HG Insights is providing a better way for customers to identify and score best-fit prospective accounts within the HG Insights Platform. This new capability will generate a list of accounts based on a new industry term we are coining “ICtP” or “Ideal Customer Technology Profile.” This feature analyzes the holistic technology footprint of thousands of organizations to determine the specific technologies that indicate/correlate with a specific (customer) product(s). The output is a dynamic list of companies that have technology environments that are most known to be a perfect fit for your product or service.

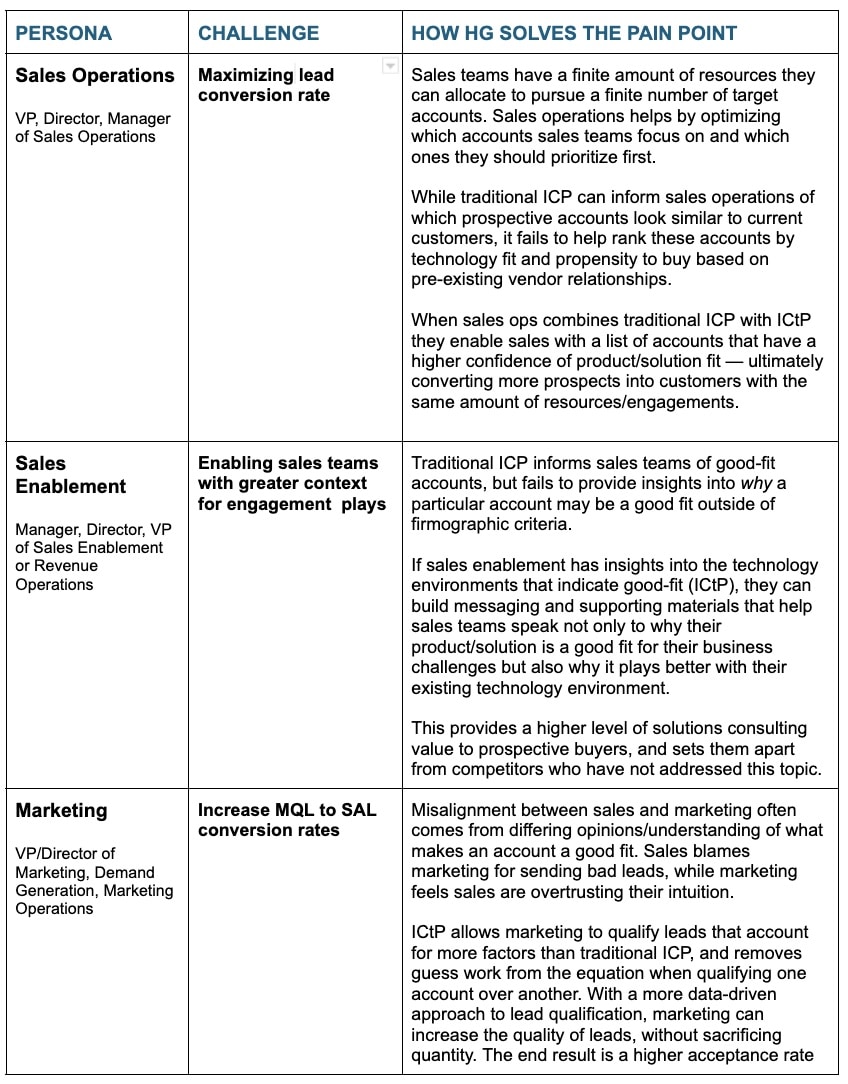

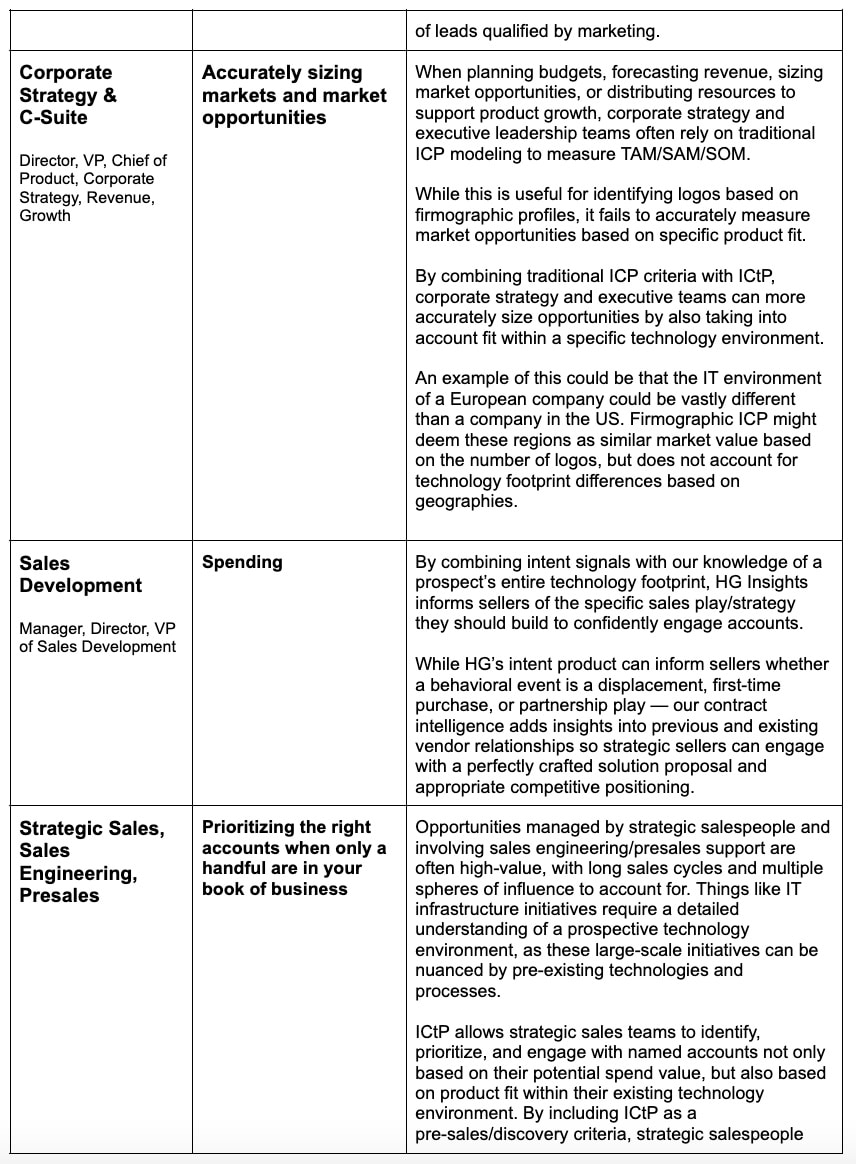

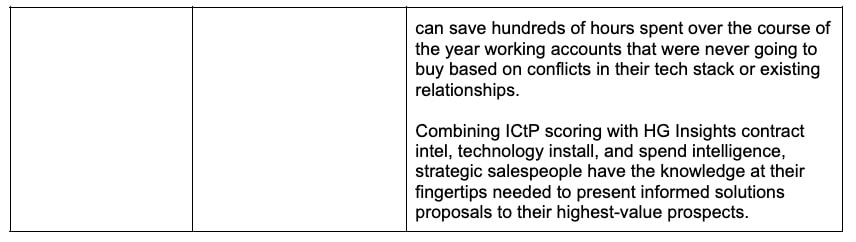

This feature can be used by many departments that make up GTM and revenue teams. Marketing can be used to optimize and nurture campaigns and score inbound leads. Sales and operations teams can use ICtP to refine target account lists, optimize territories, and prioritize outreach. In general, ICtP can be combined with traditional ICP modeling to improve organization-wide GTM alignment around best-fit accounts.

Background

What is a traditional ICP?

The term “ICP,” short for “Ideal Customer Profile,” refers to the set of firmographic characteristics that represent an organization’s best customers. This typically includes analyzing the employee counts, revenues, geographies, and industries of a company’s customer base to determine the ranges where the majority of customers fall. The GTM and revenue teams then use this criterion to identify and score the accounts they will pursue next.

A simple example of an Account-level ICP:

- Employee Count (250 – 4,000)

- Revenue ($50M – $500M)

- Industries (Financial Services, Banking, Private Equity, Capital Management)

- Locations: California, Boston, New York, Nevada, EMEA

What are the shortcomings of a traditional ICP based on firmographics?

Traditional firmographic-based ICP is still a great tool for scoring prospect-fit, however, ICP has several shortcomings that are addressed by layering in ICtP modeling, including:

- Firmographic ICP does not measure technological maturity/sophistication

For many technology organizations, whether or not a prospective company is a good fit has much more to do with the sophistication of their internal processes and tech stack than with how many customers or employees they have. With ICtP, organizations can identify and target high-value prospects who would have otherwise been an outlier or received a low-fit score using traditional ICP. - Traditional ICP lacks the ability to prioritize accounts with similar firmographic characteristics

Often with traditional ICP (based on firmographics), several accounts may be similar in size, and geography, and serve similar verticals. In these cases, revenue teams may spread their resources equally to pursue these accounts, when in reality, one of them has a much more congruent technology environment than the others. By layering ICtP modeling over traditional ICP modeling, organizations can better optimize account prioritization.

A Data-Driven Approach to Best-Fit Accounts

For sales, marketing, operations and GTM strategy teams who are looking to embrace a more scientific approach to identifying and scoring the best-fit prospective accounts, HG Insights ICtP offers a revolutionary new way of finding optimal product/solution fit by modeling the holistic technology footprint of your total addressable market.

Unlike traditional ICP models that ignore technology maturity, IT infrastructure, and pre-existing vendor relationships and focus only on company size, location, and vertical, an ICtP ensures high-value accounts don’t slip through the cracks and reduces wasted resources on accounts that falsely appear to be good-fits at firmographic (face) value.

With HG Insights’ 15+ years of researching and analyzing the technology environments of millions of organizations, our proprietary technology intelligence modeling and understanding of patterns that indicate product-fit have only been accessible by enterprise organizations who partner with HG Insights to accomplish this level of data science. Until now.

By making ICtP available in the HG Insights Platform, we are democratizing access to advanced account scoring, made possible by our market-leading technology intelligence, which was previously only accessible by a handful of tech giants. By incorporating ICtP into your account identification/scoring models, you can:

- Increase win rates by focusing on the best-fit accounts missed by traditional ICP alone

- Reduce churn by onboarding customers whose technology environment are more complimentary to your product/service

- Retain logos by proactively working with customers who show a lower ICtP score than others

- Refine sizing of markets based on technology intelligence rather than firmographics alone

Target Audience

- Company Profile: Any organization that provides technology products or related services and utilizes a data-driven approach to identifying and prioritizing accounts is a good candidate to leverage ICtP.

-

- Level 1 (least mature): Strategic Account Targeting

- Where are you going to start focusing and why?

- Largest dollar potential accounts

- Up to 50 accounts

- Where are you going to start focusing and why?

- Level 2 (medium maturity): Look-alike Targeting

- What traits do some of your best customers share?

- Up to 5,000 accounts

*ICtP should be most appealing to Level 2, because these companies don’t have the Martech and data analysis resources to get to level 3.

- Level 1 (least mature): Strategic Account Targeting

-

- Level 3 (most mature): Data-driven Account Selection

- Powered by AI or predictive technology and analytics; this last level of ABM maturity can’t be met without advanced MarTech

- Up to 5,000 accounts

- Level 3 (most mature): Data-driven Account Selection

- Industry

- Computer Software, SaaS, technology, computer hardware, professional services, business services

- Company Size

- Small to medium size organizations will perceive the most value from ICtP, as they do not have the in-house expertise or data to accomplish this modeling in-house

- Enterprise organizations will see value, however they may use insights from HG ICtP modeling to further refine their own internal business analytics

- Company Revenue

-

- >$20M

- Organizations under $20M should be considered “startups.” Their lack of resources makes ICtP attractive, however the price point must be reduced

- Target User Profile

- The responsibility of identifying and scoring accounts is often a collaborative effort between mid- to senior-level sales, marketing, and operations teams at smaller organizations. At more mature, enterprise organizations, senior growth market personnel, corporate strategy, and business analyst teams continually refine the accounts that fall within their GTM strategy.