Key Takeaways:

- Retail Industry technology spend is projected to reach $131.6 billion in the next 12 months.

- The United States is the largest market for IT in the Retail industry by more than 7x versus the next highest spender (Germany).

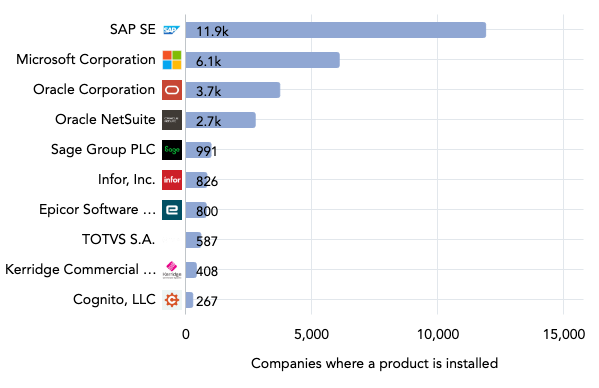

- The top ten Core ERP products for Retail companies are all developed by SAP, Oracle, and Microsoft.

- 44% of IT spending by Retail companies will go toward IT Services, 28% will be spent on Software, 16% on Hardware, and 12% on Communications.

- Retail industry technology trends like AI and machine learning, omnichannel experiences, and data analytics are impacting IT adoption and spend.

The retail industry is more technologically connected than anyone could have imagined 30 years ago. Customers still shop in brick-and-mortar retail stores, of course; but they also shop online, through social media, in marketplaces, and elsewhere — demonstrating the complexity of the buyer journey. Customer loyalty is harder to win than ever.

The foundation for those customer experiences is the technology each retailer deploys.

HG’s data can uncover how retailers are investing in IT across various categories, regions, and buyer profiles. According to the HG platform, 301,000 companies in the Ecommerce and Retail industry will spend $131.6 billion on IT over the next 12 months.

This report analyzes Retail technology trends in IT adoption, usage, and spend, including the leading vendors and products across five key categories. All data and insights were uncovered with the HG Market Intelligence Platform over a forecast period of December, 2024 to December, 2025.

Retail Technology Trends

With how much the retail industry has changed over the past few decades, it’s hard to imagine where we could be ten years from now. Here are three retail technology trends we are keeping an eye on and using to shape our market analysis:

1. Artificial intelligence (AI) and machine learning (ML)

As AI continues to spread through every industry, retail continues its long history of being a testing ground for the technology. Amazon’s first version of its Recommendation system launched in the early 2000s, and since then personalized shopping recommendations – powered by AI and ML algorithms – have propagated across the industry.

We expect to see retailers continue down this path, especially as McKinsey estimates the annual value of AI for the retail industry to be between $400 and $800 billion.

Where to next? AI has a number of exciting use cases for retail: Predictive data analytics, dynamic price optimization based on real-time data, personalized marketing, and even applications in brick and mortar stores like “smart” shelves video analysis.

We’re already seeing a number of popular uses for Generative AI in particular – from chatbots for customer service to product description drafting – all of which can improve operational efficiency and enhance customer experience.

Learn more about GenAI and see our list of the 1000 most AI-mature companies in 2024. →

2. Omnichannel shopping experience

When discovering new products, would you rather buy online or shop in-store? Looking at current customer behavior, it’s not necessarily one or the other – and there are likely other stops on the road to purchasing. Some talk to friends and family for recommendations, others research on search engines or social media. No matter the journey, consumer expectations for a seamless omnichannel experience are sky-high.

To support omnichannel on the IT side, retailers will be analyzing existing infrastructure to ensure it aligns with their visions of the future. They’ll also need strong integrations between their commerce platforms and other key systems like inventory management and customer databases.

3. Data analytics and insights

Retailers collect a staggering volume of customer data from any number of locations, including point of sale, market research, customer service, and digital channels. Customers’ personal, demographic, and behavioral data offers a treasure trove of information on their preferences and desires (as long as it’s collected within that market’s regulations, of course).

According to PwC, retailers that invest in customer data and implement specific use cases can expect a 3%-5% increase in contribution margin. But it doesn’t stop at collecting the data and removing siloes – we’re seeing retailers use integration solutions to pool data from different sources and then leverage AI and ML to turn that data into insights.

Retail Industry Market Size for IT

HG’s data projects the Retail industry market size for IT will reach $131.6 billion over the next 12 months. Of the 4.3 million companies in the HG database, our analysis identified 301,000 businesses in the Ecommerce and Retail Trade industry spending money on IT solutions. (Note that the HG database includes only businesses with registered addresses.)

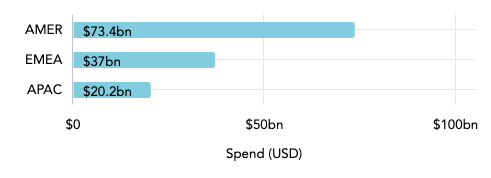

IT Spend in Retail Industry (by Region)

Retail companies in the AMER region (North, Central, and South America) spend nearly twice as much on IT – $73.4 billion – versus EMEA (Europe, the Middle East, and Africa). APAC (Asia Pacific) accounts for only 15.4% of global IT spend in the Retail industry.

Retail Industry Market Size for IT (by Country)

| Country | Total Spend | Total Companies |

| United States of America | $66,181,306,668 | 165,096 |

| Germany | $8,791,685,318 | 10,511 |

| United Kingdom of Great Britain & Northern Ireland | $7,242,812,763 | 19,643 |

| Japan | $7,051,411,490 | 8,050 |

| China | $5,730,563,175 | 6,636 |

| France | $3,845,013,838 | 7,236 |

| Canada | $3,609,363,987 | 12,439 |

| Netherlands | $2,200,962,505 | 3,397 |

| Italy | $1,981,148,210 | 4,354 |

| Australia | $1,688,394,101 | 9,129 |

The United States is the largest market for IT in the Retail industry by more than 7x versus Germany, the next highest spender. The country dwarfs other markets in the number of companies spending on IT as well, making up nearly 55% of all buyers globally.

Six of the top ten markets by IT spend are in EMEA: Germany ($8.8 billion), the United Kingdom ($7.2 billion), France ($3.8 billion), Netherlands ($2.2 billion), Italy ($2.0 billion), and Spain ($1.6 billion).

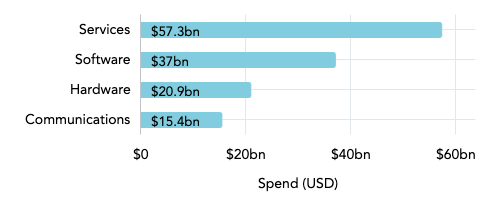

Retail Market Size by IT Category

IT buyers in the Ecommerce and Retail industry are projected to spend $57.3 billion on IT Services in the coming 12 months, accounting for 44% of total spending. Retailers will spend $37 billion on Software (28%), $20.9 billion on Hardware (16%), and $15.4 billion on Communications (12%).

With HG’s best-in-class data, you can better understand your market landscape: Size opportunities, target high propensity accounts, track competitors, and win more deals. Experience our Market Intelligence platform →

Retail Industry Market Share for IT: Top Vendors and Products

Using the HG platform, we’ve analyzed the Retail industry market share for IT vendors and products across five key IT categories: Cloud Services, Security Software, Core ERP, Database Management, Business Intelligence.

Cloud Services in the Retail Industry

According to HG’s data, Ecommerce and Retail companies will spend $21.3 billion on Cloud Computing Services in the next 12 months.

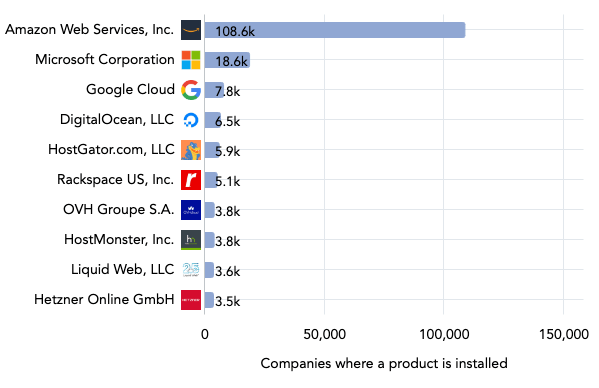

Top Cloud Services Vendors

As with many other industries, the three largest global cloud companies – Amazon Web Services (AWS), Microsoft, and Google Cloud – lead by Retail Industry market share. But there’s a clear winner of the “Cloud Wars” between these vendors, at least for Retail: AWS has nearly 6x the detected installations versus Microsoft and 14x versus Google Cloud.

You can learn more about the “Cloud Wars” between these vendors in our data-driven market reports:

- The AWS Ecosystem in 2024

- The Microsoft Azure Ecosystem in 2024

- The Google Cloud Platform Ecosystem in 2024

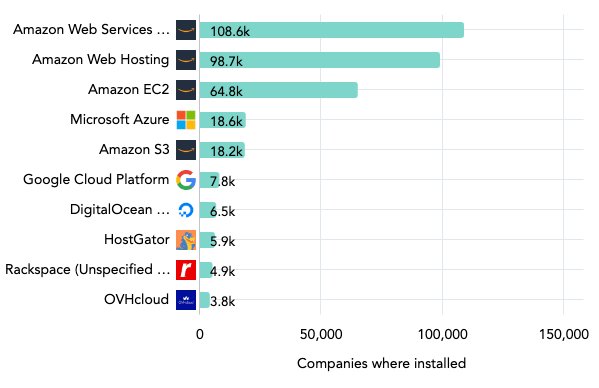

Top Cloud Services Products

Four of the top five Cloud Services products in the Retail Industry come from Amazon: AWS, Amazon Web Hosting, Amazon EC2, and Amazon S3. Of course, products are not mutually exclusive and many are bundled together, explaining the relatively high count of detected installations.

Besides Microsoft Azure and Google Cloud Platform, other top products at Retail companies include DigitalOcean (6,457 detected installs), HostGator (5,939), Rackspace (4,930), and OVHcloud (3,820).

Security Software in the Retail Industry

HG’s data projects that companies in the Retail industry will spend $2.6 billion on Security Software over the coming 12 months.

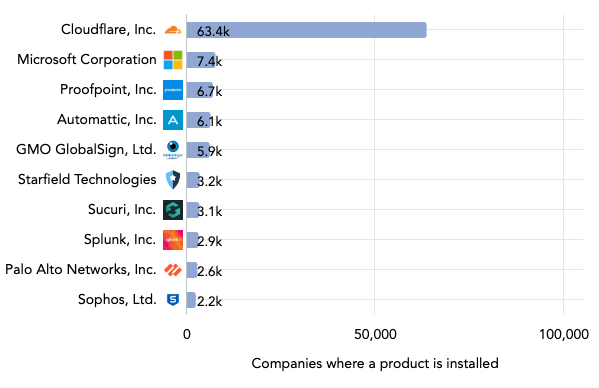

Top Security Software Vendors

Security Software is crucial for any business handling private customer data and processing transactions. Because modern retail stores are often both physical and digital, protecting data from attacks, unauthorized access, and other threats can be even more complex.

For the Ecommerce and Retail industry, Cloudflare rises above the other Software Security vendors by Retail Industry market share with 63,411 detected installations. Other leaders include Microsoft (7,423), Proofpoint (6,746), and Automattic (6,105).

This analysis includes the three subcategories of Security Software: Identity and Access Management, Information and Threat Management, and Vulnerability Management.

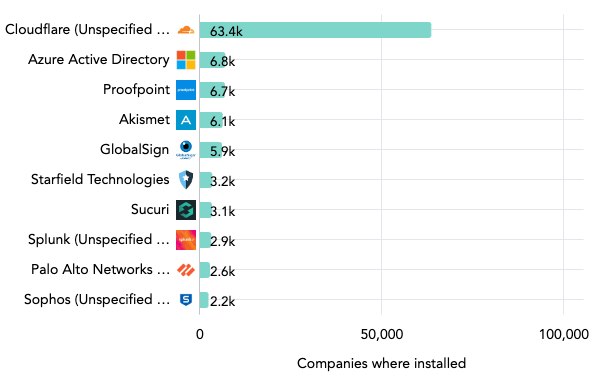

Top Security Software Products

CIOs often compare the process of changing out an ERP to replacing a jet engine mid-flight. So, it’s no surprise that most organizations won’t switch out their ERP unless it has been installed for more than 10 years. For buyers in the Ecommerce and Retail industry, the top Core ERP providers are SAP (11,890 detected installs), Oracle (6,465 buyers when combined with NetSuite), and Microsoft (6,079 installs).

Core ERP for the Retail Industry

HG’s data projects that businesses in the Ecommerce and Retail industry will spend $5.9 billion on Core ERP Systems in the next 12 months.

HG defines Core ERP as all subcategories of Enterprise Resource Planning (ERP) except Customer Relationship Management (CRM) applications.

Top Core ERP Vendors

CIOs often compare the process of changing out an ERP to replacing a jet engine mid-flight. So, it’s no surprise that most organizations won’t switch out their ERP unless it has been installed for more than 10 years. For buyers in the Ecommerce and Retail industry, the top Core ERP providers by Retail Industry market share are SAP (11,890 detected installs), Oracle (6,465 buyers when combined with NetSuite), and Microsoft (6,079 installs).

Top Core ERP Products

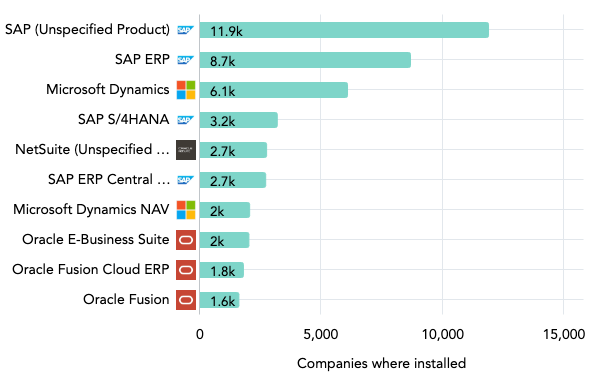

The top ten Core ERP products for Retail companies are all developed by the three leading vendors:

- SAP – ERP, S/4HANA, ERP Central Component (ECC), etc.

- Oracle – NetSuite, E-Business Suite, Fusion Cloud ERP, Fusion

- Microsoft – Dynamics, Dynamics NAV

Get a deep dive on this category with our ERP Market Report →

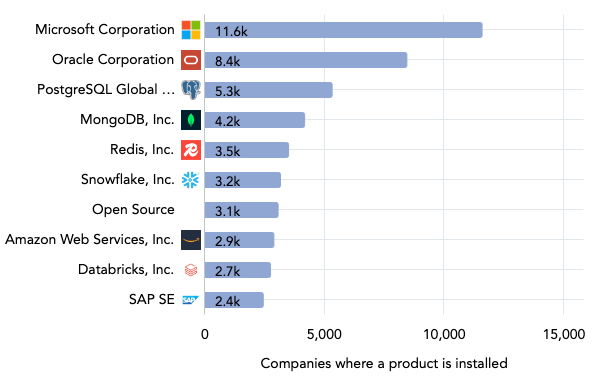

Retail Database Management Systems

HG’s data projects that businesses in the Retail industry will spend $2.1 billion on Database Management Systems over the next 12 months.

Top Database Management System Vendors

Microsoft, Oracle, and PostgreSQL have the largest Retail Industry market share by technology installations among Database Management System vendors. Alongside the top vendors on the list, there are also 3,054 detected installations of open source Database Management solutions.

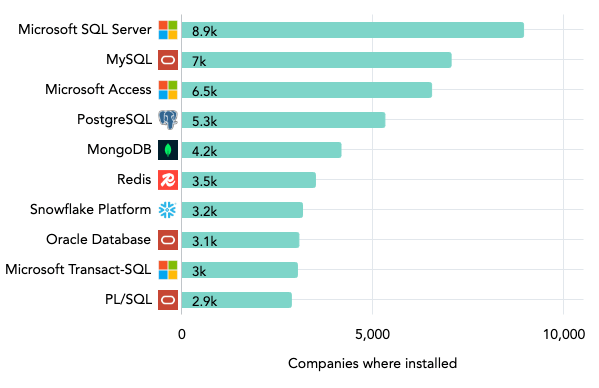

Top Database Management System Products

Microsoft and Oracle have three products each on the list of the top ten Database Management products for Retail:

- Microsoft: SQL Server (8,942 detected installs), Access (6,534), and Transact-SQL (3,022)

- Oracle: MySQL (7,045 installs), Database (3,060), and PL/SQL (2,863)

Business Intelligence (BI) in the Retail Industry

HG data projects that Ecommerce and Retail companies will spend $1.9 billion on Business Intelligence (BI) and Analytics Tools in the next 12 months.

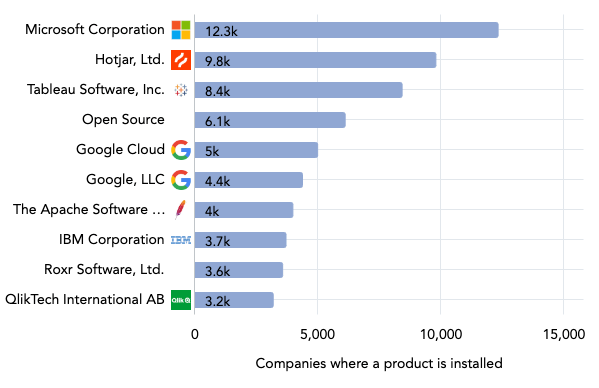

Top Business Intelligence Vendors

Microsoft is leading among BI vendors by market share with 12,321 detected installations at Retail companies. Hotjar (9,792) and Tableau (8,419) are also popular, as are open source BI solutions with 6,104 installations.

If we sum the detected installations of Google and Google Cloud, the provider is detected at 9,354 Retail businesses, putting it in third place behind Hotjar.

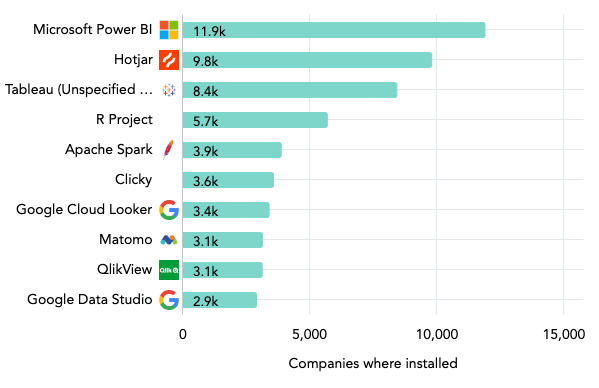

Top Business Intelligence Products

Microsoft is the developer of Power BI, the top BI product for the Retail industry with 11,888 detected installations. Google is the only vendor with two separate products on the list: Google Cloud Looker (3,391) and Google Data Studio (2,895).

To learn more about the BI market – including top vendors and products – check out our Business Intelligence market report →

Understand Technology in the Retail Industry with HG Insights

The data in this report (and all our other market reports) is uncovered using the HG Market Intelligence platform, which enables go-to-market teams to map their markets, identify ICP accounts, segment territories, and uncover expansion opportunities.

We use advanced insights into Technology Intelligence — on IT spend, technographics, cloud usage, intent signals, Functional Area Intelligence, and contract details — to provide global B2B companies with a better way to analyze markets and target prospects. Our customers achieve unprecedented results in their marketing and sales programs thanks to the indexing of billions of unstructured documents each day with insights into product adoption, usage, spend data, and more to build high-resolution maps of activity across an organization’s entire digital infrastructure to power business decisions with precision and confidence.

Schedule a demo with an HG solutions expert to see your best-fit accounts and capitalize on these Retail technology trends.