest YoY at 23%. In contrast, from 2022 to 2023, Azure’s Startup customer count grew by 17.6%.

While year-over-year growth in Enterprise customers was the lowest of the four segments, those additional 310 Enterprise customers likely made an outsized impact on revenue growth.

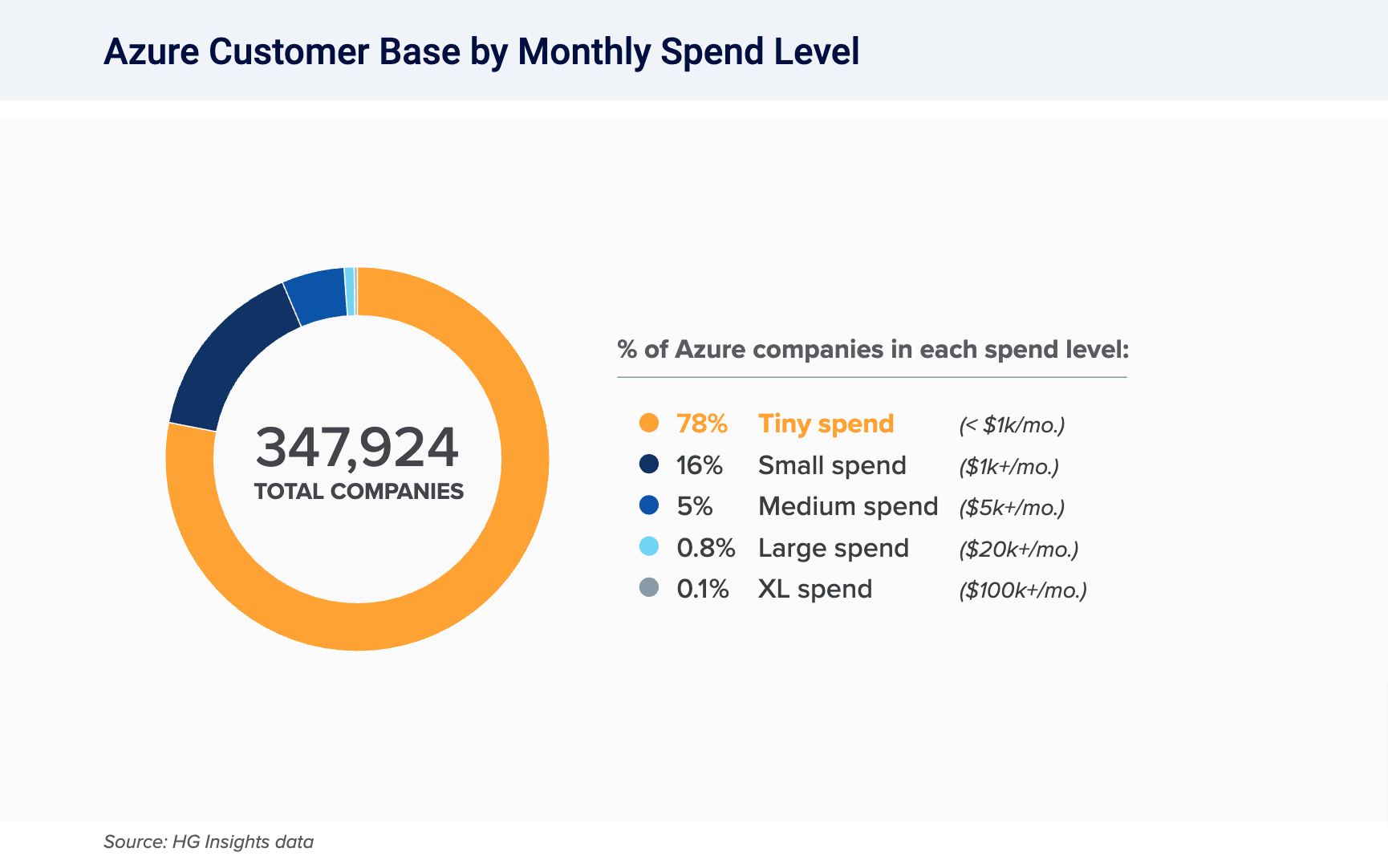

More than three-quarters of Azure customers (78%) are in the lowest spending tier, with less than $1k in monthly spend. However, from 2023 to 2024, Azure customers increased across all revenue tiers.

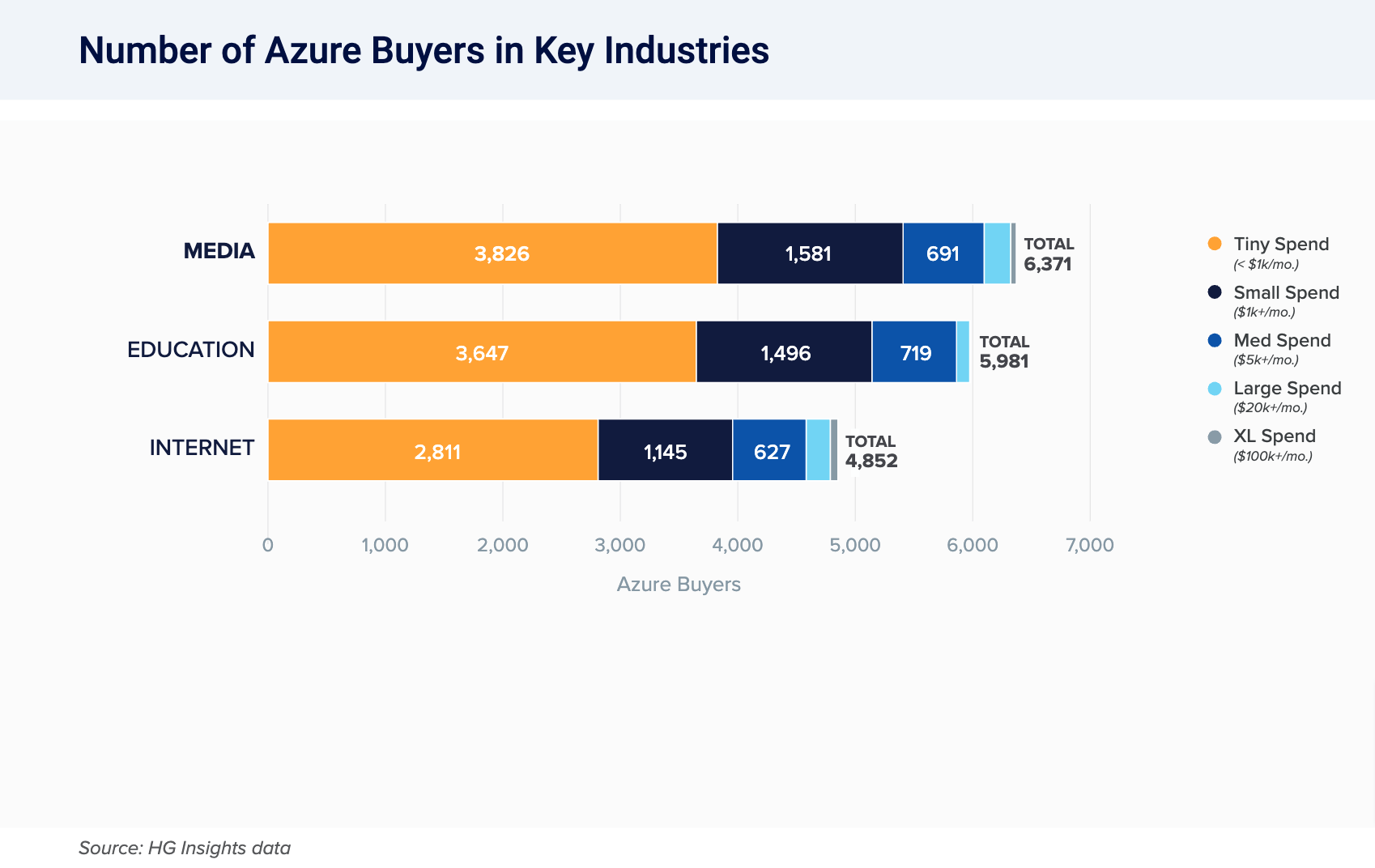

To dig in deeper, we analyzed the cloud spending of Azure customers in three trending industries: Media, Education, and Internet.

This chart shows the number of companies with detected Azure installations, grouped by industry and estimated monthly Azure spend. While not the largest industry by total customers, the Internet sector has the most Azure buyers (64) spending more than $100,000 per month.

Trends Shaping the Microsoft Azure Ecosystem in 2024

HG Insights’ combination of detailed usage and spend data with industry-level detail allows us to understand adoption rate and potential by business type. Here are the Azure ecosystem trends we are watching in 2024:

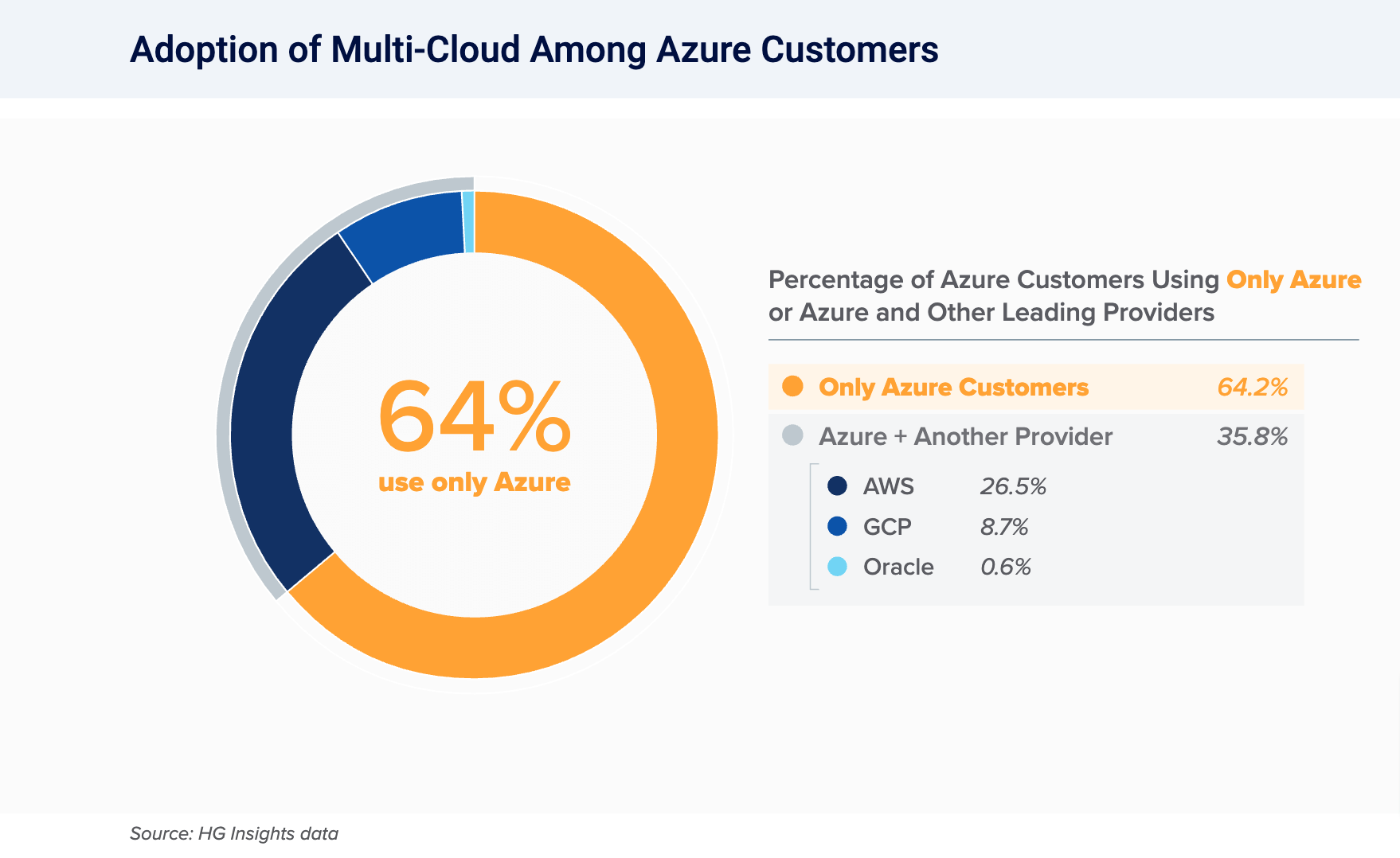

This chart illustrates multi-cloud usage among Azure customers; specifically, what percentage are using Azure exclusively versus those combining Azure with another leading provider (AWS, GCP, or Oracle).

HG’s data reveals that approximately 64% of Azure customers use the platform exclusively, while about 36% use both Azure and another leading provider. Azure’s public moves on multi-cloud have continued over the past year, as the company made several announcements at the end of 2023 expanding its partnership with Oracle. The most notable of these was Oracle Database@Azure, which became available in the US in December and will go live in more regions in 2024.

HG Insights collects data on the IT infrastructure of more than 11 million companies worldwide. This data can be used to identify where Azure customers are on the digital transformation curve.

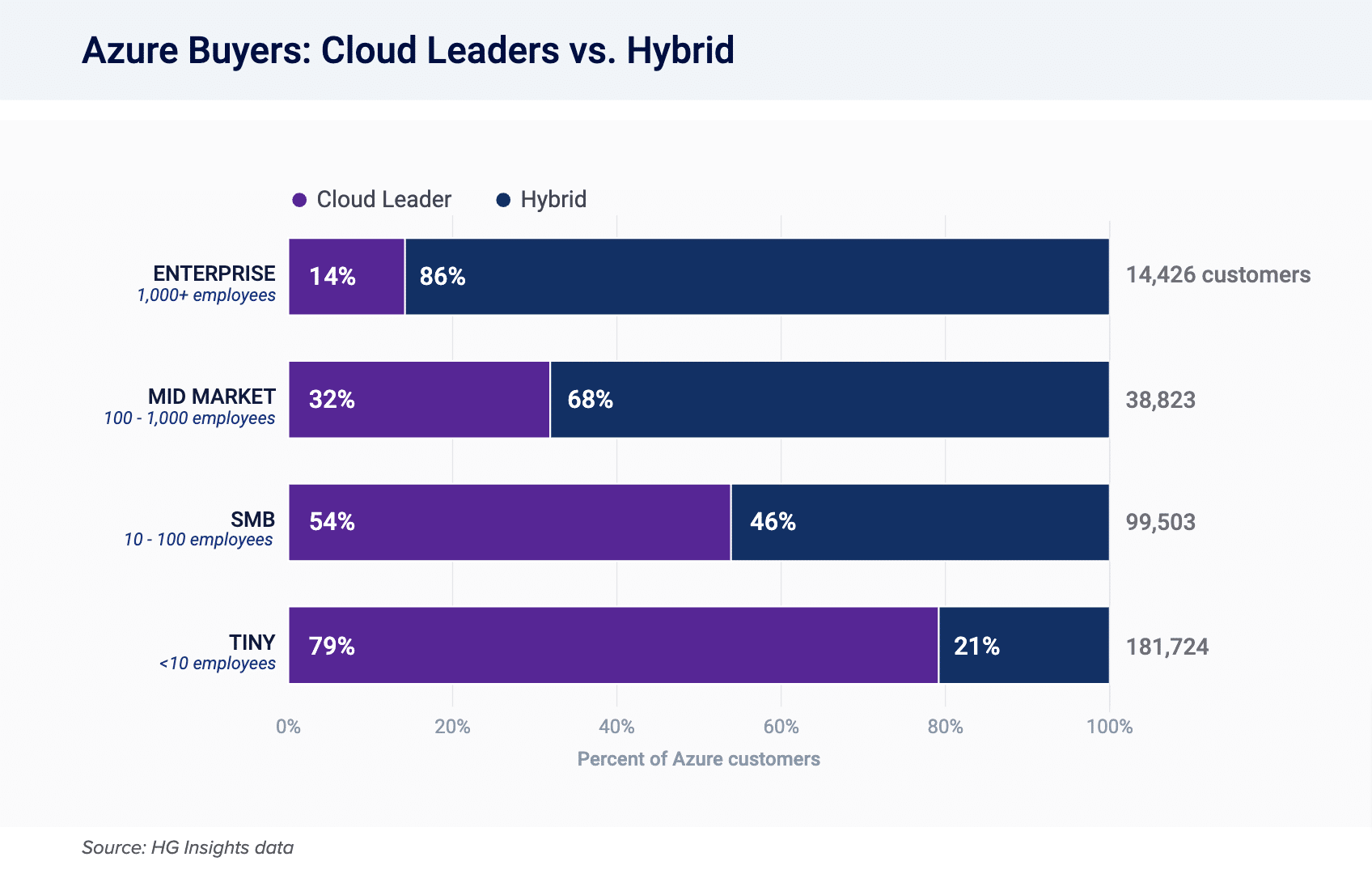

This chart segments Azure buyers, by company size, into two distinct groups:

- Cloud Leaders: Cloud-native; the majority of their infrastructure spend is with the three leading cloud providers and almost no data center spend

- Hybrid cloud: Companies with high spend on both cloud and data center solutions

Uncover Cloud Revenue Opportunities with HG

Prioritize your prospects with HG Cloud Dynamics. We provide GTM, sales, and marketing teams with detailed cloud product adoption, usage, and spend data for over 7 million businesses worldwide, and 21,000+ cloud products.

HG is a global provider of data-driven insights to 75% of Fortune 100 tech companies. We use advanced technology intelligence to deliver insights on technographics, IT spend, buyer intent, and contract renewal dates — providing B2B companies with a better way to analyze markets, find and acquire new customers, and shorten sales cycles. If you have questions or want to learn more about HG insights, reach out!